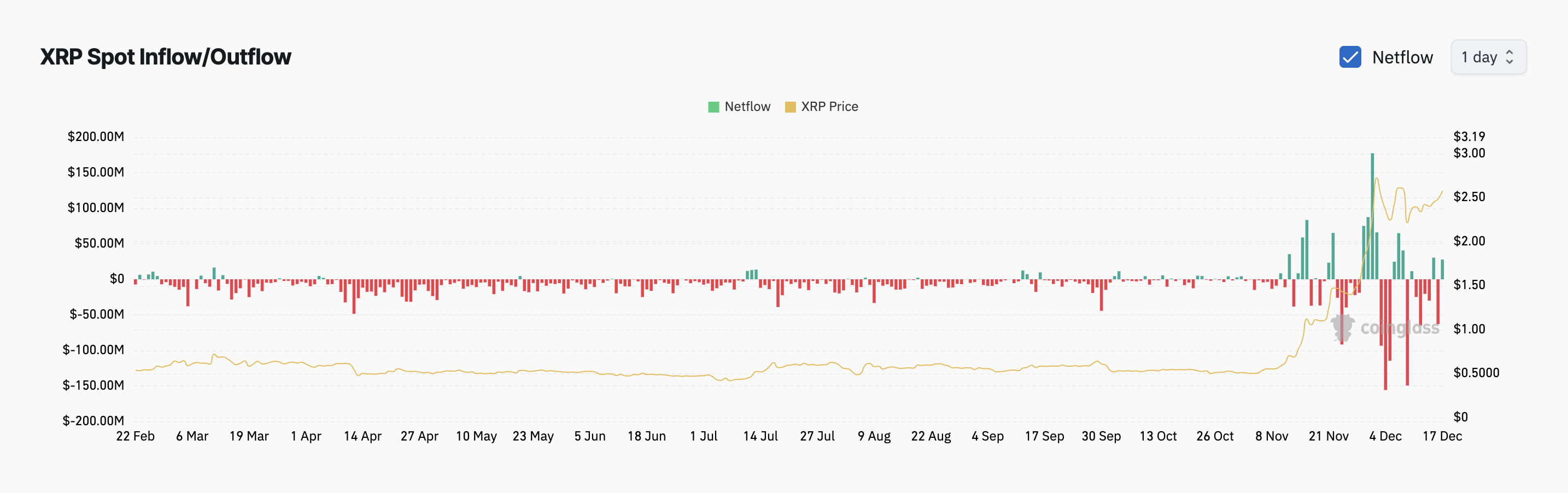

A significant increase in XRP inflows to cryptocurrency exchanges has been observed, coinciding with the anticipated global launch of Ripple’s new stablecoin, RLUSD.

This surge suggests that some XRP holders are capitalizing on the market excitement by selling their tokens for potential profits. This puts the altcoin at risk of a short-term decline.

Ripple’s RLUSD Triggers Token Selloffs

Following last week’s approval from the New York Department of Financial Services (NYDFS), Ripple’s RLUSD stablecoin will begin trading globally on Tuesday.

The United States dollar-backed stablecoin will launch on Uphold, MoonPay, Archax, and CoinMENA. Other exchanges, such as Bitso, Bullish, Bitstamp, Mercado Bitcoin, Independent Reserve, and Zero Hash, are expected to list RLUSD in the near future.

XRP’s price has surged by almost 10% since the news broke. However, this uptrend has prompted some investors to sell off their tokens, as reflected by its rising exchange inflows. According to Coinglass, XRP inflows into cryptocurrency exchanges have totaled $28 million today.

When an asset’s exchange inflows spike, it means a significant amount of cryptocurrency is being deposited into exchanges, often indicating an increase in selling activity. This signals that traders are preparing to sell their holdings, potentially leading to downward price pressure in the market.

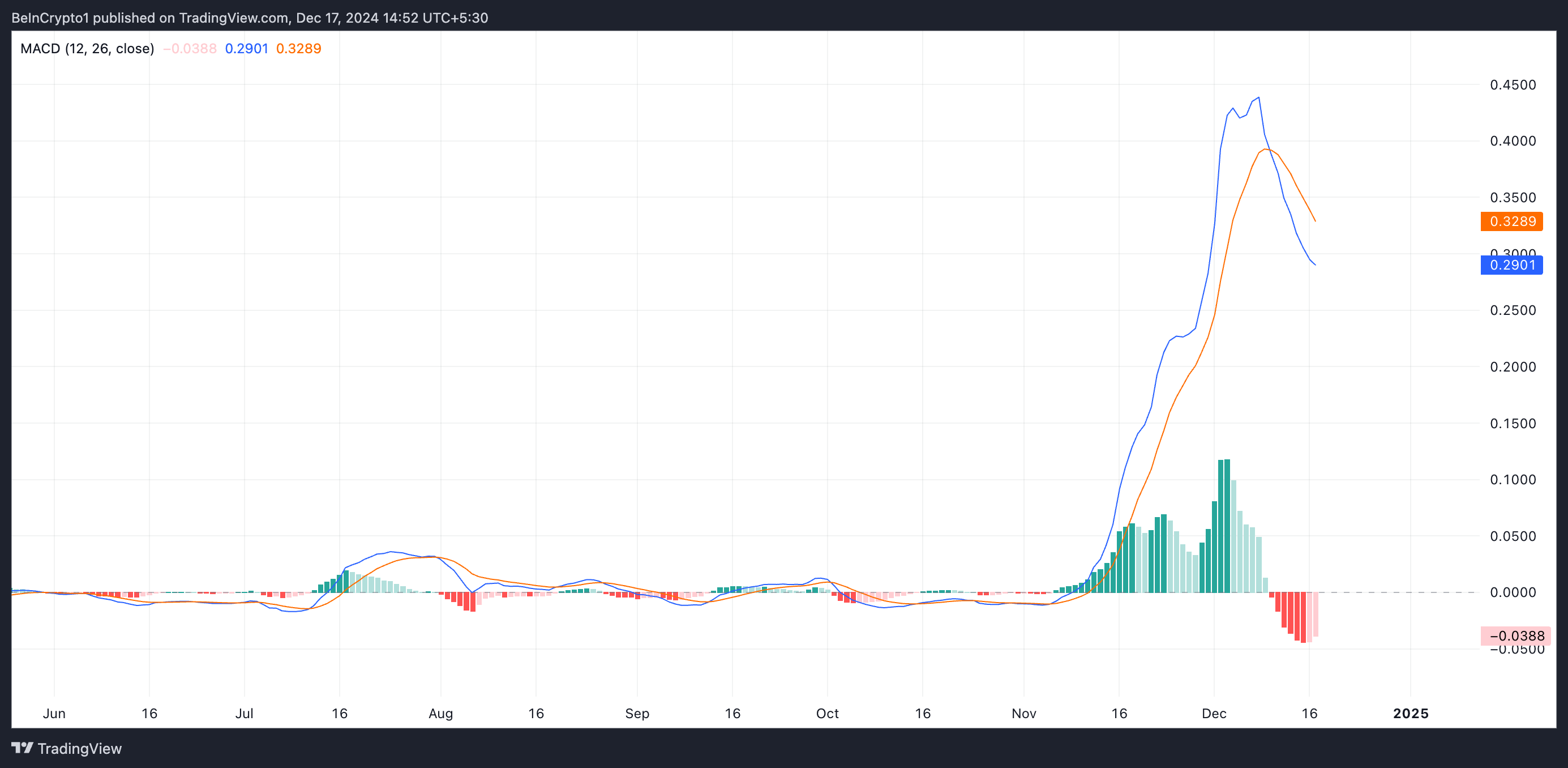

Additionally, XRP’s Moving Average Convergence Divergence (MACD) supports this bearish outlook. At press time, the token’s MACD line (blue) is below the signal line (orange), signaling a surge in bearish pressure.

The MACD indicator measures the changes in an asset’s price trends, direction, and momentum. When the MACD line is below the signal line, it indicates a bearish trend, suggesting that the price may be in a downtrend or that a potential sell signal is forming.

XRP Price Prediction: Token May Shed 10% of Its Value

Although XRP is up 7% in the past 24 hours, the increasing selloffs and strengthening bearish pressure put it at risk of shedding these gains in the near term. Should this happen, the token’s price may dip to $2.31, a 10% decline from its current market value.

On the other hand, if the launch of the RLUSD token triggers a shift in market trends and the sell-off subsides, XRP could make a run at its multi-year high of $2.90.