Polygon (MATIC) price is among the first few altcoins to officially note a downtrend, and at the rate at which MATIC is falling, losing $1 may not be far from happening.

The power to prevent this sits in the hands of investors alone. Here is how.

Polygon Price Decline Continues

Polygon’s price has dropped from $1.26 to $1.05 at the time of writing. In doing so, MATIC fell through multiple support levels and the 50-day Exponential Moving Average (EMA). The altcoin is now less than 6% from falling below the $1.00 price point.

Technical indicators, Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) exhibit bearishness. The RSI gauges the speed and change of price movements, indicating potential overbought or oversold conditions. The MACD assesses trend momentum by comparing two moving averages of an asset’s price, often used to identify buy or sell signals.

Combining the two, it is evident that the signal is to sell since both are in the negative/bearish zones, respectively.

Furthermore, the sell signal is intense since the Market Value to Realized Value (MVRV) ratio is already below the zero line. The MVRV ratio is a crucial indicator for assessing the average profit or loss of investors who have acquired an asset.

Specifically, the 30-day MVRV ratio evaluates the average profit or loss of investors who obtained an asset within the previous month. For instance, in the case of Polygon, the 30-day MVRV ratio of -3% suggests that investors who bought MATIC in the last month are currently observing a 3% loss.

Historical data indicates that when the MVRV value falls within the range of -5% to -12%, it often precedes market rallies. This particular range is called an “opportunity zone,” representing an ideal scenario for asset accumulation.

However, MATIC is still a little above this zone, which means it will register more declines before it becomes an ideal asset for accumulation.

MATIC Price Prediction: $1 Support Likely to Fall

Based on the aforementioned cues, the Polygon price will likely note a decline below $1. The altcoin is only 5.7% above the mark and could fall below it.

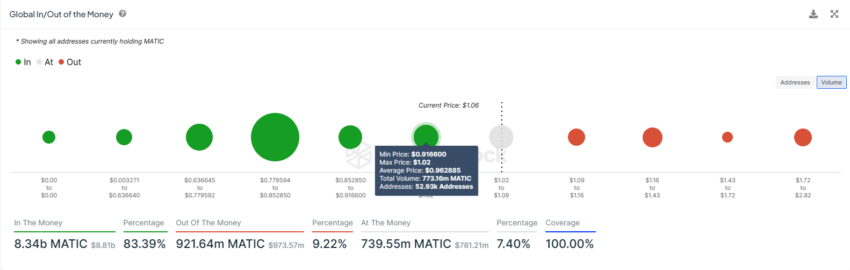

However, it will find some significant resistance in falling too much formed by about 773 million MATIC. The $819 million worth of supply was bought by investors who purchased their assets at an average price of $0.96.

Thus, MATIC will face some challenges in falling through it and might even bounce back before losing $1. This would invalidate the bearish thesis and help reclaim the 50-day EMA as support.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.