Solana (SOL) has recently struggled to secure the $148 support level, with the altcoin unable to hold above this critical barrier. Despite an 11% increase over the last four days, the price remains stuck under $148, and bearish signals are becoming more prominent.

A crucial moment is approaching that could trigger a potential reversal in Solana’s price action, leaving its chances of breaking $150 uncertain.

Solana Is Closing In On A Reversal

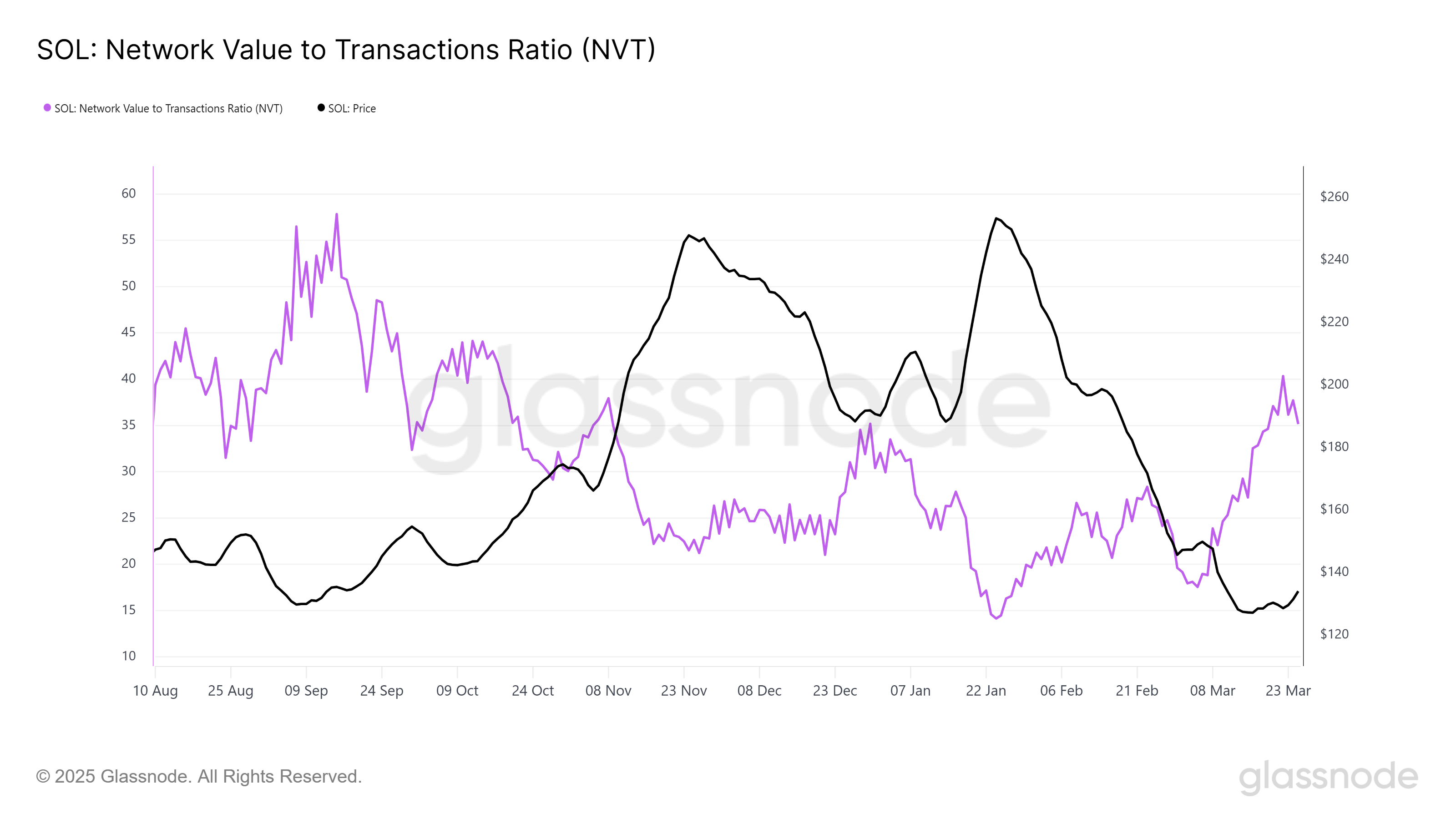

Solana’s market sentiment is showing mixed signals, with the network activity outpacing actual transaction activity. Recently, the NVT Ratio for SOL hit a 5-month high, indicating that the hype and surface-level support for the altcoin may not be translating into meaningful network growth. This disparity suggests that while investors are optimistic, the network is not seeing significant adoption or engagement.

The filing of a spot SOL ETF by Fidelity with CBOE has fueled some optimism, but this has not yet resulted in substantial growth for the network itself. Although the ETF announcement is seen as a positive development for Solana, the lack of corresponding activity on the blockchain is concerning.

Solana’s macro momentum is also facing challenges as key technical indicators approach a critical point. The 50-day and 200-day EMAs are nearing a Death Cross, a bearish signal that occurs when the 200-day EMA crosses below the 50-day EMA. This reversal would signal a potential downturn in Solana’s price, marking the end of a 16-month-long Golden Cross.

A Death Cross could significantly impact Solana’s price, especially if it is confirmed in the coming days. This development, coupled with the current weakness in market sentiment, could send Solana’s price further down, reinforcing the bearish outlook for the altcoin.

SOL Price Needs To Breach This Barrier

Currently trading at $142, Solana’s price has been unable to break the crucial $148 resistance. The altcoin is facing significant challenges in securing this level of support, limiting its ability to cross the $150 mark. As long as this resistance holds, Solana may continue to struggle in the short term.

In the coming days, Solana is likely to see a pullback, with the price potentially falling back to $135. From there, SOL may either consolidate above $135 or experience further declines toward $125. Such a move would erase most of the recent gains, reinforcing the bearish pressure on the cryptocurrency.

However, if the broader market cues improve and investor sentiment strengthens, Solana could breach the $148 resistance. If this happens, SOL could rise to $161, potentially invalidating the bearish thesis and giving the altcoin a shot at a more sustained recovery.