Paxos has launched a new stablecoin called the Global Dollar Network (USDG). This stablecoin results from collaborating with multiple exchanges, including Bullish, Kraken, Robinhood, and other prominent crypto firms.

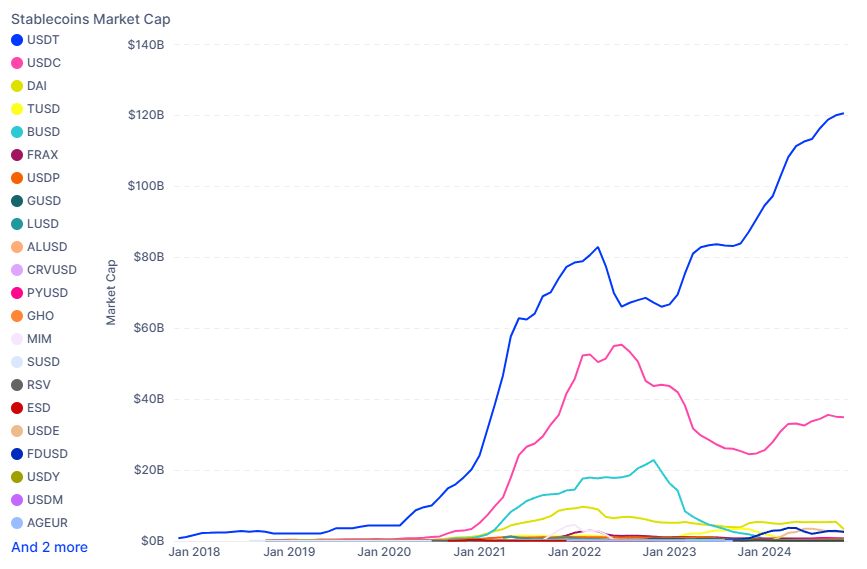

In 2024, many new stablecoins have appeared in the market. The market cap for stablecoins is now close to $180 billion.

Global Dollar Network Joins the Stablecoin Race

On November 5, Paxos announced the Global Dollar Network (USDG) launch. This new network aims to accelerate the global use of stablecoins. The USDG launch brings in backing from several industry giants, including Paxos, Anchorage Digital, Bullish, Galaxy Digital, Kraken, Nuvei, and Robinhood.

Read more: What Is a Stablecoin? A Beginner’s Guide

Paxos plans to issue USDG from Singapore. The stablecoin will comply with upcoming stablecoin regulations by the Monetary Authority of Singapore.

USDG will initially be available on Ethereum, but Paxos plans to release it on other blockchains in the future. Paxos noted that Global Dollar Network will reward almost all returns to its participants.

“Stablecoins are replatforming the financial system and revolutionizing how people interact with US dollars and payments. However, the leading stablecoins are unregulated and retain all the reserve economics. Global Dollar Network will return virtually all rewards to participants and is open for anyone to join. It is designed to incentivize global stablecoin usage and accelerate societal wide adoption of this technology.” – Charles Cascarilla, CEO and Co-Founder of Paxos, said.

In an earlier announcement in late October, Paxos mentioned that DBS Bank, the largest bank in Southeast Asia by total assets, would be the primary banking partner for USDG. The bank will manage USDG’s cash and custody. USDG will be backed by US dollars, short-term US Treasury bonds, and other cash equivalents.

At present, the stablecoin market cap is close to $180 billion. Tether (USDT) alone represents nearly 67% of this, with $120 billion.

Its market share continues to grow in 2024. Tether recently reported record profits of over $2.5 billion in Q3, with the majority coming from earnings on US government bonds.

Read more: A Guide to the Best Stablecoins in 2024

Besides USDG, several other stablecoins have also recently debuted, including RLUSD by Ripple, UStb by Ethena, USDS by Sky, and a synthetic stablecoin from DWF.