Leading meme coin Shiba Inu (SHIB) has witnessed a significant decline in large-holder coin flow to exchanges in the last week.

This is due to the steady fall in the coin’s value. As of this writing, SHIB trades at $0.0000152, falling by almost 10% in the past seven days.

Shiba Inu Whales Refrain From Trading But For Good Reasons

Due to SHIB’s price decline in the past several weeks, the whales holding the meme coin have reduced their trading activity to prevent further losses.

On-chain data show that the coin’s large holder netflow has plummeted by over 500% in the last seven days.

This metric measures the net amount of tokens that large holders transfer into or out of exchanges. When it surges, more tokens are being transferred from large holders’ wallets to exchanges. This usually suggests that these holders might be preparing to sell their tokens, which could result in an increase in selling pressure.

Converesly, when the metric declines, it suggests that large holders are withdrawing their tokens from exchanges, possibly to hold them for a longer term. This is often due to market uncertainty or them simply waiting for a better opportunity to enter new positions.

Read More: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

The rationale behind the whales’ strategy is clear. The decline in SHIB’s price has led to significant losses for most daily traders.

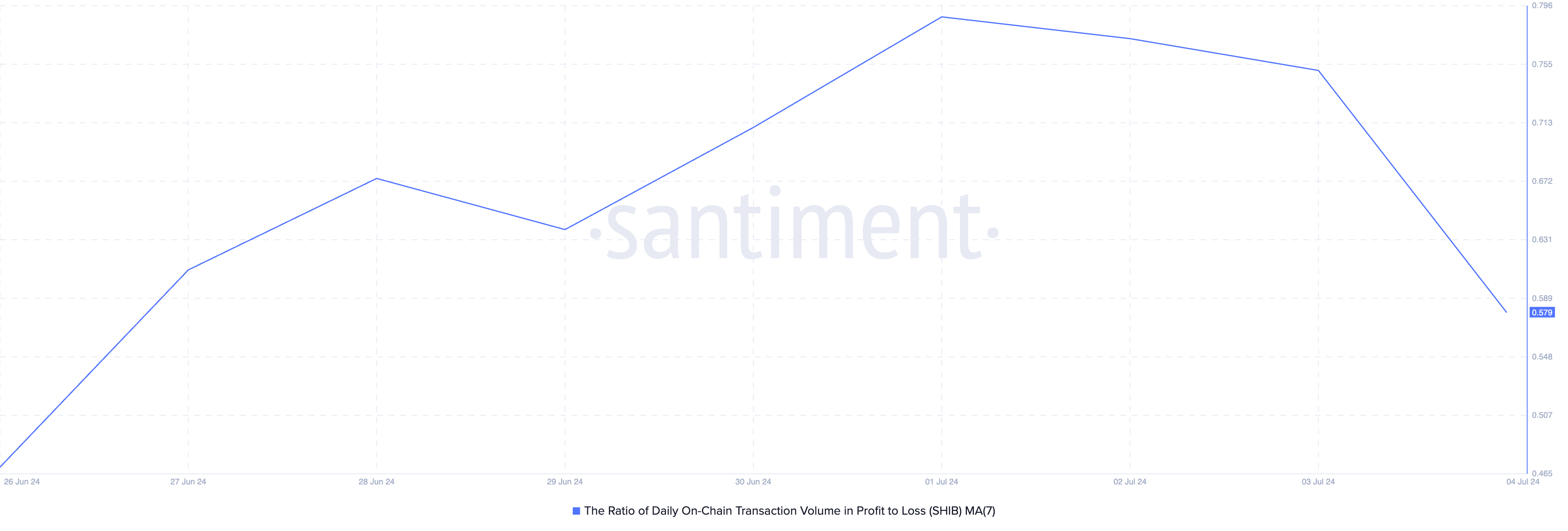

An analysis of the altcoin’s ratio of daily transaction volume in profit to loss, using a seven-day moving average, reveals that for every SHIB transaction that has resulted in a loss over the past week, only 0.57 transactions have been profitable.

This means that SHIB traders have made more losses than profits in the last week.

SHIB Price Prediction: Coin Trades Below Key Moving Average

SHIB’s steady price decline has caused its price to fall under its 20-day exponential moving average (EMA), which measures its asset’s average price over the past 20 trading days.

When an asset’s price falls below this level, it signals a sustained decline in buying pressure. If this trend continues, SHIB’s value may dip to $0.0000151.

Read More: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

However, if a price rebound backed by sufficient demand occurs, the coin’s value may climb to $0.0000185.