Reserve Rights (RSR) has experienced a notable 22% increase in its price over the last 24 hours. This surge follows the news of Paul Atkins, former Reserve Rights Foundation advisor, becoming the new chair of the US Securities and Exchange Commission (SEC).

Additionally, US President Donald Trump’s decision to pause reciprocal tariffs has added a layer of optimism to the cryptocurrency market, further buoying RSR’s price.

Reserve Rights Investors May Note Profits Soon

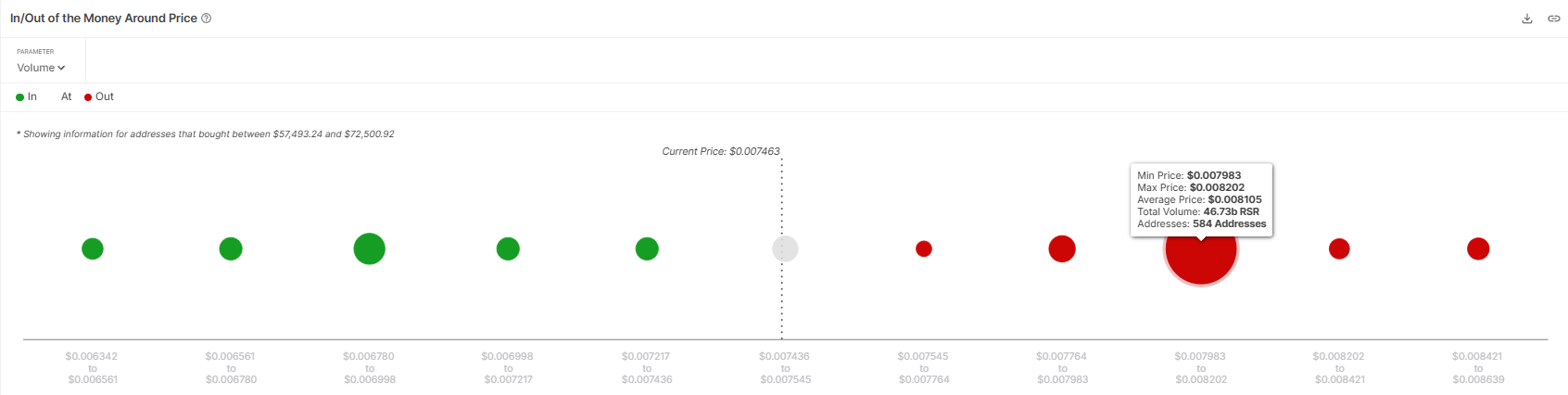

The market sentiment surrounding RSR remains cautiously optimistic, driven by a significant accumulation of tokens. According to the IOMAP, around 46.73 billion RSR tokens, valued at over $350 million, are currently sitting at a price range between $0.007983 and $0.008202.

These tokens have not yet reached a profit zone, but an 8% rally would make them profitable for investors. As these large holders are likely to maintain a bullish outlook, the anticipation of possible profits could further strengthen the buying sentiment, contributing to a price increase.

However, if the holders aim to sell for a break-even, it might negatively impact the RSR price rally.

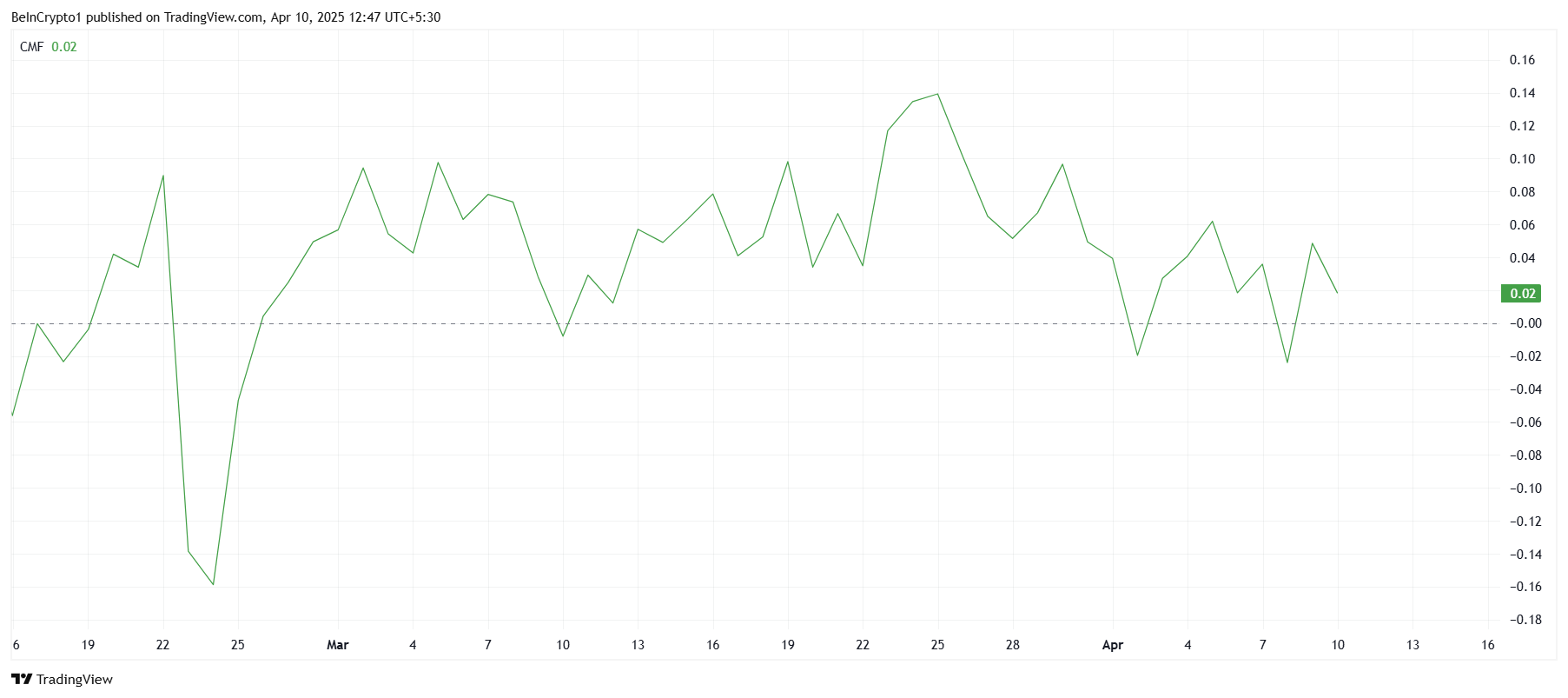

Despite the news of Paul Atkins becoming SEC Chair, the overall macro momentum for RSR appears to be lackluster. The Chaikin Money Flow (CMF) indicator, which measures market liquidity and investor buying pressure, has not seen any sharp upticks, even after the recent announcements.

This suggests that, while the netflows have been positive, they remain underwhelming compared to the size of the positive developments. If RSR’s price continues its uptick in the coming days, there is a chance that the CMF will start to reflect stronger positive sentiment.

RSR Price Is Rising

Reserve Rights (RSR) price is currently trading at $0.007543, with a strong support level at $0.007386. Given the 22% rally over the last 24 hours, it is possible that the token will continue to rise if it holds above this support.

A bounce off $0.007386 could see RSR making its way to $0.008196. This would bring the altcoin closer to a profitable range for many investors as well as imbue confidence regarding further rally.

However, should RSR fail to breach the $0.008196 resistance or fall below the support of $0.007386, the altcoin’s price could drop to $0.006601 or even lower towards $0.005900. This would significantly damage the bullish thesis and extend recent losses, potentially leading to a further period of consolidation.