Shiba Inu’s (SHIB) price has jumped 13% in the past seven days, mirroring the short-term momentum seen across many altcoins.

However, this uptick could encounter a major setback due to factors outlined in this analysis.

Low Liquidity, Weak Traction Threatens Shiba Inu’s Upswing

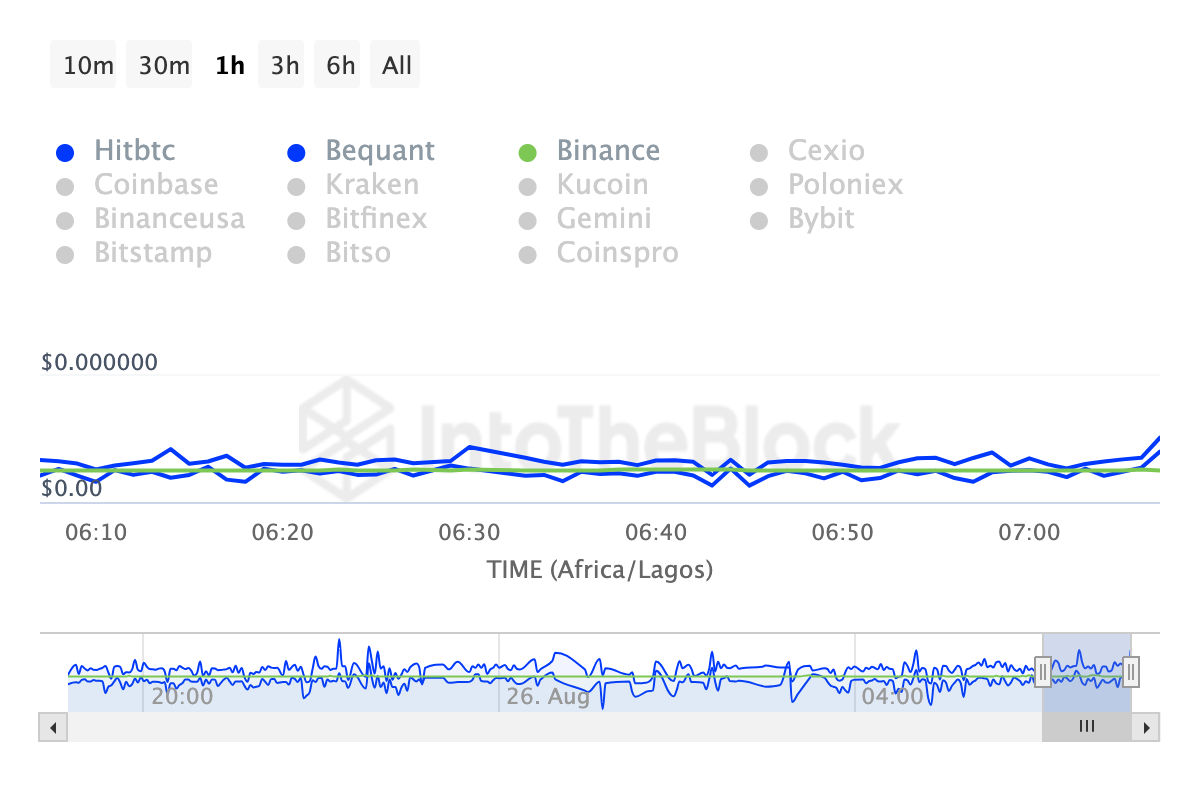

One key concern is the recent surge in Shiba Inu’s bid-ask spread, signaling growing illiquidity for the token. The bid-ask spread, a crucial liquidity metric, measures the difference between buy and sell prices.

A low spread indicates a liquid market, while spikes, as seen with SHIB, suggest diminished liquidity, leading to short-term losses for traders.

This spike, coupled with a recent price drop, could trigger sharp fluctuations unless the spread narrows. Currently, SHIB is priced at $0.000014. If the liquidity issue persists, the price could see further declines.

Read more: 6 Best Platforms To Buy Shiba Inu (SHIB) in 2024

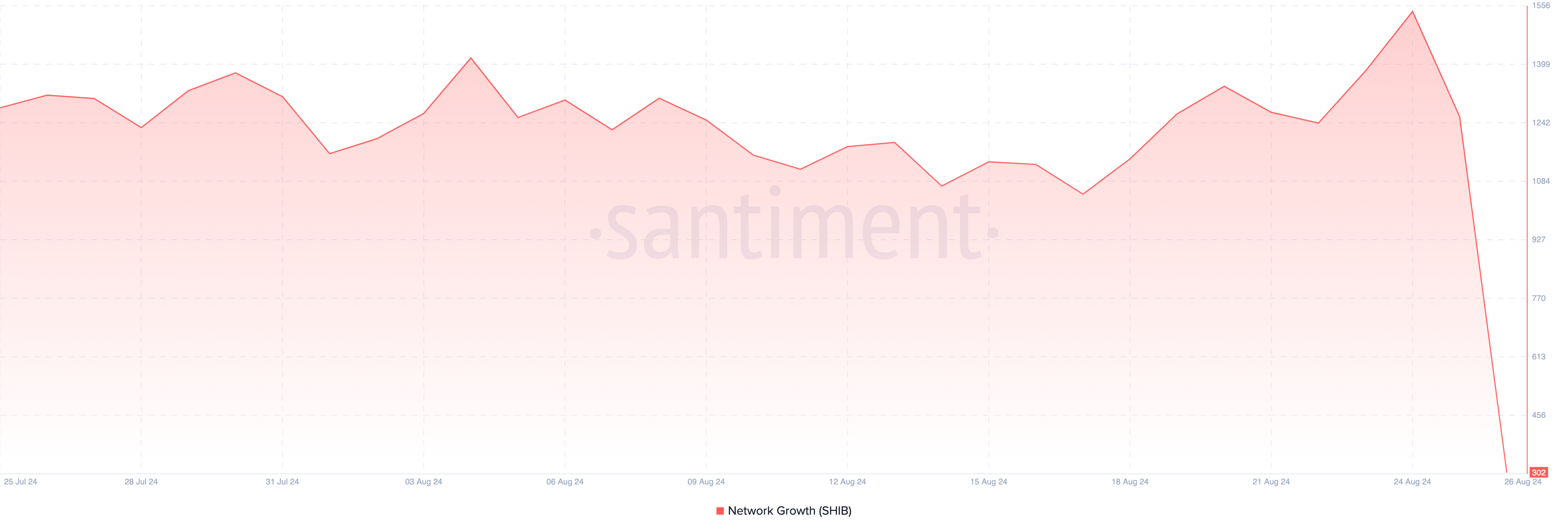

Further contributing to the bearish outlook is Shiba Inu’s declining Network Growth, a key indicator of adoption and user traction. Network Growth measures the number of new addresses conducting their first transaction on the blockchain. Typically, an increase signals rising demand, which can drive prices higher.

In SHIB’s case, however, the notable in Network Growth suggests waning interest and reduced adoption. This drop could weaken long-term demand for the token, adding to the downward pressure on its price.

SHIB Price Prediction: The $0.000013 Support Is Crucial

From a technical standpoint, SHIB’s price continues to display signs of fragility, especially if liquidity concerns persist. The daily chart reveals a decline in the Chaikin Money Flow (CMF) indicator, which gauges market trading activity to measure accumulation versus distribution.

A higher CMF reading typically indicates strong accumulation, often preceding a price uptick. However, SHIB’s declining CMF suggests that distribution is outpacing accumulation, pointing to increased selling pressure.

If this trend continues, SHIB could struggle to maintain its current price of $0.000014, raising the risk of further declines.

Read more: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

A crucial support level to monitor is $0.000013. If SHIB drops below this threshold, it could indicate a deeper correction, potentially pushing the price down to $0.000010.

On the upside, the $0.000016 resistance is a pivotal level for bulls aiming to extend the rally. Should bearish momentum be invalidated and bulls regain control at $0.000016, SHIB could target a recovery toward the $0.000020 range.