According to the latest report from CryptoQuant, stablecoin liquidity has crossed new records, largely due to Tether and Circle. Ripple entered the space with its new RLUSD token.

Heightened stablecoin activity on centralized exchanges also signals bullish activity for Bitcoin.

Tether and Circle Dominate the Stablecoin Market

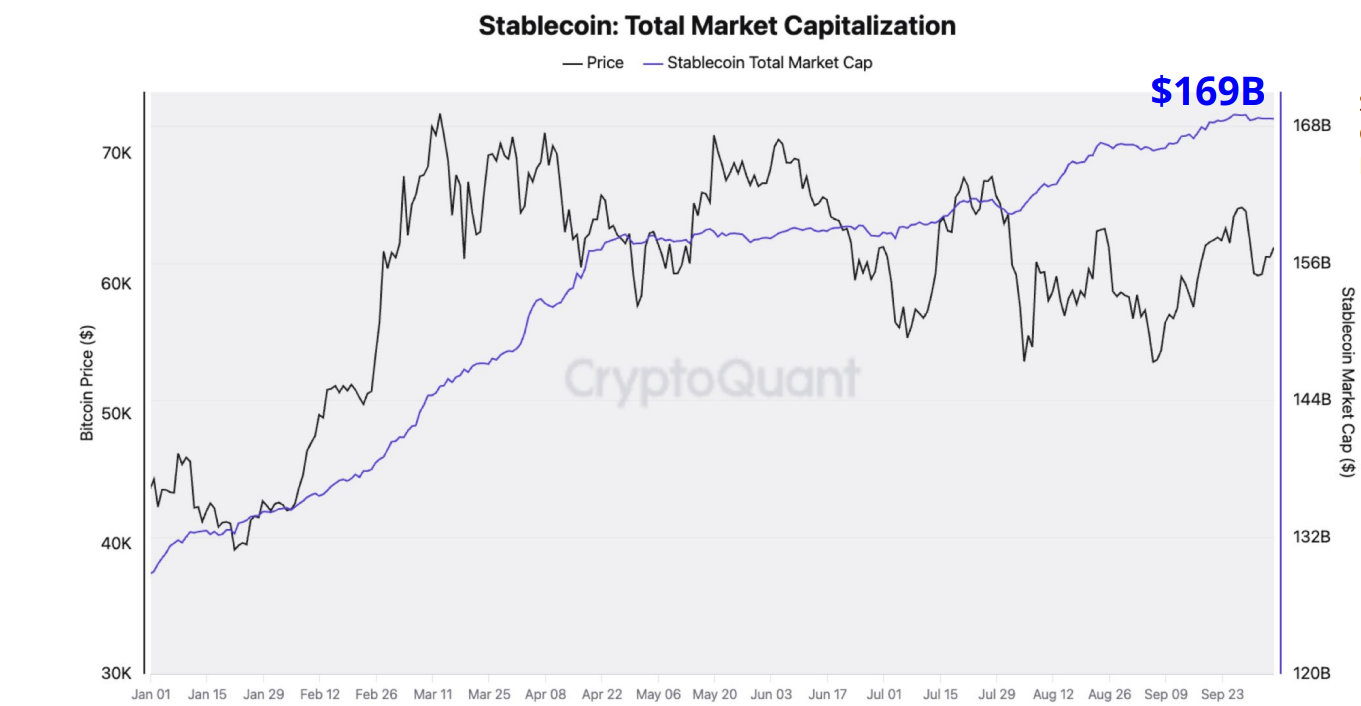

The report particularly highlights a bullish perspective, claiming that stablecoin liquidity has reached new heights.

“Crypto market liquidity, measured by stablecoin value, hit a record high in late September. The total market cap of major USD-backed stablecoins is now $169 billion, up 31% or $40 billion year-to-date. Increased stablecoin market cap typically correlates with higher Bitcoin and crypto prices by boosting market liquidity,” CryptoQuant report claimed.

Read More: What Is a Stablecoin? A Beginner’s Guide

The report paid special attention to Tether (USDT) and Circle (USDC) for obvious reasons. These two assets, particularly USDT, hold an overwhelming dominance over the stablecoin market. Notably, these major companies alone account for over 90% of the total stablecoin market cap.

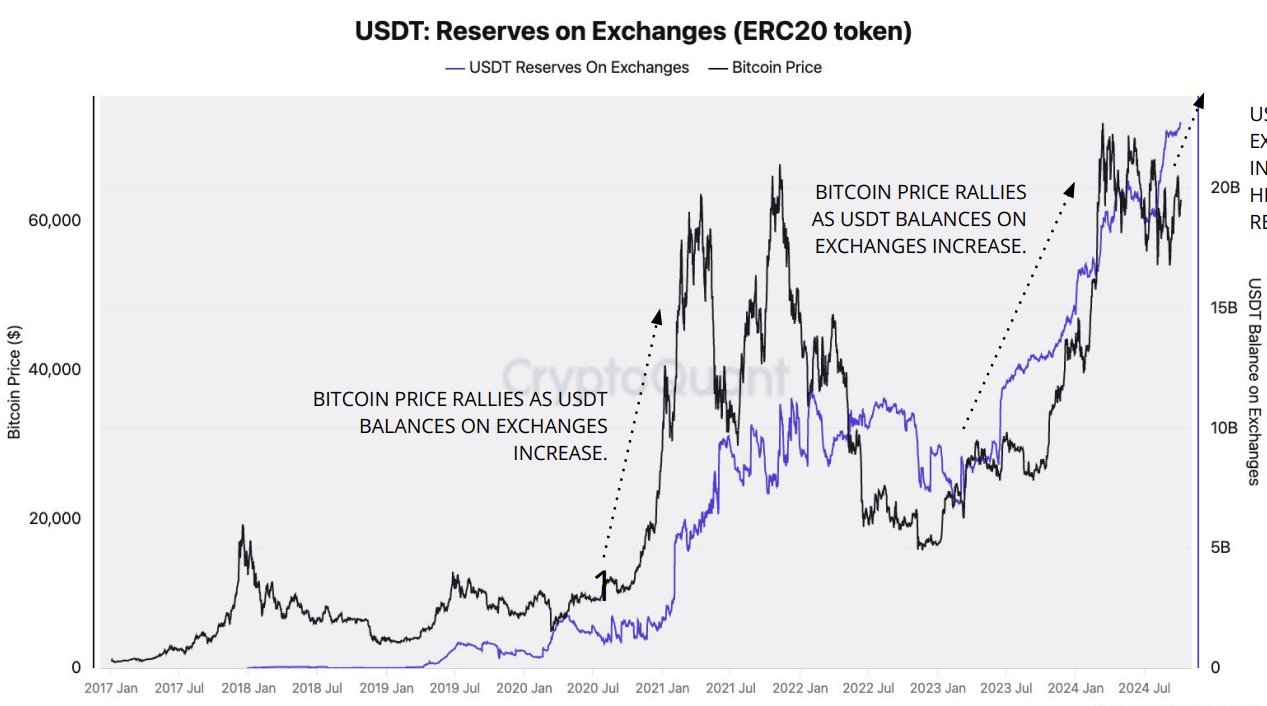

The growth of these assets on centralized exchanges is particularly reassuring for markets. Stablecoins are frequently used as intermediaries for Bitcoin purchases on crypto exchanges, and their liquidity growth is positively correlated with Bitcoin price jumps.

Ripple’s New Challenger

Still, these two assets might face challenges in continuing their dominance. The new EU stablecoin regulations have particularly threatened Tether’s hold over the European market, which could be a massive opportunity. Ripple has already been planning its own stablecoin launch for months, and it began minting the new RLUSD in late September.

Read More: A Guide to the Best Stablecoins in 2024

RLUSD has grown to a market cap of $47 million, and it operates on both Ethereum and Ripple’s XRPL network. Additionally, according to further analysis, RLUSD is particularly well-suited for XRPL. These include a high volume of traffic in USD and Chinese Yuan and infrastructure for remittances.

It is presently unclear how successful RLUSD might be at breaking into the stablecoin market. However, it can acquire a considerable chunk of market share if it focuses on the EU stablecoin regulations.