A new report from CoinShares suggests that the United States Securities and Exchange Commission’s (SEC) delay in making a decision on the approval of Bitcoin exchange-traded funds (ETF) has led to a significant Bitcoin sell-off.

“Disappointment from SEC ETF decisions has impacted sentiment,” the report declares.

SEC Uncertainty Leads to Sell-Off

Over the last week, the market has been impacted by the SEC’s delayed decision on the approval of a Bitcoin ETF, according to an Aug. 21 CoinShares report:

“We believe this is in reaction to recent media highlighting that a decision by the US Securities & Exchange Commission in allowing a US spot-based ETF is not imminent.”

The previous report for the week ending Aug. 11 highlights Bitcoin inflows amounting to $27 million after three weeks of outflows. During the past week, Bitcoin has once again experienced a net negative sell-off:

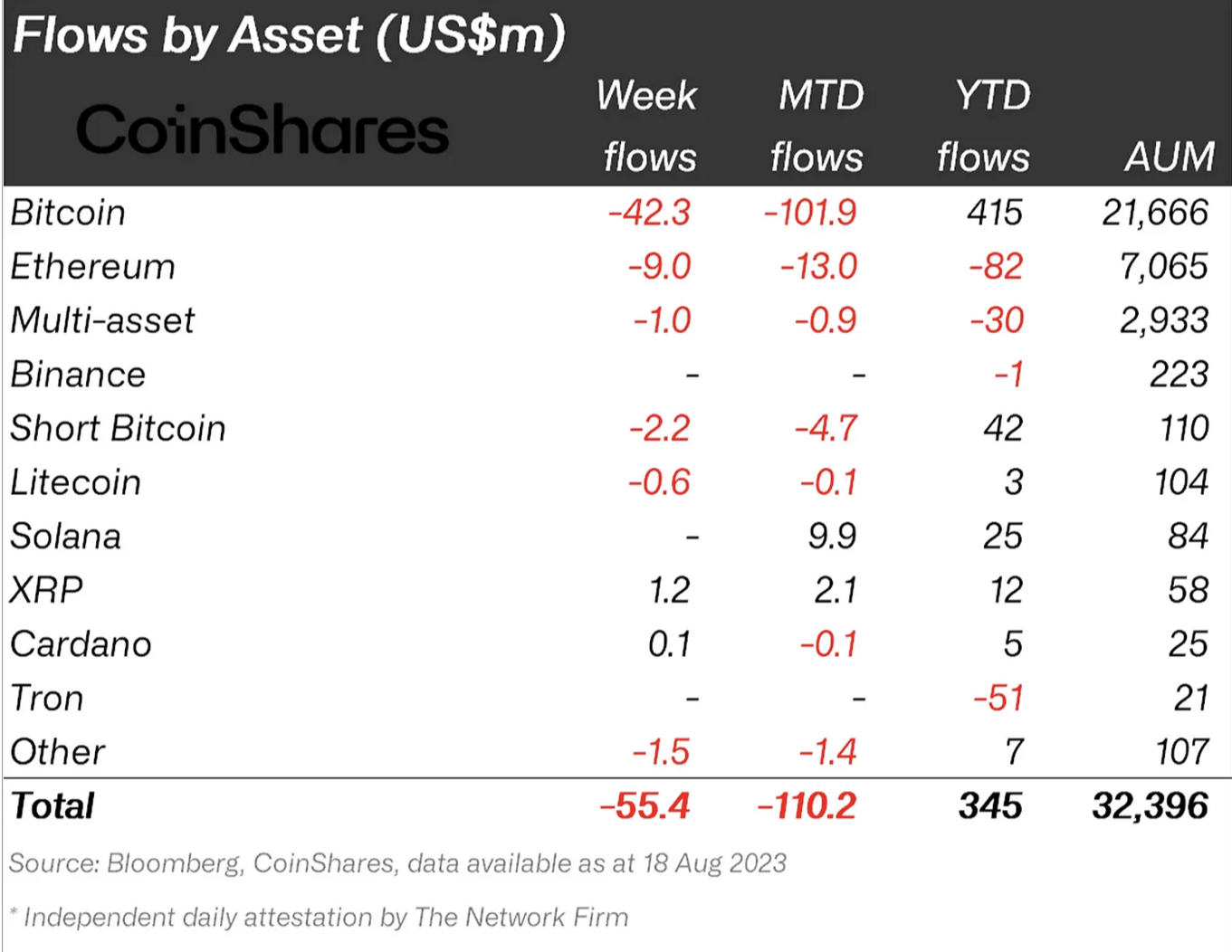

“Bitcoin saw outflows totalling US$42m, reversing the inflows seen the prior week, while short-bitcoin saw outflows for almost the 17th consecutive week,” the report states.

Ethereum ETF Status and Setbacks

It wasn’t just Bitcoin that took a turn. Ethereum, which in the previous week had inflows of $2.5 million, also returned to outflows:

“Ethereum saw US$9m outflows,” it states, despite recent reports that the SEC is looking to approve Ethereum Futures ETFs by as early as October.

To learn how to sell Bitcoin, read BeInCrypto’s guide: How to Sell Bitcoin (BTC) in Four Easy Steps — A Beginner’s Guide

There was a notable variation in overall digital asset trends between this week and the previous one. In the preceding week, an influx of $29 million occurred, attributed to US inflation data falling slightly below projections.

However, the current week shows substantial outflows of $55 million.

Three more of the top 20 cryptocurrencies by market capitalization saw outflows for the week ending August 18:

“Polygon, Litecoin, and Polkadot also saw outflows of US$0.9m, US$0.6m, and US$0.5m, respectively,” the report notes. On the other hand, XRP, ranked 5th by market cap, experienced inflows week-on-week.

This follows the recent conclusion of a 2.5-year lawsuit between Ripple, the company behind XRP, and the SEC, where XRP was deemed not a security when sold to individual investors. On August 17, the same judge who issued the ruling granted the SEC permission to file an appeal.