Ripple might be interested in buying some of the assets of the recently bankrupted exchange FTX, The Sunday Times reported.

According to the report, Ripple CEO Brad Garlinghouse said he would like to buy parts of the company with a focus on its stakes in other companies and the parts that dealt with institutional clients.

Ripple Eyes FTX Assets

Garlinghouse claimed that he spoke with FTX founder Sam Bankman-Fried on Wednesday. This was when SBF sought investors to raise funds before the company eventually filed for bankruptcy. He said:

“Part of my conversation [with SBF] as if he needs liquidity, maybe there’s businesses that he has bought or he has that we would want to own. Maybe there are investments that we would want own. Would we have bought some of those from him? I think that was on the table.”

However, he noted that FTX filing for bankruptcy makes any deal different. Even at that, he noted that Ripple will still look into buying some of the assets even though it won’t be as easy as before.

With FTX having stakes in over 100 companies, Ripple’s acquisition could be a good way for the San Francisco-based company to expand its business.

Meanwhile, Ripple had previously shown interest in buying assets of the failed crypto lender, Celsius. But it didn’t make any bid for it in the end.

Ripple Also Wants FTX Former Employees

The cross-border payment crypto firm is already courting former FTX employees.

Ripple’s chief technology officer David Schwartz said that his firm would be open to hiring any FTX employee that was not working in the business ethics, compliance, and finance department.

The XRP community hailed the specificity as reports had revealed that the bankrupt exchange had an almost nonexistent financial department. The firm also faces increased regulatory scrutiny due to its mishandling of customers’ funds.

In an interview with CNBC, Garlinghouse also noted that there is a need for the crypto industry to mature. According to him, although Ripple is not a public company, it is highly transparent.

Ripple XRP Grows Through Market Turmoil

Ripple XRP is the only top 10 digital asset that was not impacted by FTX’s implosion.

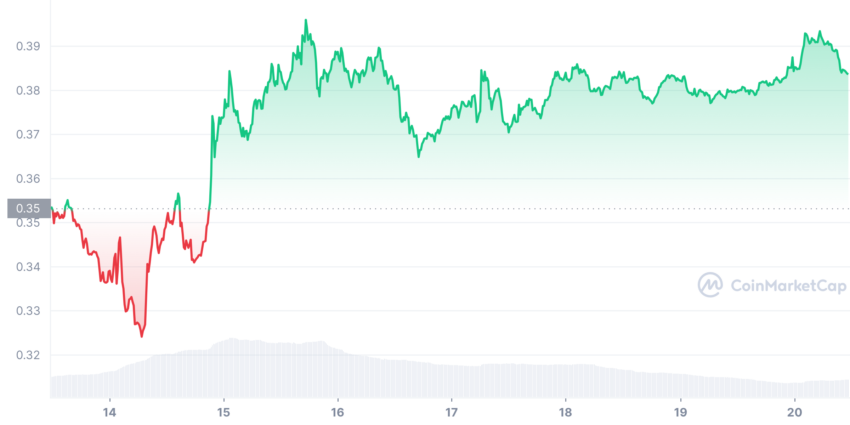

According to CoinMarketCap data, XRP gained 5.4% in the past week, trading for $0.3863 as of press time.

For context, Bitcoin and Ethereum shed 0.9% and 3.8% of their values over the same time frame, respectively. Solana lost its place among the top 10 due to the collapse.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.