Polygon Labs announced on July 18 that it will replace MATIC, the native token of its Layer 2 network Polygon, with a new token, POL, on September 4.

As the swap date approaches, MATIC is poised to continue its downtrend.

Polygon Shows Ailing Signs

At press time, MATIC trades at $0.52. The altcoin’s value has plunged by almost 10% in the last month. With short-term price recovery seeming unlikely, major investors have steadily reduced their holdings in the altcoin over the last 30 days.

According to data from IntoTheBlock, the token’s large holder netflow has plummeted by 271% in the past 30 days.

Large holders refer to addresses that hold over 0.1% of an asset’s circulating supply. An asset’s large holder netflow measures the difference between the coins these investors buy and the amount they sell over a specific period.

When the metric declines, it indicates that an asset’s whale addresses are selling their holdings. It is a bearish signal which suggests a spike in selling pressure and a potential price decline.

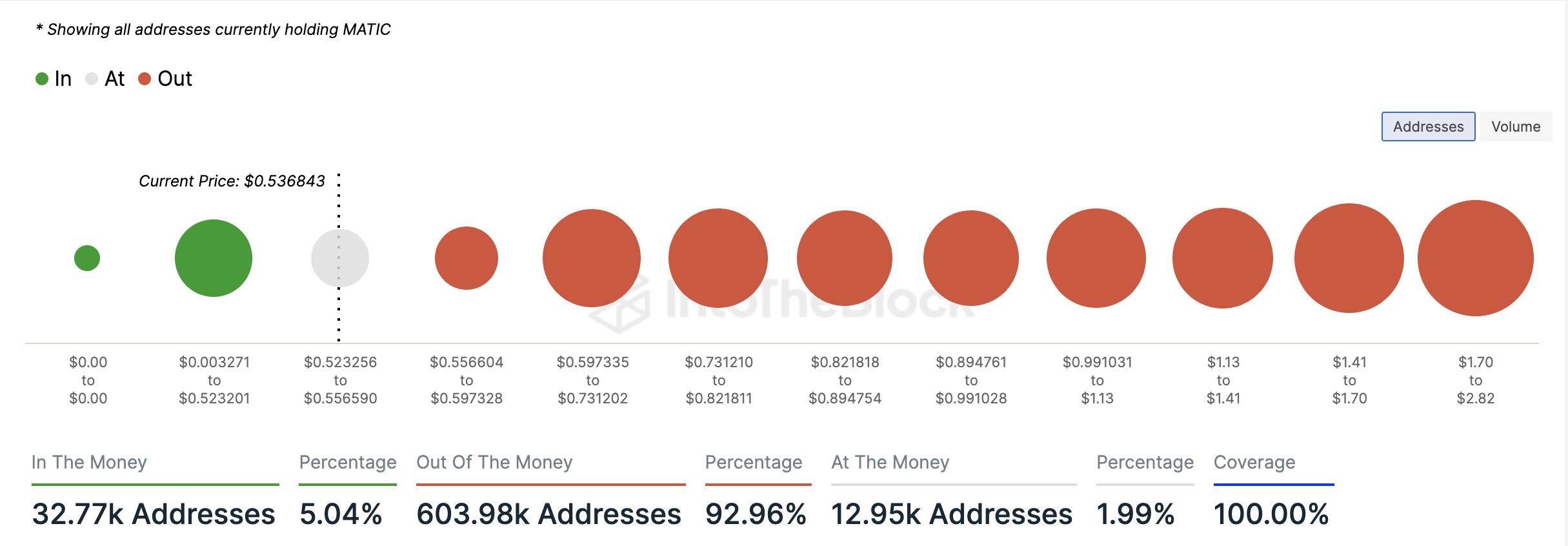

MATIC whales are not incentivized to hold the altcoin because many holders continue to sit on unrealized losses. As of this writing, 604,000 addresses, which make up 93% of all MATIC holders, are “out of the money.”

Read more: Polygon (MATIC) Price Prediction 2024/2025/2030

An address is considered out of the money if the current market price of an asset is lower than the average cost at which the address purchased (or received) the tokens it currently holds.

Conversely, only 33,000 addresses, representing 5% of all the token holders, hold their coins at a profit.

MATIC Price Prediction: Is a Decline to a 2-Year Low Imminent?

MATIC’s Directional Movement Index (DMI) setup confirms the bearish bias toward the altcoin and hints at a further decline if the current trend persists. At press time, the token’s negative directional indicator (-DI) rests above its positive directional indicator (+DI).

An asset’s DMI indicator tracks the strength and direction of its price trend. When the -DI is positioned above the +DI, it typically signals a bearish trend. This indicates that the negative momentum is stronger than the positive momentum, suggesting that the market may be in a downtrend.

If selling pressure continues to outweigh buying activity in the MATIC market, the token’s value may plummet to $0.42. The last time the L2 token traded at this low was in July 2022.

Read more: How To Buy Polygon (MATIC) and Everything You Need To Know

However, if the current trend reverses and the demand for MATIC spikes, its price may climb to $0.63.