Solana (SOL) has faced a recent decline, struggling to regain momentum despite multiple attempts at recovery. The altcoin is currently aiming to breach the $180 resistance level, which has remained a key hurdle.

While long-term holders (LTHs) are supporting the price, SOL still needs stronger momentum to break past this critical level.

Solana Investors Are Hopeful

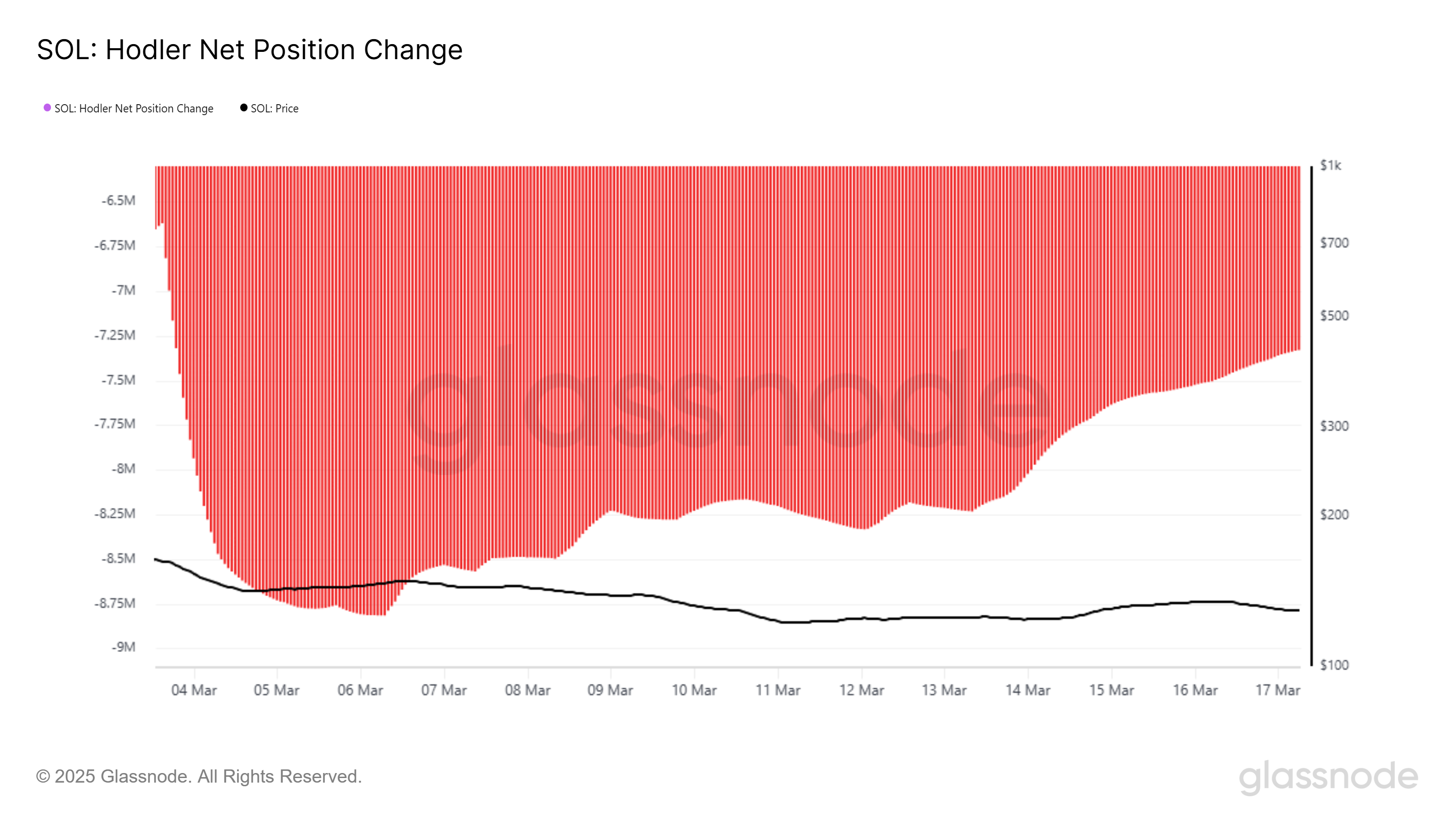

The HODLer Net Position Change metric indicates that Solana holders are rebuying the SOL they previously sold. Over the past week alone, long-term holders have accumulated more than 1 million SOL, worth approximately $128 million. This buying activity signals confidence among investors who anticipate a recovery in Solana’s price.

Historically, increased accumulation by long-term holders has been a bullish sign. As these investors continue buying at lower price levels, it reinforces support and reduces the chances of sharp declines. If this trend continues, it could create the necessary foundation for Solana to attempt another breakout.

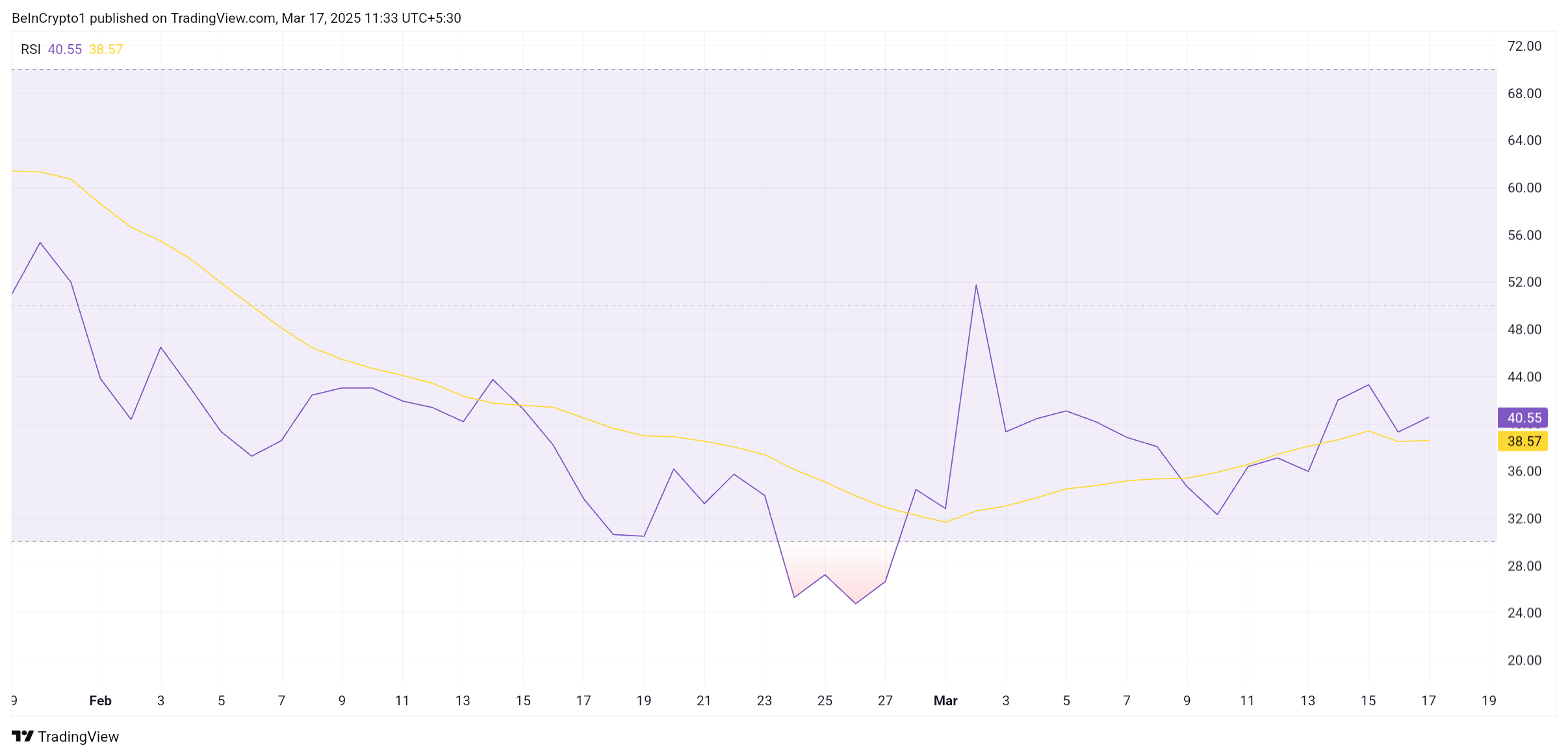

From a technical perspective, Solana is showing signs of improving momentum. The Relative Strength Index (RSI) has been trending upward, indicating a potential shift toward bullish sentiment. However, for confirmation, the RSI needs to breach the neutral 50.0 level and turn it into support.

A rising RSI suggests growing buying pressure, which could help SOL regain lost ground. This would increase the likelihood of Solana making another attempt at breaking its key resistance levels.

SOL Price Recovery Remains Uncertain

Solana is currently trading at $128, and the crypto token’s price is down by 5.5% in the last 24 hours. Despite the decline, SOL is holding above the $126 support level while attempting to breach the $135 resistance. The long-term target remains at $180, a crucial milestone for bullish confirmation.

Breaking past $180 has been a challenge, with Solana failing to attempt it in recent weeks. To reach this level, SOL would need to rally 40%, which becomes more achievable if it first breaches $161. Sustained buying pressure and improving market sentiment could help facilitate this move.

On the downside, if Solana fails to breach $148 or struggles to move past $135, it could lose its current support levels. A drop below $126 and $118 would expose SOL to further declines, potentially testing $109. This scenario would invalidate the bullish outlook and shift momentum back to the bears.