Robinhood has confidentially filed for an IPO, as revealed by a draft filing submitted to the US Securities and Exchange Commission (SEC).

Robinhood, the now much-maligned trading app, has confidentially filed a draft registration statement for an IPO.

The story was first reported by Bloomberg and later confirmed by Robinhood in a blog post.

A Robinhood IPO has been in the works for some time. Reuters reported that Goldman Sachs would lead the IPO.

The IPO will take place once the filing receives the SEC’s approval. Though, the firm notes that the number of shares on offer and the price range has not been decided.

Robinhood received a near $12 billion valuation following a funding round in September 2020. The company’s backers include Andreessen Horowitz and Sequoia Capital.

Recent events have wrought turmoil for the company. Most notably, the company’s role in the GameStop stock incident resulted in a significant dip in its reputation.

Many criticized Robinhood for being hypocritical. This is because its motto of democratizing investment was in conflict with its decision to suspend the trading of the GameStop stock. Users of the app accused Robinhood of siding with institutions, and going against the idea of democratizing finance.

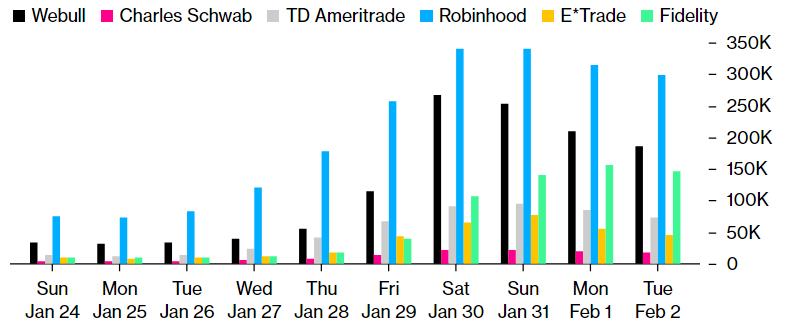

Still, Robinhood is an extremely popular app despite all the incidents. The app saw over 600,000 downloads in a day, according to research from SimilarWeb and JMP Securities. Its popularity holds because, in terms of user experience, few apps come close.

Robinhood IPO Could Be a Boost for Crypto

Robinhood, which offers cryptocurrency investments as well, has been popular among younger investors thanks to its sleek interface. The company is one of many related to the cryptocurrency industry that is set to go public.

Coinbase is the other major headliner for crypto-related IPOs. The San Francisco-based exchange will undergo a direct listing instead of an IPO, it announced in January 2021. Coinbase’s most recent valuation has been set at $90 billion.

As many as eight other crypto-associated companies have mulled going public. These include mining hardware manufacturer MicroBT and social trading platform eToro.