Medical device company Sharps Technology nearly doubled in value Monday, with its stock soaring 96% to an intraday high of $14.53, after announcing a $400 million plan to build a Solana-based digital asset treasury.

The rally followed news of a private placement deal and a partnership with the Solana Foundation to acquire SOL, the blockchain’s native token. Sharps closed the day at $12.01, still well above Friday’s $7.40.

Solana Treasury Strategy Announced

Sharps confirmed Monday that it signed a letter of intent with the Solana Foundation to purchase $50 million of SOL tokens through a private investment in public equity (PIPE) transaction. Accredited investors will buy company stock and stapled warrants at $6.50 per unit, with warrants exercisable at $9.75 over three years. This structure links Sharps’ equity directly to Solana’s price performance.

The company appointed Alice Zhang, co-founder of Web3 startup Jambo, as its chief investment officer to lead the treasury pivot. Another prominent Solana figure, James Zhang, will serve as a strategic adviser.

“Global adoption of Solana’s ecosystem is accelerating,” Alice Zhang said in the company’s press release. “We believe now is the right time to establish a digital asset treasury strategy with SOL, which will set Sharps up for long-term success.”

The offering, expected to close on or around August 28, allows investors to fund allocations using either locked or unlocked SOL and receive pre-funded and stapled warrants in return.

Several US-listed healthcare and biotech companies have already adopted cryptocurrencies as treasury assets. Hoth Therapeutics allocated $1 million in Bitcoin in November 2024, while Atai Life Sciences followed in March with a $5 million purchase. 180 Life Sciences rebranded as ETHZilla in July and announced a $425 million Ether treasury after a 99% stock plunge.

Wall Street Warns of Risks

Investor enthusiasm surged following Sharps’ announcement. On Stocktwits, a social media platform aggregating retail market sentiment, the outlook on STSS shifted from “bullish” to “extremely bullish” within 24 hours, while message volume hit record highs.

Not all analysts agree. In a recent investor education video, Charles Schwab warned that companies moving large reserves into volatile digital assets outside their core business “have raised a red flag or two.”

Sharps, however, insists the crypto pivot will strengthen its long-term outlook. With seasoned executives and growing institutional backing, the company is betting a Solana treasury will deliver more substantial returns than traditional reserves.

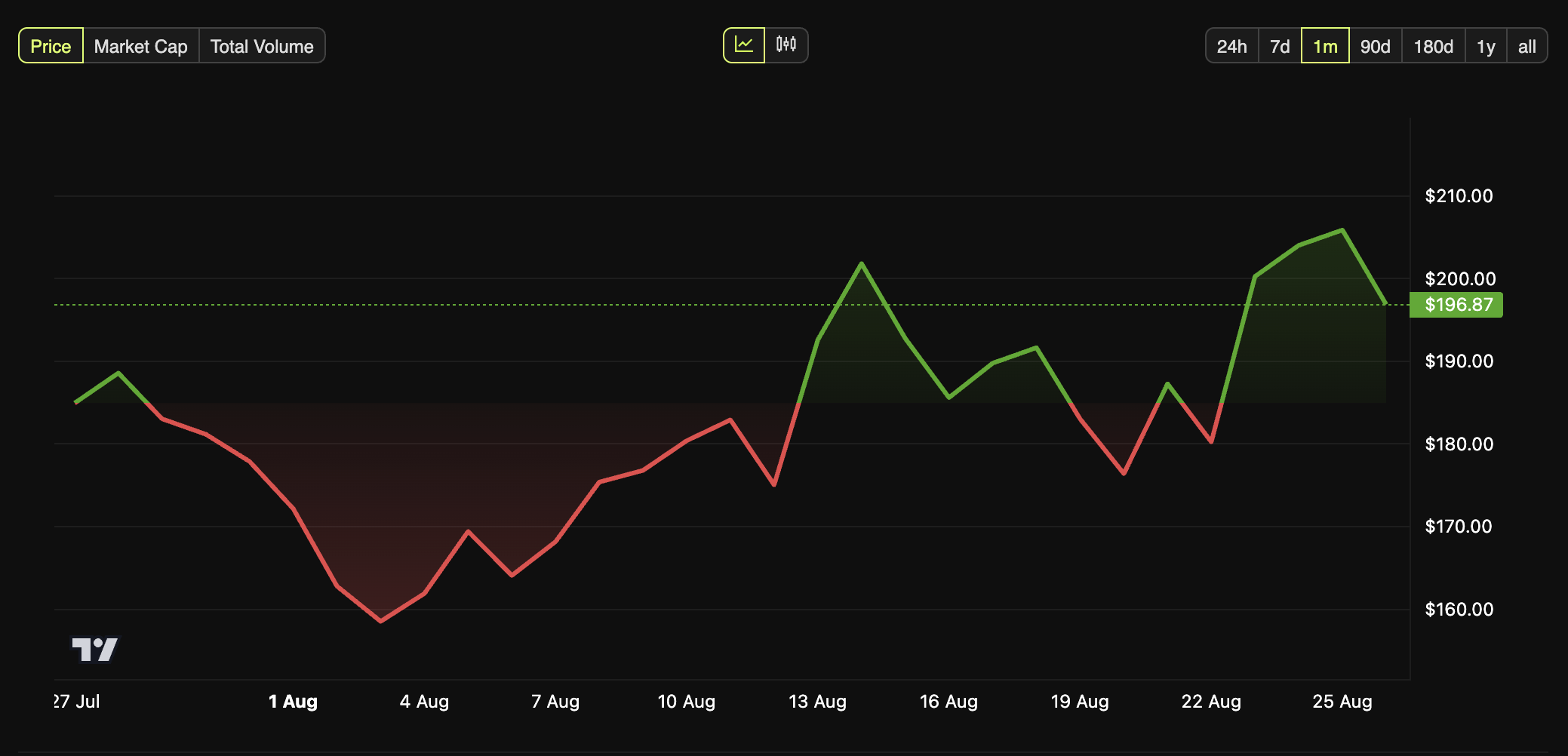

Solana’s native token traded at $187-189 on Tuesday, down 10-11% in 24 hours after briefly topping $212 over the weekend. Despite the dip, SOL remains one of the most institutionally supported assets, with Visa testing its blockchain to speed global credit card settlements. The token’s all-time high of $293 was reached in January.