Cryptocurrency exchange Bullish, backed by Palantir co-founder Peter Thiel, saw its shares jump more than 150% in its debut on the New York Stock Exchange on Wednesday.

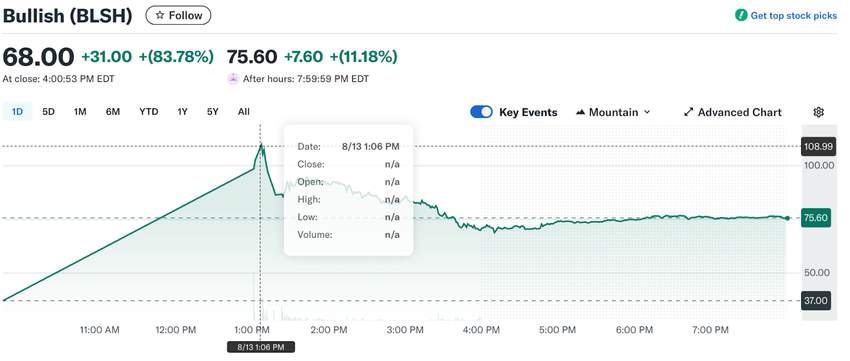

The company had already raised $1.11 billion before the public offering, pricing 30 million shares at $37, above the anticipated range. Bullish’s stock closed at $75.3 after reaching an intraday high of $109.9, valuing the firm at approximately $9.94 billion.

Bullish’s Shares Jumped More Than 150%

This successful IPO represents a rare US listing for crypto exchanges and follows recent corporate successes in digital assets.

“Bullish came out with an attractive initial valuation, and investors responded by aggressively bidding it up during the pre-IPO process,” noted Jeff Zell, a senior research analyst at IPO Boutique.

Who is Bullish & Why It Matters

Prominent backers, including Peter Thiel’s Founders Fund, Nomura, and Galaxy Digital, launched Bullish in 2020. The company makes its second attempt to go public after calling off an SPAC merger in 2022.

Tom Farley, the former president of the New York Stock Exchange, leads the firm. He will assume the chairman role following the listing and brings deep market-structure expertise. His credibility with institutional clients provides a critical advantage in the competitive crypto exchange space. Bullish targets institutional clients, whose crypto holdings should grow with new regulations.

After confidentially filing for its IPO in June with JPMorgan and Jefferies, Bullish achieved a successful debut. The debut comes amid surging investor confidence in digital assets. Circle Internet Group achieved similar success when its shares leaped over 500% after its debut. Other firms like Gemini, Grayscale, Figure Technology, and BitGo are also seeking to go public.

Demand for crypto-related equity investments is perhaps stronger than ever. Several token projects have created digital asset treasury companies to transform listed companies into crypto accumulation machines. Strategy, formerly MicroStrategy, famously pioneered this with Bitcoin, a path also taken by companies like Japan’s Metaplanet. More recently, firms such as BitMine and SharpLink have followed a similar playbook by focusing on accumulating Ethereum, often leveraging its utility for staking.

This wave of IPOs is occurring as the US capital markets show a bullish sentiment toward crypto, a trend underscored on the same day by Bitcoin’s new all-time high of $123,500. A pro-crypto White House, corporate treasury adoption, and new ETF inflows drive this market optimism.

Bullish is nearing completion of a two-year process to obtain New York’s “BitLicense” for state operations. The company also plans to convert IPO proceeds into stablecoins, which boomed after the Genius Act passed.