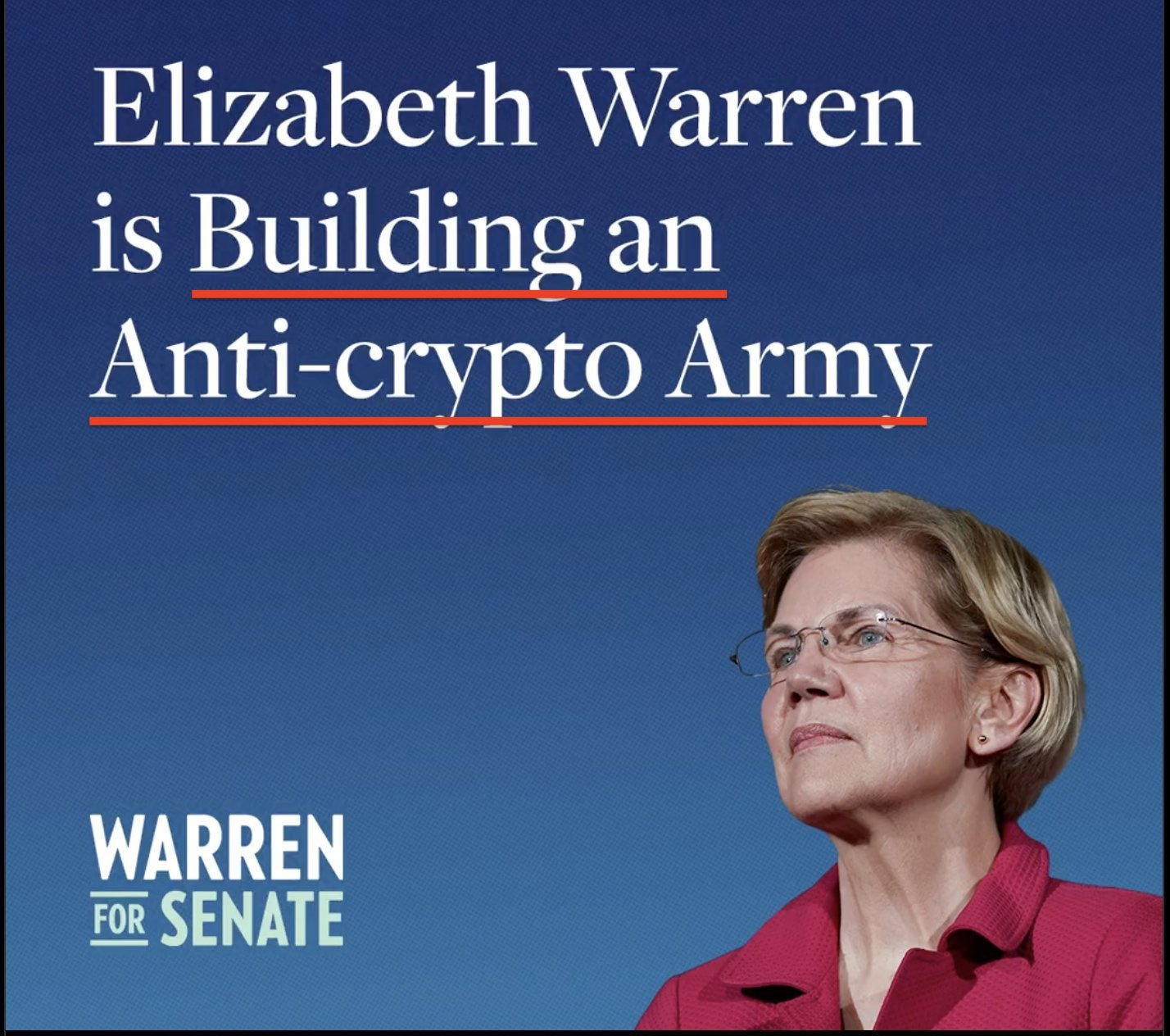

Senator Elizabeth Warren (D-Mass.) and Sen. Roger Marshall (R-Kan.) decided to re-introduce the Digital Asset Anti-Money Laundering Act. She appears determined to pass her legislation to make the crypto industry kneel.

Elizabeth Warren, a U.S. Senator from Massachusetts, has strongly voiced her concerns regarding cryptocurrencies. Particularly their lack of regulation and potential for fraud and abuse. Her stance on cryptocurrency has been described as ‘anti-crypto’ by many.

Warren’s statements have put added pressure and scrutiny on the cryptocurrency industry by other policymakers and regulators, potentially leading to increased regulation and oversight.

This makes it difficult for some cryptocurrency projects to operate and may limit the adoption of cryptocurrencies by mainstream investors and businesses. If this wasn’t enough, Warren recently announced her bid for a new Senate term.

Elizabeth Warren Making Another Senate Run

Senator Elizabeth Warren (D-Mass.) aims to continue her political trajectory in the Senate. The state’s senior Senator made her third-term bid official in a two-plus-minute video posted to social media:

The video highlights her achievements, such as a corporate minimum tax, over-the-counter hearing aids, and canceling student loan debt (which remains stalled in court). But above all is her narrative towards cryptocurrencies by building an anti-crypto army.

Warren has long been a proponent of stricter regulations for the crypto industry. In 2018, she called for a coordinated effort to regulate the industry, arguing that cryptocurrencies had become a ‘Wild West’ for investors. She was also critical of Facebook’s proposed Diem (formerly Libra) cryptocurrency, which she argued would threaten the global financial system.

Warren’s reelection bid could affect the crypto industry, as she will likely continue pushing for increased regulation. The proposal could significantly impact the crypto industry, especially given her past comments.

A Look Into Elizabeth Warren’s Proposed AML Act

In recent years, the senator has been a vocal critic of cryptocurrencies, arguing that they are used to facilitate illicit activities, such as money laundering and terrorist financing. Elizabeth Warren and Sen. Roger Marshall are now aiming to pass the Digital Asset Anti-Money Laundering Act.

First introduced last December, the act aims to close loopholes that terrorists, rogue states, and other bad actors currently exploit to launder money through crypto transactions. The reintroduction of the Digital Asset Anti-Money Laundering Act could signal a renewed focus on regulating the industry.

If passed, the Digital Asset Anti-Money Laundering Act would require crypto exchanges and other virtual asset service providers to comply with the Bank Secrecy Act (BSA) and other anti-money laundering (AML) laws. The bill would also establish a new framework for regulating digital assets. It would require the Financial Crimes Enforcement Network (FinCEN) to issue rules for detecting and reporting suspicious activities involving digital assets.

Furthermore, the bill would extend anti-money laundering reporting requirements to include U.S. persons who transact $10,000 or more in digital assets using an offshore account and require the Treasury Department to do anti-money laundering compliance examinations for money service businesses, the registration that large U.S. crypto companies fall under.

What Does This Mean for Crypto?

In addition to Warren’s reelection bid, the regulatory landscape for cryptocurrencies is also evolving rapidly. Of late, there has been a flurry of activity from regulators and lawmakers worldwide. Many countries have begun to introduce new regulations or propose changes to existing ones. In the United States, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have both signaled that they will increase their oversight of the crypto industry.

Speaking to BeInCrypto, Ryan Sean Adams, the founder of Bankless, asserted:

“The bill (proposed) is the most significant attack on digital freedom I’ve ever seen. It turns validators into money services businesses. It bans financial privacy. It turns America into a full-on surveillance state. “

Further added, ‘this is how western democracies die.’ Other critics, too, have aired their thoughts following the development. For instance, famed analyst Dan Held tweeted:

Another user used sarcasm to display the thought process, as evident in the tweet below. It depicts the ‘traditional’ mentality behind creating this task force.

Will the Anti-Crypto Army Be a Success?

The crypto industry is evolving and constantly developing new technologies and innovations. Some experts believe the industry is on the cusp of a significant breakthrough, with cryptocurrencies and blockchain technology potentially transforming how we conduct financial transactions. Blocking such innovation could seriously hinder growth.

So, overall, successfully creating a force can take time and effort. Various surveys covered by BeInCrypto show that major swathes of the population see cryptocurrency and blockchain as keystone features of the global economy. One study showcased that nearly 60% of Democrats saw the potential for crypto to shape the future of finance.