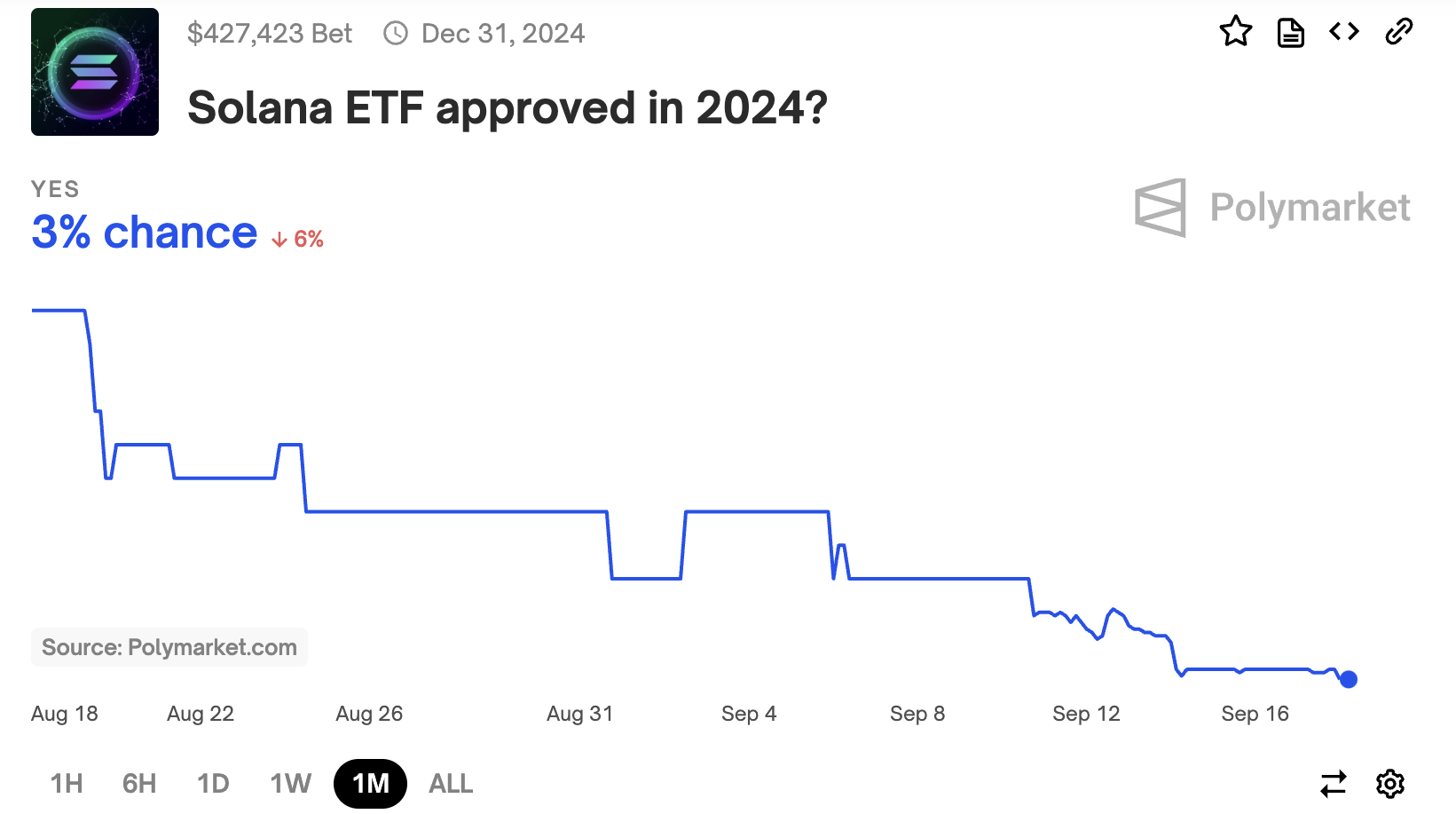

Polymarket predictions for a Solana exchange-traded fund (ETF) plunge lower than ever before, to a dim 3%. Nevertheless, some experts are bullish on the long game.

The importance of regulatory changes is agreed upon, but the ideal form of these changes is disputed.

Solana: The Longshot ETF

Polymarket, the decentralized prediction market platform, has downgraded the likelihood of a Solana ETF yet again. Since the site began taking bets on the Solana ETF, its probability has never exceeded 15%. Nevertheless, the past month has seen this already-low chance crash, such that it now sits at a dismal 3%.

Read More: Solana ETF Explained: What It Is and How It Works

In other words, a Solana ETF has always been considered a longshot. And yet, it still has certain advantages that make it more likely than most cryptoassets.

After a prolonged struggle, the SEC approved ETFs for Bitcoin and Ethereum in the same year, and many experts think that Solana is a viable candidate for number three. Brazil has already announced its approval, and hope remains that this ETF will serve as a valuable test case.

Silver Linings?

Nate Geraci, President of The ETF Store, was frank in his dismissal via social media.

“It’s difficult to envision any additional spot crypto ETFs coming to market under [the] current administration. Nothing would indicate a spot Solana or XRP ETF is possible in next year or two given [the] current state,” Geraci said.

For Geraci, in other words, the only hope for a Solana exchange traded fund would come from the US Presidential election, though he did not explicitly back a candidate.

Matt Hougan, the Chief Investment Officer at Bitwise, was more optimistic. In a recent interview, he argued that Bitcoin ETFs spent ten years fighting rejections. Yet, the SEC finally gave a green light to Bitcoin and Ethereum ETFs in 2024.

The first approval can open the floodgate, and subsequent victories will be easier.

“From my perspective, resolution of uncertainty is the most important factor. We think those things are going to coalesce It’s gonna take regulatory changes”, he added.

Read More: XRP ETF Explained: What It Is and How It Works

Hougan seemed much less inclined to link ETF performance to the upcoming election itself. Rather, he claimed that regulatory uncertainty would resolve itself during the campaign, and new ETF efforts would perform better in the resultant clarity. Bitwise plans to lead these efforts through data.

“Bitwise has always led with data in its SEC filings. We’re very excited about the Solana ecosystem. We think it’s robust. We’re doing the work,” Hougan claimed.