Shiba Inu’s (SHIB) price is bouncing back from four-month lows, looking to recover the losses witnessed in the past month.

Investors also have a shot at making the most of this opportunity, as selling will likely take a break for now.

Shiba Inu Investors Lose Big

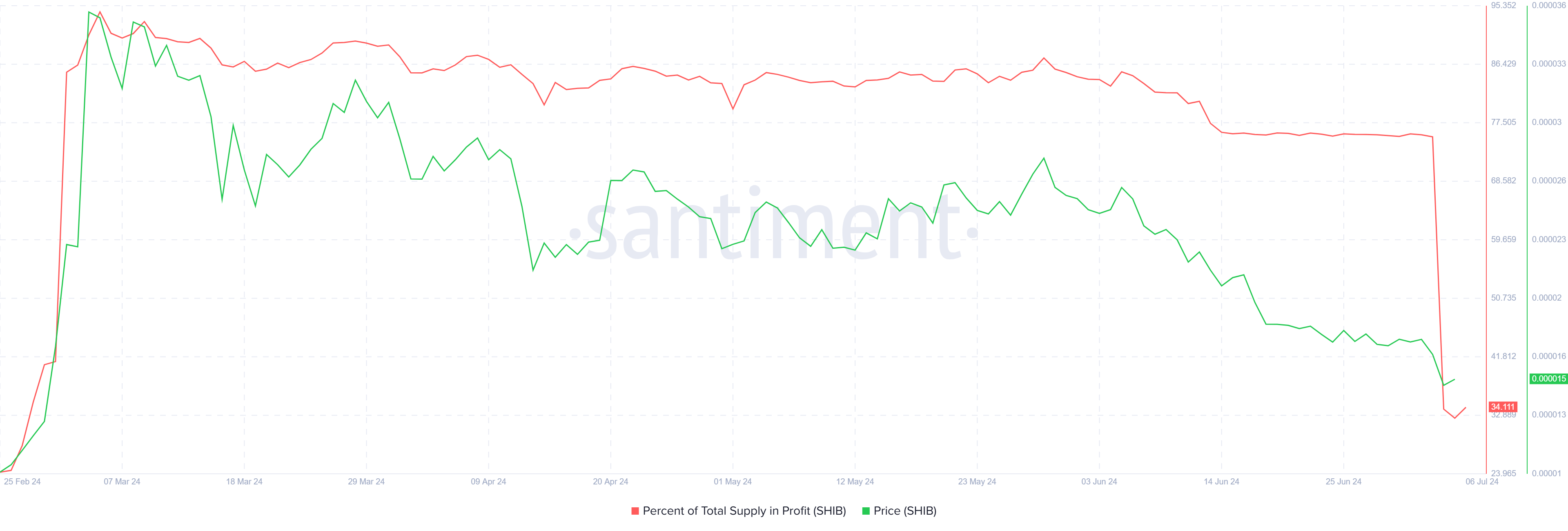

While Shiba Inu’s price only declined by 15% over the last week, the impact on investors was three times larger. The total supply in profit dropped by close to 42%, falling from 75% to 33% in a day.

This is because about 434 trillion SHIB, worth $6.7 billion, was bought between $0.00001900 and $0.00001500. As the meme coin slipped to $0.00001281 during intra-day lows yesterday, this supply lost its profitability completely. This will keep investors from selling now, as such a large supply would only be sold when it bears profit again.

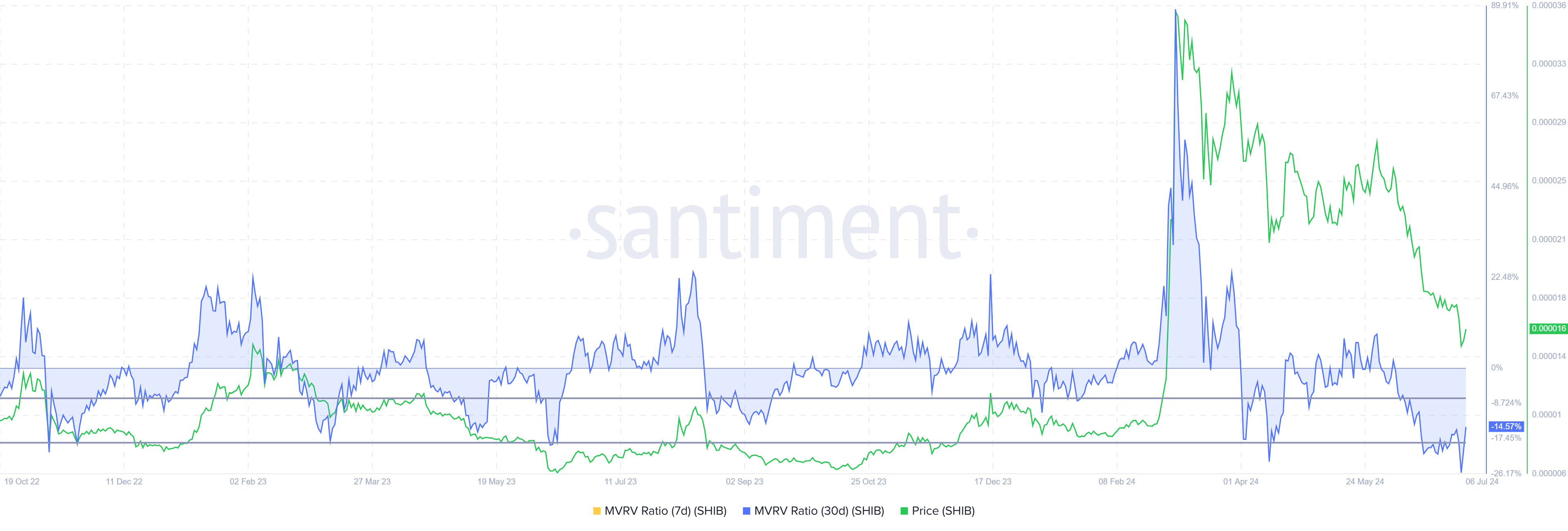

Furthermore, most investors anticipating recovery and profits will likely turn to accumulation. The Market Value to Realized Value (MVRV) ratio suggests a good opportunity to do so.

The MVRV ratio assesses investor profit and loss. Currently, Shiba Inu’s 30-day MVRV stands at -14.5%, indicating losses, which may lead to buying pressure.

Historically, SHIB’s MVRV between -7% and -18% usually signals the start of recoveries and rallies, marking an opportunity zone for accumulation. This could help steer Shiba Inu’s price upwards.

Read More: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

SHIB Price Prediction: The Critical Range

The range between $0.00001473 and $0.00002093 is critical to Shiba Inu’s price as it houses 73% of all SHIB circulating supply. For this reason, the meme coin could find considerable resistance here.

Nevertheless, investors’ attempts to recover their profits would motivate them to push SHIB upwards. Once $0.00002093 is breached, the altcoin would have a shot at profits.

Read More: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

However, if this breach fails, Shiba Inu’s price might consolidate within this range. This would continue until stronger bullish cues help the coin escape; otherwise, the bullish thesis would be invalidated.