The US Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC) could soon begin working unilaterally, following a new bill presented by Republican Tennessee Congressman John Rose.

Crypto regulation in the US remains a contentious issue, with the pro-industry folk accusing regulators of stifling innovation and driving investment overseas.

Congressman Pushes for Unilateral Regulation

Congressman Rose is pushing for the creation of a joint advisory committee between the SEC and CFTC. He introduced the “BRIDGE Digital Assets Act,” which proposes a 20-member private sector group, with each member representing various interests within the cryptocurrency space.

“The current heavy-handed, regulation-by-enforcement approach isn’t working and is instead encouraging investment in this key innovation overseas. The Joint Advisory Committee on Digital Assets will provide a framework for the government and private sector partners to cooperate on a path toward success for the regulatory landscape of digital assets and private sector participants,” the bill read.

Citing unnamed persons, Fox Business reporter Eleanor Terrett said the committee would be a bridge between the regulators and industry players. This would allow industry participants to address sector-related matters with the SEC and CFTC through the committee.

A unilateral or coordinated regulatory body could indeed offer more clarity in the crypto space, especially given past conflicts between the SEC and CFTC over jurisdictional authority. These disagreements have created confusion within the industry, highlighting the need for clearer oversight.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

In March 2023, the SEC asserted that all Proof-of-Stake (PoS) tokens and digital assets should be classified as securities. In contrast, the CFTC argued that Ethereum, trading as a futures contract on its exchange, should be considered a commodity. CFTC Chair Rostin Behnam stated that he believed Ethereum was a commodity, claiming jurisdiction over it since Ethereum futures were traded on the CFTC exchange.

Nevertheless, community members remain skeptical about the effectiveness of a joint committee, especially with Gary Gensler still serving as SEC chair.

“I highly doubt the SEC is waiting for this. They’ll probably treat the advice the way they promised to offer advice,” another user commented.

Coinbase, Ripple CLOs Respond to SEC’s on Securities Term

Meanwhile, the US SEC has provided more clarity on the securities term for crypto assets. Following eToro’s settlement with the SEC for a $1.5 million penalty, Coinbase chief legal officer Paul Grewal said it is an admission that Ethereum is not a security.

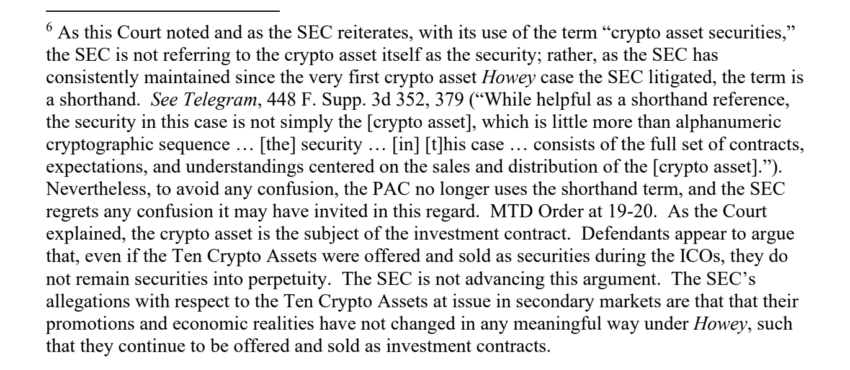

He also highlighted a statement in the footnote of SEC’s amended complaint against Binance, noting the regulator’s regret of any confusion invited by falsely and repeatedly stating that tokens themselves are securities.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

Further Grewal said the regulator’s allegations of Ethereum being a security have affected ETH transactions as the second largest crypto by market capitalization looks to “avoid the agency’s clutches.” Similarly, Ripple CLO Stuart Alderoty acknowledges the SEC’s admission of fault on token security statuses.

“So the SEC finally admits that 1/ “crypto asset security” is a made-up term and 2/ to prove a “crypto asset security” is an investment contract, the SEC needs evidence of a bundle of “contracts, expectations, and understandings”? Think it’s time for the SEC to admit it has become a twisted pretzel of contradictions,” Alderoty wrote.

The SEC has stifled the crypto industry for several years. As the US elections approach, many hope that this will be the game changer, opening the door for more favorable policies in the space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.