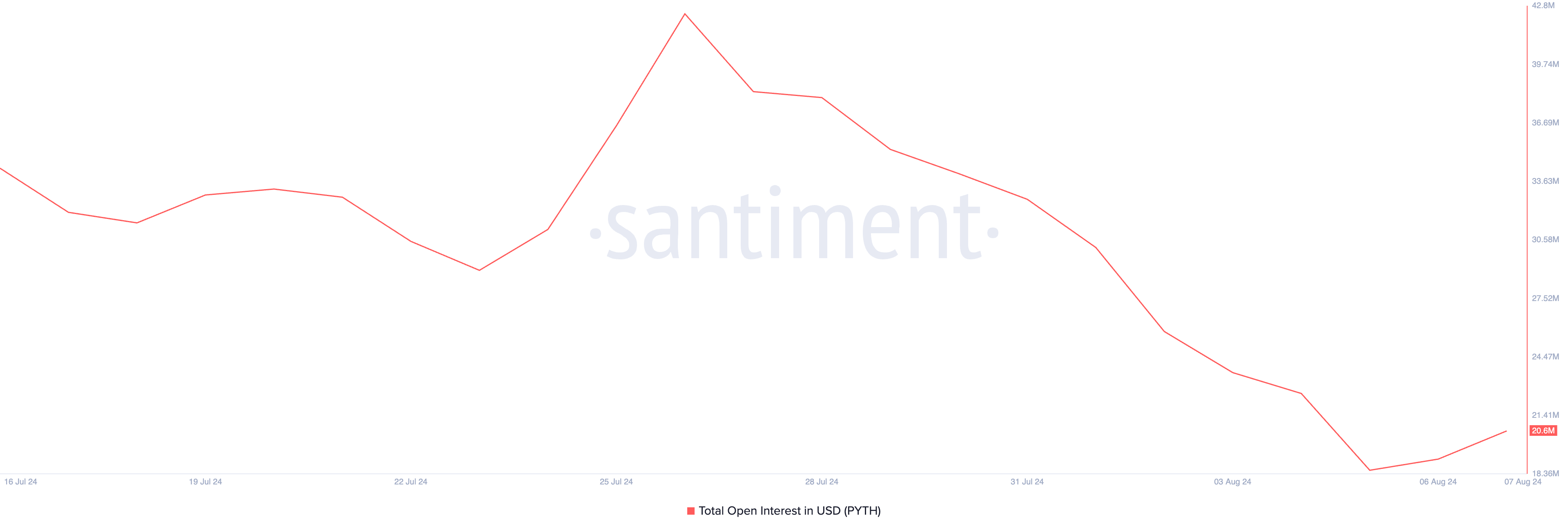

PYTH, the token that powers oracle service provider Pyth Network, has witnessed a significant decline in its derivatives market. Its total open interest has fallen to an all-time low.

This comes amid the general market downturn, which caused the token’s price to close at an all-time low of $0.22 during Monday’s trading session.

Pyth Record New Lows on Multiple Fronts

According to Santiment’s data, PYTH’s open interest reached an all-time high of $113 million on March 17. It has since experienced fluctuations, hitting both lower highs lows and lower highs.

However, Monday’s widespread losses in the cryptocurrency market led many PYTH derivatives traders to close their positions, causing open interest to plummet to a record low of $19 million.

Open interest refers to the total number of outstanding derivative contracts, such as options or futures, that have not been settled. When it drops, traders are closing their positions and exiting the market without opening new ones.

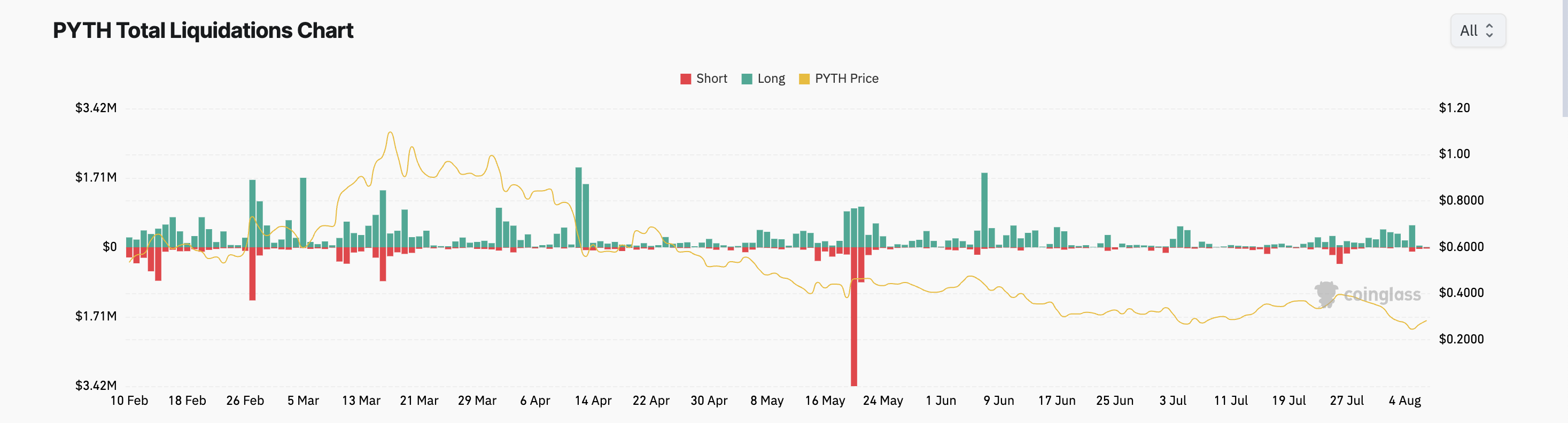

Further, due to PYTH’s double-digit price decline over the past week, several long positions have been liquidated. According to Coinglass, PYTH’s long liquidations have exceeded $1.8 million over the past seven days.

Read more: What Is a Blockchain Oracle? An Introductory Guide

As expected, market sentiment has shifted to negative as traders have demanded more short positions since the beginning of August. This means more traders are buying PYTH and expecting a price decline than those accumulating the altcoin in hopes of selling high.

PYTH Price Prediction: Will Price Revisit the All-Time Low?

The same bearish bias trails the altcoin in its spot market. Highlighting the decline in demand, PYTH’s Relative Strength Index (RS), as assessed on a daily chart, is below the 50-neutral line at 40.35 as of this writing.

An asset’s RSI measures its overbought and oversold market conditions. At 40.35, PYTH’s RSI indicates that selling pressure exceeds buying activity.

Further, the altcoin’s Chaikin Money Flow (CMF), which tracks how money flows into and out of its market, is below the zero line at -0.01. A CMF value is a sign of market weakness, as it indicates liquidity exit. It is a popular precursor to a sustained price decline.

PYTH’s price risks revisiting its all-time low of $0.22 if demand remains low and capital outflow persists. However, if bullish sentiment grows, the token’s price may rally toward a 30-day high of $0.44.