Economist and longtime Bitcoin critic Peter Schiff warned that Bitcoin could collapse to $20,000 if the asset loses key support near $50,000.

His comments come as geopolitical tensions escalate following reports that the US military is preparing strike options against Iran.

Peter Schiff’s Anti-Bitcoin Perception is Stronger than Ever Before

Schiff argued that a drop below $50,000 now appears likely and could trigger a much deeper decline. He suggested Bitcoin may repeat historic crash patterns seen in previous cycles, even despite increased institutional adoption and broader mainstream interest.

His warning arrives as Bitcoin trades near $66,000, down sharply from its recent cycle highs.

Schiff has remained one of Bitcoin’s most consistent skeptics for over a decade. He has repeatedly described Bitcoin as a speculative bubble and argued that it lacks intrinsic value.

Throughout previous bull markets, he predicted major crashes, while continuing to promote gold as a superior store of value.

However, Bitcoin has also repeatedly recovered from severe corrections and reached new highs over time.

His latest warning comes at a fragile moment for crypto markets. Global risk sentiment has weakened amid fears of potential US military action against Iran.

Historically, Bitcoin often falls in the early phase of geopolitical shocks as investors reduce exposure to volatile assets.

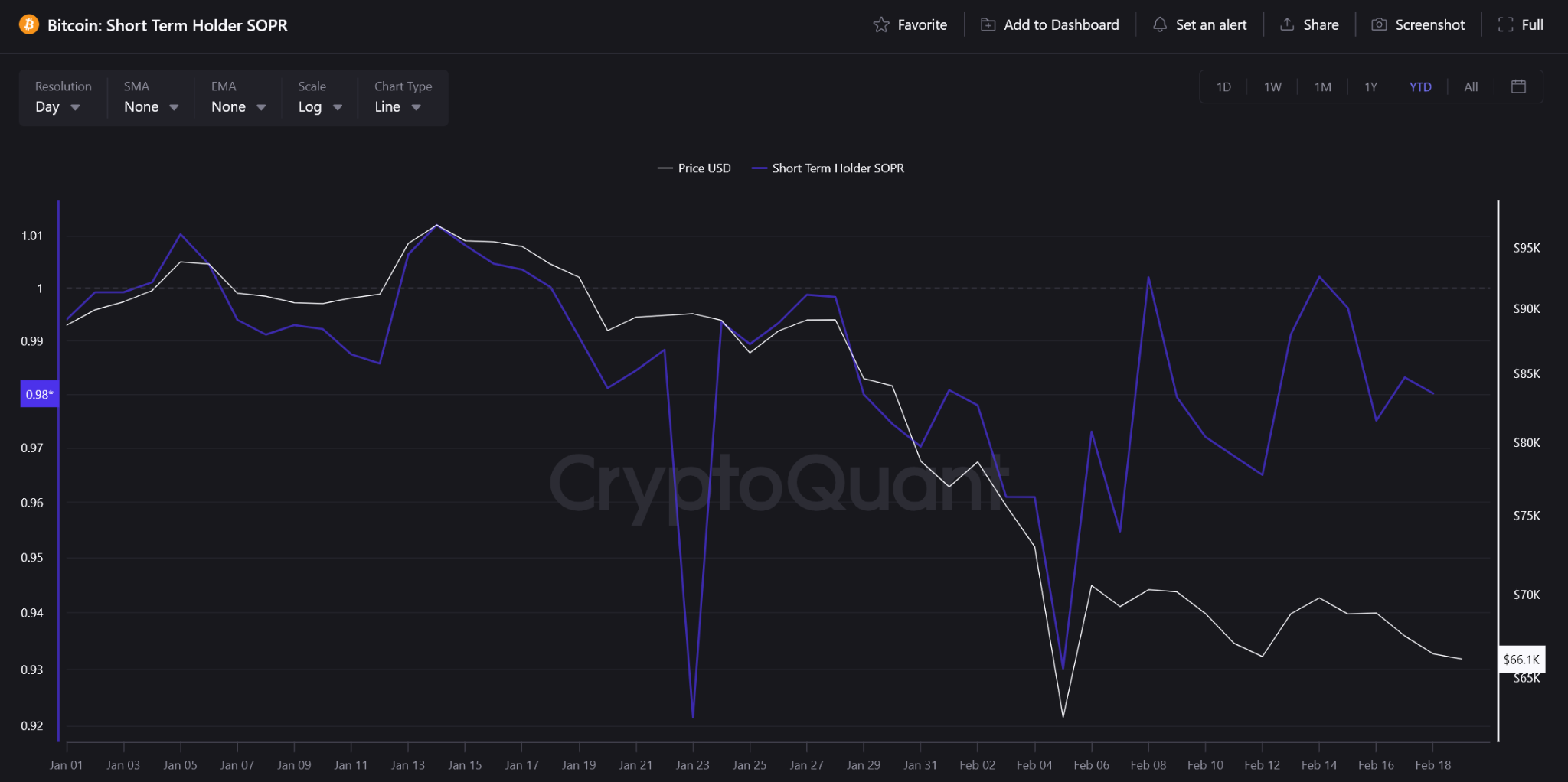

On-chain data supports the view that short-term weakness remains possible. The Short-Term Holder SOPR indicator currently sits below 1, showing that recent buyers are selling at a loss.

This reflects fear and ongoing capitulation among weaker investors.

At the same time, another key metric tells a different story. Bitcoin’s short-term Sharpe ratio has dropped to extremely negative levels.

This suggests Bitcoin has already experienced unusually poor returns relative to volatility.

In past cycles, such conditions often appeared near local bottoms rather than the beginning of prolonged collapses.

This creates a mixed outlook. While geopolitical stress and weak sentiment could push Bitcoin lower in the short term, much of the speculative excess appears already flushed out.

Schiff’s prediction reflects rising uncertainty—but on-chain data suggests the market may be closer to a reset phase than the start of a full-scale collapse.