Solana’s (SOL) price rise over the last couple of weeks has been impressive and stable, bringing the altcoin to $185.

In doing so, SOL hit a new milestone as the altcoin rose further up in the ranks of leading crypto assets.

Institutions Vote for Solana

Solana’s (SOL) price crossing $185 may not usually be a big deal, but it is at the moment as it resulted in the altcoin flipping the Binance native token BNB. The “Ethereum killer” turned into the “BNB killer” as SOL’s market cap reached $86.23 billion, surpassing BNB’s $85.79 billion.

One of the biggest driving factors behind this achievement by Solana has been the approval and launch of spot Ethereum ETFs. As one altcoin entered the spot ETF space, it opened up the possibility of other altcoins witnessing a similar fate.

Read more: Solana ETF Explained: What It Is and How It Works

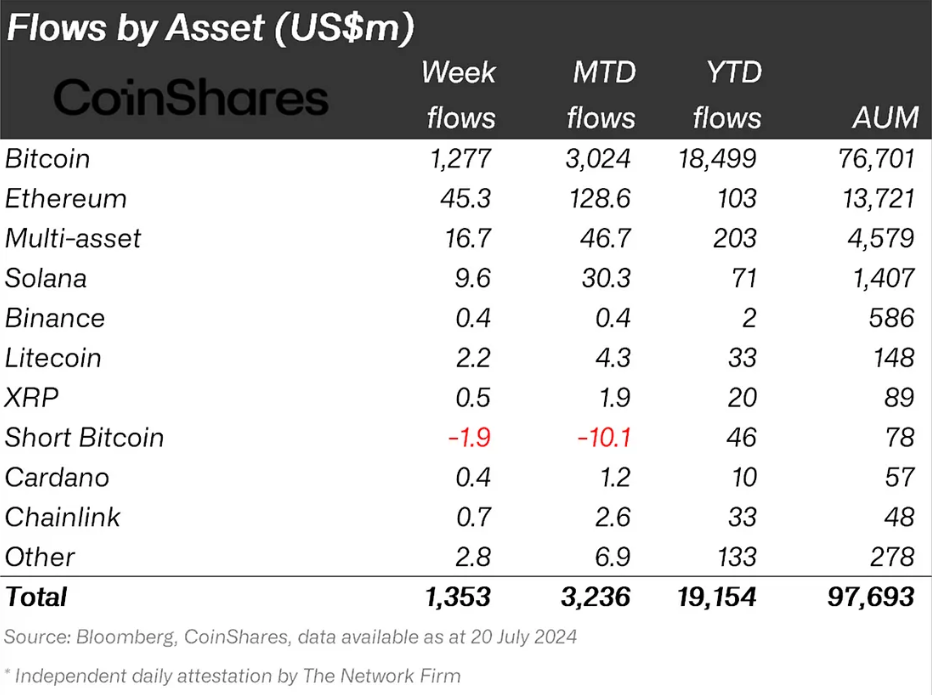

With Solana being the top contender for a potential ETF, the attention of retail and institutional investors shifted to the altcoin. According to CoinShares’ report, for the week ending July 20, SOL noted the highest inflows of any altcoin after Ethereum.

Solana inflows touched $9.6 million, with the next closest asset being Litecoin at $2.2 million. This gap between the assets is evidence that institutions are pining for SOL as their next investment target.

This achievement and demand will continue to push Solana’s price higher, potentially beyond the $200 mark.

SOL Price Prediction: Up Next, Breakout

Solana’s price trading at $185 at the time of writing, is forming a double bottom pattern. Also known as the “W” pattern, this is a bullish formation and a breakout above the neckline leads to considerable gains.

At the moment, the macro bullish pattern is suggesting a potential 31% rally ahead for SOL. This places the target at $245, bringing the altcoin closer to its all-time high of $260. The chances of this happening would further increase once $200 is flipped into a support floor.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

On the other hand, a failed breakout or profit-taking among SOL holders could diminish the chances of a rally. This could also bring Solana’s price down to $175, which would invalidate the bullish thesis.