Many retail crypto investors have been holding on throughout last year’s harsh crypto winter. Younger age groups seem to be the most optimistic about crypto’s long-term potential. But will the conviction to hold such a volatile asset class continue this year?

Cryptocurrency investments tend to be a bit more complicated than traditional means, given their volatile nature. The asset class, which is still in its infancy, has faced many obstacles. Given the newness of crypto, most enthusiasts urged newcomers to learn the basics and invest in the long run rather than gamble on high-risk altcoins.

This ‘slow and steady’ mindset was mainly brought on by factors like the global COVID-19 pandemic after the traditional high-valued equity sector took a massive blow. This drew investors to explore other asset classes, with crypto leading the charge. Retail crypto investors have been heavily accumulating Bitcoin since October 2021 while whale addresses sold.

This was also evident in a recent eToro report shared with BeInCrypto. The study surveyed 10,000 retail investors from 13 countries and three continents.

Retailer crypto investors’ perspectives

Retail investors are still optimistic about crypto and are finding renewed confidence as inflation softens. Despite the bear market, 67% of retail investors are either optimistic or neutral toward the crypto market. The remainder wrote off the sector, given the rapid devaluation of the market last year.

Nonetheless, the uncertainty around the perceived threat of inflation drove a positive mentality toward crypto. According to the report, 19% saw inflation as the main threat to investments in 2023, while fears of a global recession ranked first at 22%

Less risk-averse investors also cited interest rates, unemployment, and volatility as reasons to remain on the sidelines.

Speaking to BeInCrypto, Ben Laidler, Global Markets Strategist at eToro, stated:

“The fact that two-thirds of retail investors feel indifferent, or even more positive, after the worst year for markets in a generation might seem odd. But the majority of this cohort thinks in years and decades. For those with longer time horizons, the back end of 2022 has offered a chance to buy companies at lower valuations, improving the outlook for long-term returns.”

Divided by Age, Held Together By Crypto

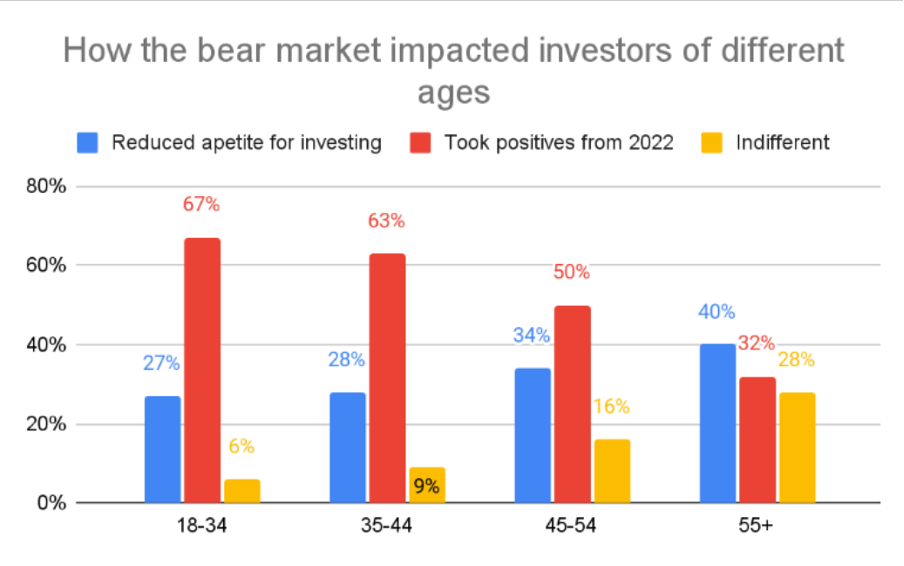

Younger investors, perhaps unsurprisingly, are less cautious than older investors. Crypto’s newness and uniqueness drove the younger generation’s optimism, despite a long-term 2022 downtrend.

Younger investors tend to like newer things, while older age groups often prefer investing in assets with more longevity and avoid investments that they do not fully understand.

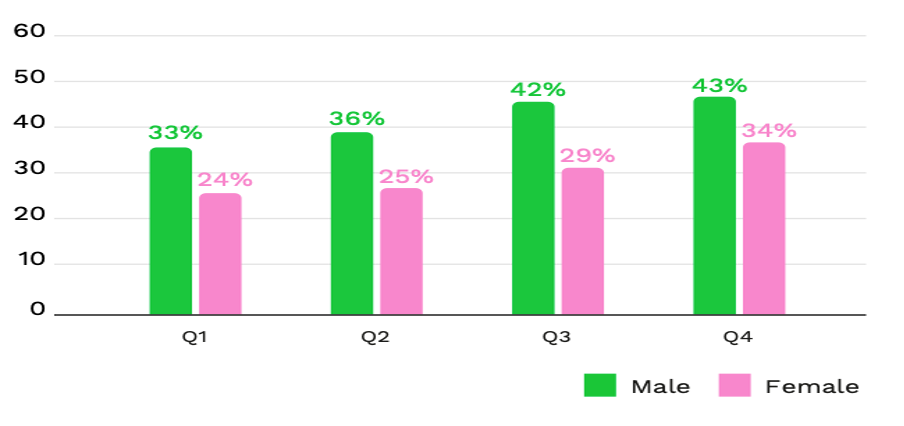

The report additionally found that crypto ownership among women is rising. Female crypto investors increased 29% in Q3 to 34% in Q4 2022.

Diversify, Diversify, Diversify

Other retail investors are holding the money in checking and savings accounts. Rates and the yields in some of these accounts have risen, enticing many to park their money there while the market unfolds.

Crypto platforms and companies continue to proclaim that 2023 is an excellent time for betterment while promoting crypto as a form of slow and steady long-term diversification. Despite this most recent crypto winter, many investors are optimistic that crypto is an asset class for the future and is the next wave of innovation.

Overall, retail investors cited the ability to make high returns as the main reason for investing in crypto. Others believe crypto is a transformative technology and want to invest in that ethos.

“This is an asset that every investor must have in their portfolio. Bitcoin (BTC) is the best-performing asset over two years, over three years, over five years, over ten years, and the life of all 14 years, and you have to have some exposure in the portfolio,” Mark Yusko, the renowned executive at the Morgan Creek Capital Management asserted.

While these narratives can help boost investor confidence, holding an extremely volatile asset class does come with its challenges. Fears of strict regulations or risks of getting hacked remain high barriers to enter the market.