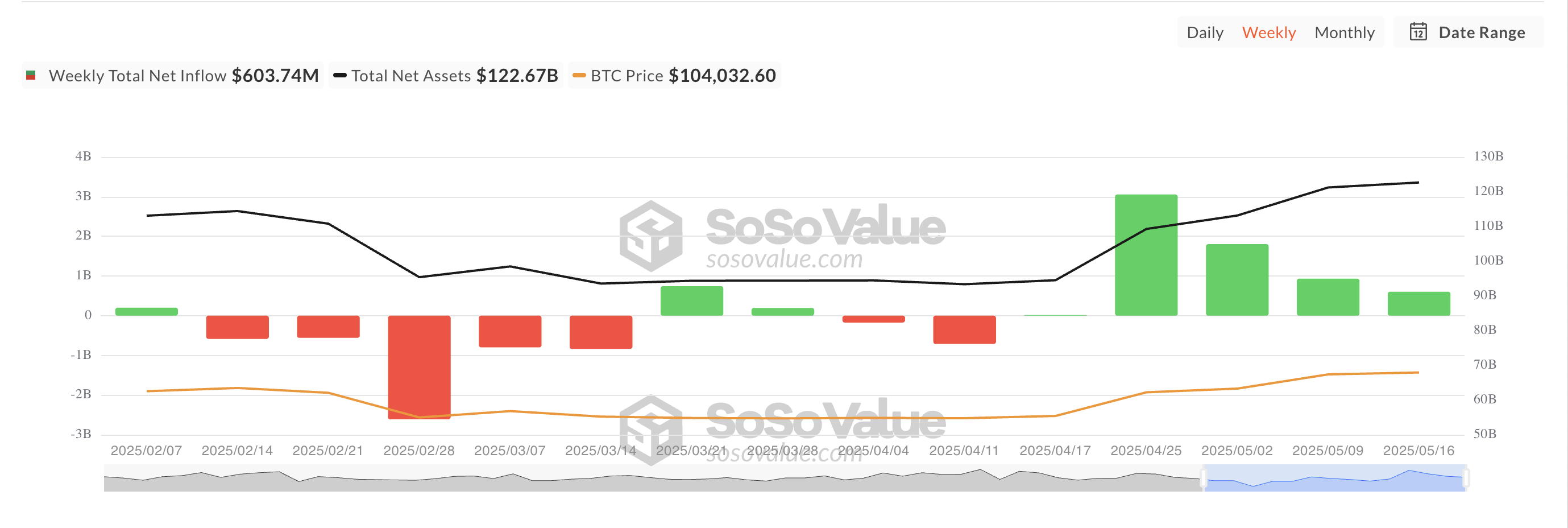

Last week, US-listed spot Bitcoin exchange-traded funds (ETFs) recorded net inflows exceeding $600 million.

While this marked a continuation of positive capital movement into digital asset products, it also had the lowest weekly inflow figure in the past month, signaling investor caution or profit-taking at higher levels.

ETF Inflows Slow as Price Consolidation Cools Investor Appetite

Between May 12 and May 16, inflows into spot BTC ETFs totaled $603.74 million. Although this was a net positive in terms of inflow into these funds, last week’s figure was the lowest weekly inflow in the past month. This highlights a more cautious but sustained capital movement into the market.

The slowdown in ETF inflows can be linked to BTC price consolidation during the five-day period under review. Throughout that period, BTC traded sideways, facing resistance at around $104,971 while finding consistent support at $102,711.

This lack of clear movement likely led some investors to be more cautious, resulting in reduced capital inflows into BTC ETFs last week.

BTC Eyes Fresh Highs

Still, bullish momentum persists in the BTC market. The king coin briefly surged to a three-month high of $107,108 during Monday’s early Asian trading session. While it has since corrected to trade at $104,956, the bullish bias toward the coin remains significant.

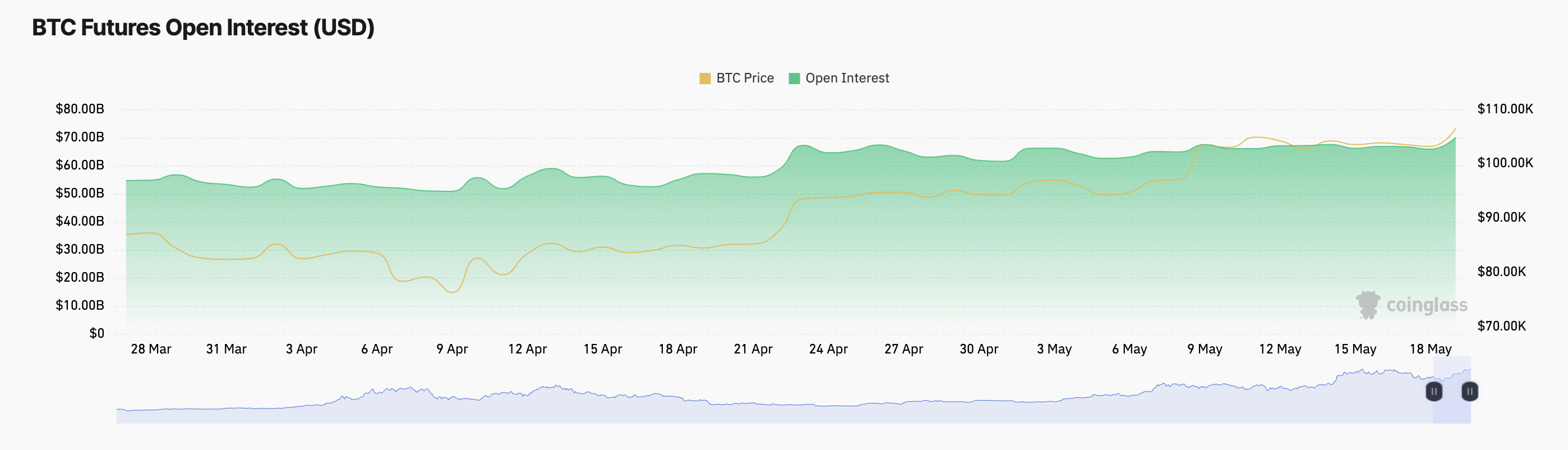

BTC’s price uptick comes alongside a rise in its futures open interest. This stands at $70.03 billion at press time, climbing 7% over the past day.

Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled. When open interest rises alongside price, it typically signals that new money is entering the market. This supports the strength of BTC’s ongoing trend and could trigger a sustained price uptick in the near term.

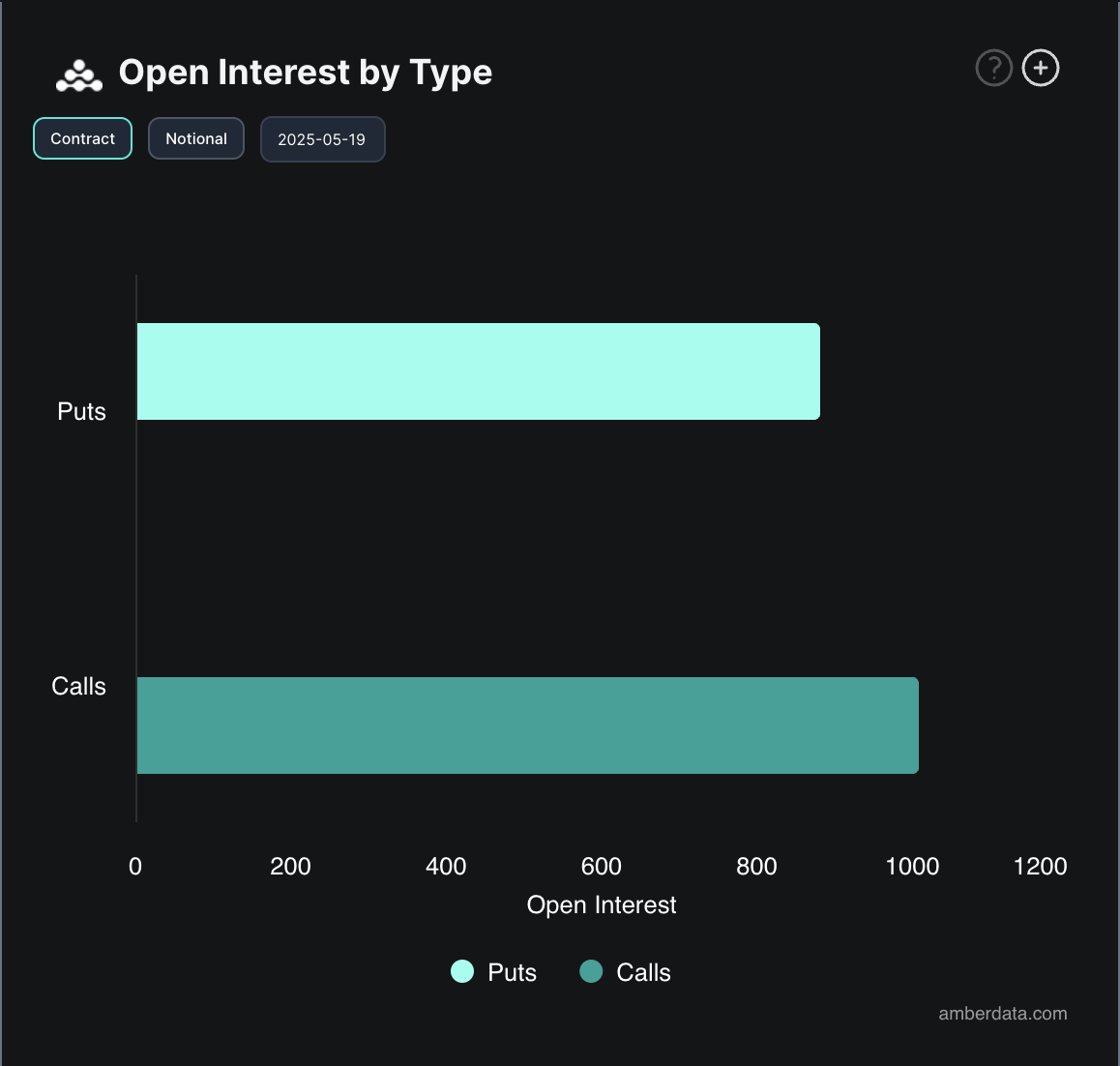

Moreover, options market data further supports this optimistic outlook. Today, the demand for call options has outpaced puts, pointing to a growing demand for bullish positioning.

Nevertheless, with derivatives activity surging and BTC reclaiming higher price levels, the coin could reach new highs in the short term.