Circle, a major stablecoin firm, has announced it will cease support for USDC (USD Coin) on the TRON blockchain. This move comes amid the firm’s strategic push towards an Initial Public Offering (IPO) in the United States.

Effective immediately, Circle will discontinue minting USDC on TRON, marking the start of a phased transition.

Circle’s USDC Cuts Ties With TRON

The decision reflects Circle’s commitment to maintaining USDC as a trusted, transparent, and safe digital dollar.

“As part of our risk management framework, Circle continually assesses the suitability of all blockchains where USDC is supported,” a Circle spokesperson stated.

For Circle Mint customers, the company will facilitate the transfer of USDC to other blockchains until February 2025. Additionally, users can redeem USDC on TRON for fiat currency directly with Circle.

Read more: A Guide to the Best Stablecoins in 2024

Retail USDC holders and non-Circle customers have the option to transfer USDC between blockchains or redeem it for fiat currency through global services, including retail exchanges and brokerages.

The USDC issuer’s decision aligns with its broader growth strategy and IPO ambitions. Having considered going public since last year, Circle confidentially filed for a US IPO last week.

While shying away from any specific details, the action appears to be a step towards falling in line with regulatory standards.

“Our decision to discontinue support for USDC on TRON is the result of an enterprise-wide approach that involved the business organization, compliance and other functions across our company,” the press release concluded.

IPO Plans and Market Cap Update

This move follows the trend set by other crypto firms like Coinbase, establishing crypto entities as viable publicly traded companies in the US.

“The IPO is expected to take place after the Securities and Exchange Commission completes its review process, subject to market and other conditions,” Circle revealed.

Read more: What Is a Stablecoin? A Beginner’s Guide

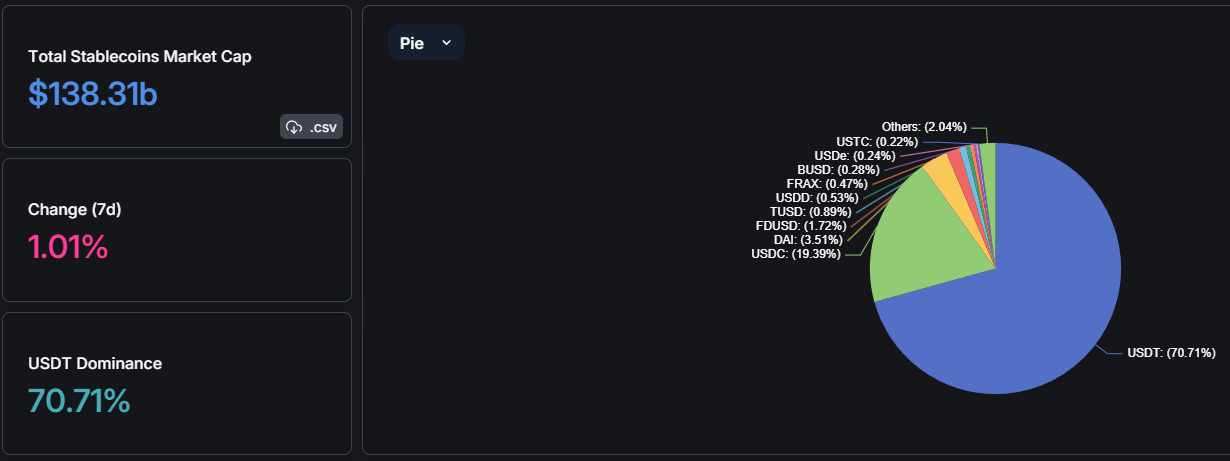

USDC, the second-largest stablecoin after Tether’s USDT, holds a significant place in the digital currency market. With a market cap of $26.8 billion, USDC accounts for nearly 20% of the stablecoin market dominance. The two stablecoins combined control nearly 90% of the total stablecoin market share.

Circle’s strategic pivot and IPO plans reflect a palpable shift in the crypto sector, where regulatory compliance, market stability, and institutional adoption are becoming increasingly important. This move reinforces USDC’s position as a leading regulated digital dollar but also sets a precedent for the future of crypto firms in the public market.