The Solana price dumped over 3% on the daily chart as a mostly bearish sentiment retook control over the global crypto market.

After a bearish start to the week, the Bitcoin price retested the lower $19,000 range amid macro market uncertainty. In tandem with the broader market blues, the SOL price sunk lower as it faced considerable sell-side pressure.

SOL price nearing range lows

For over six weeks, the Solana price has traded within a tight range between $31.35 and $34.14, aside from a short-term price uptick in mid-September. The daily RSI for SOL has remained below the neutral 50-level for most of the past month, indicating higher pressure from bears.

Meanwhile, the Chaikin Money Flow (CFM) indicator struggled to break free from a horizontal resistance. This suggests that inflows continued despite the larger bearish sentiment. However, from a price perspective, the inflows couldn’t aid much in boosting momentum as SOL volatility was still on a decline.

At the time of press, the Solana price was sitting at $31.50, up 3.29% on the daily but still suffering a 5.92% loss on the weekly chart. Overall, SOL’s technical indicators paint a bearish picture as sellers dominate the narrative with little to know retail trader euphoria and network troubles.

Where are the Solana whales?

Despite the larger bearish narrative and price blues, whales and larger entities showing a healthy accumulation often plays in favor of altcoins. For Solana, however, the Stablecoin Total Supply held by Whales with more than 5 million USD has been on a long-term downward trend. Because of this, there are fewer whales with pockets deep enough to spur large price moves.

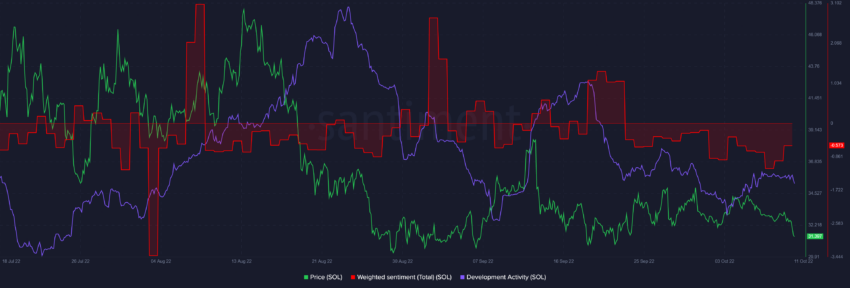

With SOL whales reducing their holdings, another worrying trend for bulls was the development activity, which is also on a downward trajectory.

Even though development activity noted a slight uptick from its Oct. 4 lows, the lower high made recently likely won’t aid much in momentum without whale HODLings and retail volumes, which are largely absent.

In addition to that, SOL’s social media mentions have declined as weighted sentiment plunged into the negative territory.

All in all, it wouldn’t be a surprise for the SOL price to revisit the $28 support considering its technicals. However, in the case of an invalidation of the bearish bias, SOL’s next resistance would likely be found at the $34 price level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.