Shiba Inu (SHIB) has witnessed a minor price rebound in the past few days. The value of the leading meme coin has surged by 13% since July 5.

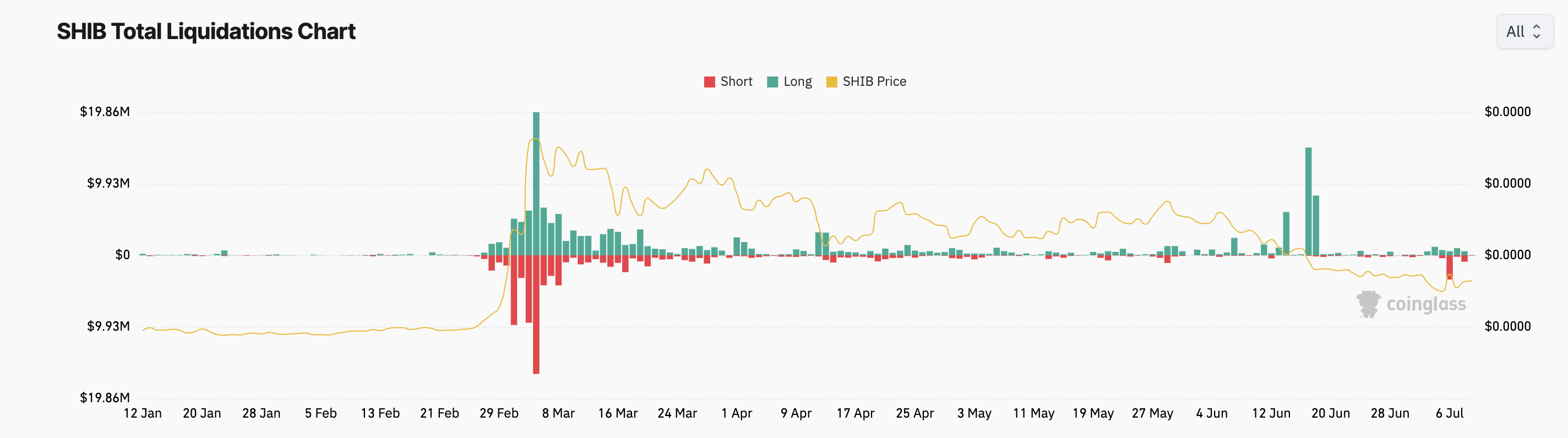

This uptick in SHIB’s value has caused many of the short positions in its futures market to be liquidated.

Shiba Inu Sees Uptick in Short Liquidations

Liquidations occur in an asset’s derivatives market when the asset’s value moves against the position held by a trader. When this happens, the trader’s position is forcefully closed due to insufficient funds to maintain it.

Short liquidations occur when traders who have taken short positions are forced to buy back the asset at a higher price to cover their losses as the price rises. This typically happens when the asset’s price increases beyond a certain point, forcing traders with open positions against a price rally to exit the market.

Since the price uptick began on July 5, SHIB has recorded more short liquidations than long ones. In fact, on July 6, SHIB’s long liquidations totaled $3.36 million, exceeding long liquidations by a whopping 491%. This represented SHIB’s highest single-day short liquidations since March 8.

Read More: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

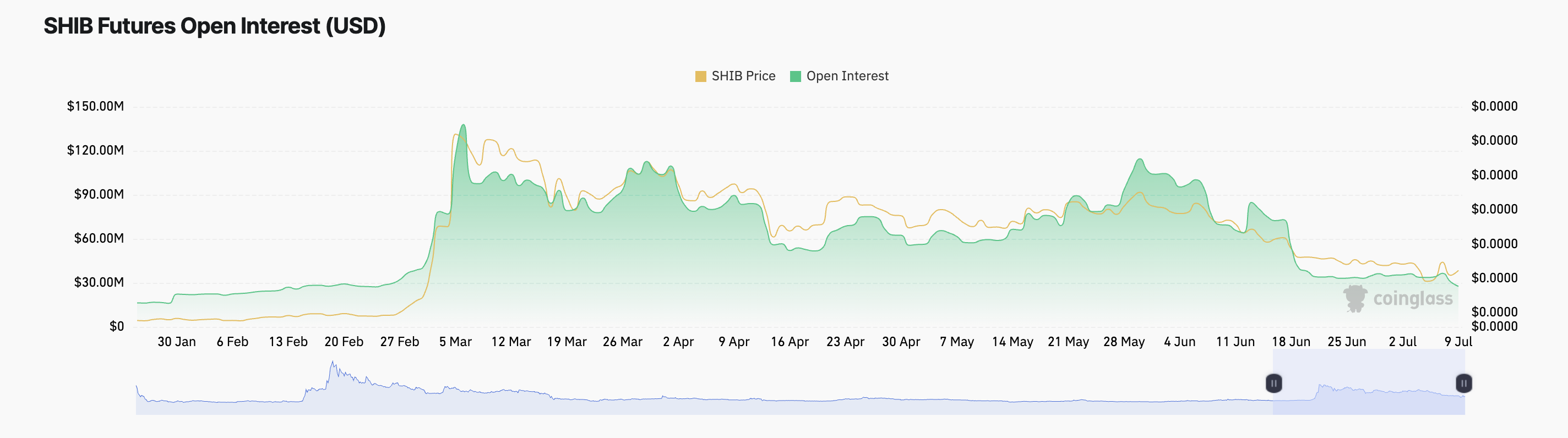

However, despite the growth in SHIB’s value in the past few days, activity across its futures market remains low. This can be gleaned from its declining futures open interest.

An asset’s futures open interest measures the total number of outstanding futures contracts/positions that have not been closed or settled. When it declines, more traders exit their positions without opening new ones.

At $27.61 million at press time, SHIB’s futures Open Interest has dropped by 23% this month alone. It currently sits at its lowest level since February.

SHIB Price Prediction: The Current Uptrend May Not Last

According to SHIB’s Aroon Up Line observed on a one-day chart, the current price rally may be short-lived. As of this writing, the indicator’s value is 0%.

An asset’s Aroon Indicator measures its trend strength and identifies potential price reversal points. When the Up Line is close to or at zero, the uptrend is weak, and the most recent high was reached a long time ago.

If a correction occurs, SHIB’s value may dip to $0.00001570.

However, if it maintains the current uptrend, its price may rally toward the $0.000017 price level.