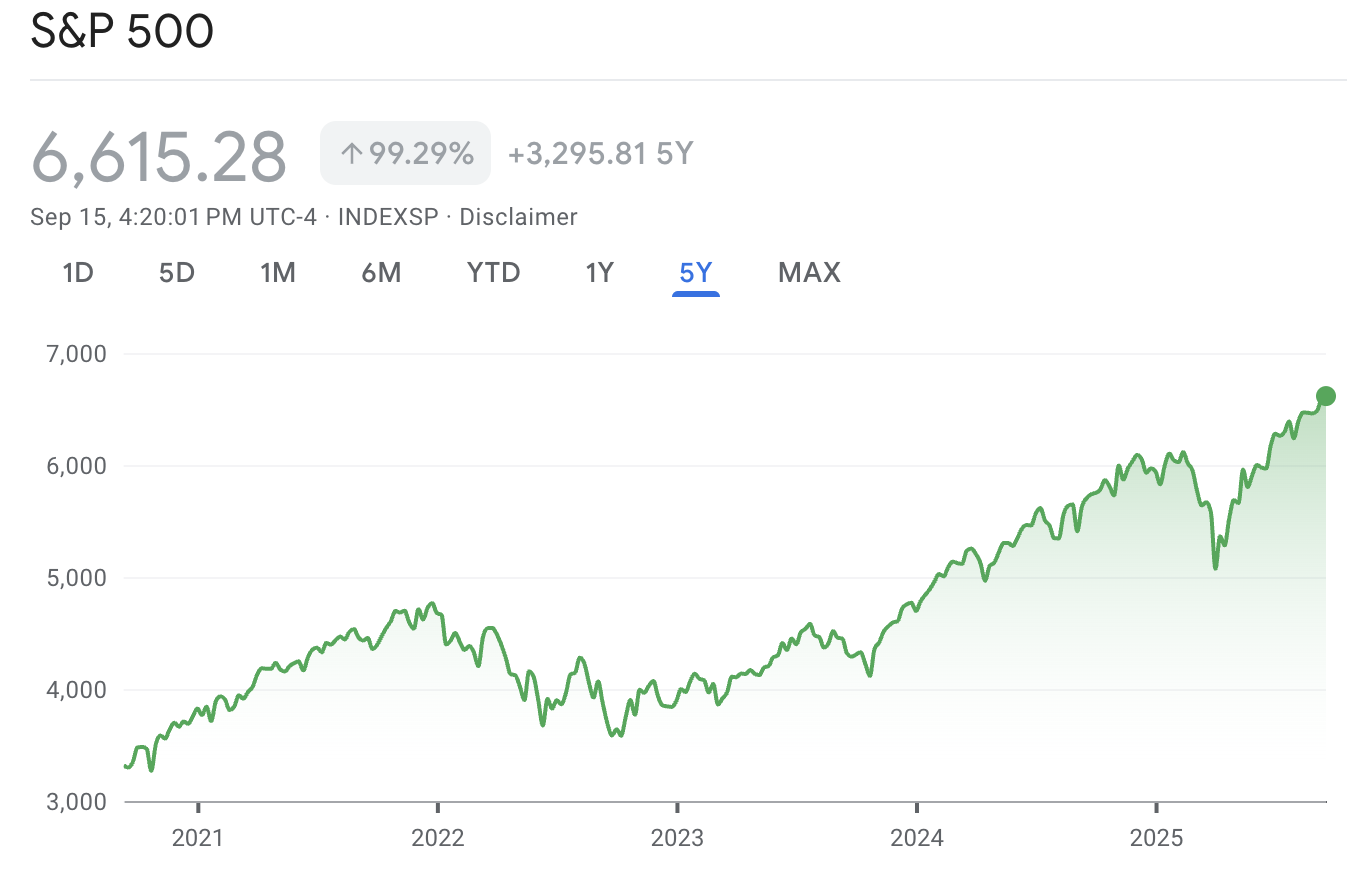

Gold and the S&P 500 both reached all-time highs today, while crypto market caps suffered a slight decline. This decoupling could be a bearish signal for future markets.

These two assets usually have an inverse correlation, so their simultaneous gains indicate a mix of caution and eagerness. If crypto gets left behind by both trends, it may be difficult to regain momentum.

Gold and S&P 500 Post Huge Gains

Bitcoin is often called the “digital gold,” and these asset categories can overlap in interesting ways. Analysts recently predicted that the ongoing gold rally could push crypto to new heights, and major firms are offering joint gold-crypto investment products.

However, the markets are looking a little disconcerting today, as crypto is currently decoupling from both this commodity and the TradFi stock market. While gold and the S&P 500 both hit all-time highs, the crypto sector’s market cap actually decreased.

Specifically, gold and the S&P 500 typically have an inverse correlation, so it’s quite concerning if they’re both gaining while crypto stays static. If these two categories are both going up, it likely signals a mix of optimism and concern in TradFi markets.

Potential Risks to Crypto?

There’s one highly visible culprit for these conflicting sentiments: impending cuts to US interest rates. The next FOMC meeting is scheduled to happen very soon, and markets are virtually certain that rate cuts will take place. This could be a mixed blessing, offering investment opportunities alongside fears of dollar inflation.

Therefore, this situation could give valuable insight into crypto market dynamics. Analysts have noted that the markets may have already priced rate cuts in. There has been ongoing speculation as to whether or not crypto momentum will continue, but these S&P 500 and gold movements could show that we have already hit a local top.

After all, why have gold and crypto decoupled if Bitcoin is a store of value? Conversely, why are Web3 market caps stagnating while TradFi is gaining like this? Are the markets exhausted from profit-taking? Could regulatory concerns be an underrated source of anxiety? It’s too soon to be certain.

Whatever happens, it’s very unusual that crypto is left behind while gold and the S&P 500 have both been gaining. If this trend continues, it could signal a bearish turn for the industry.