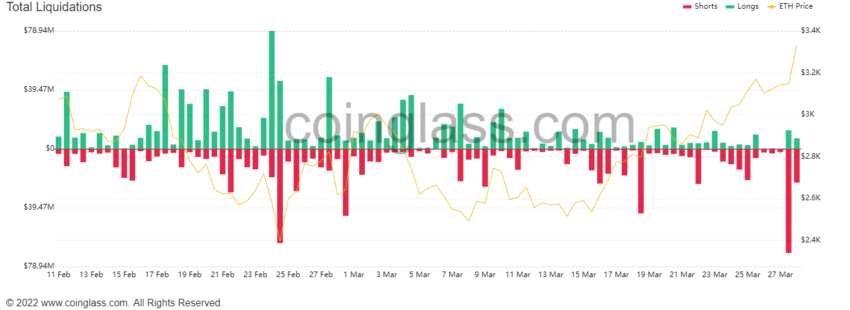

Liquidations in the crypto market have shot up in the past 24 hours, as Ethereum has seen over $100 million lost by traders. The market appears on the brink of a bull run as prices have spiked in the last week.

Liquidations in both ethereum and bitcoin have grown considerably in the past 24 hours, as shown by market data. Over $100 million in ETH has been liquidated, while bitcoin has had about $165 million liquidated. The market all around is experiencing these movements, with total liquidation totaling $365 million.

Of course, the traders themselves are probably bemoaning the liquidations as the market moves up. Over 62,500 traders have been liquidated from their positions, as a result of betting against the upward motion.

Bitcoin and the rest of the market have picked up in price over the past week, with bitcoin nearing $47,000. Other market metrics have also pointed towards a potential bull run, such as the increase in small holdings addresses and movement of assets off of exchanges.

Then there’s the fact that there have been a number of positive developments in the space, especially for Ethereum. The Merge, which brings the beacon chain to a particular testnet and eventually mainnet, successfully took place on the Kiln testnet earlier this month.

That seems to have piqued the public’s interest, as Ethereum Merge Google searches have reached new highs. The search term received a Google Trends score of 100, which probably attracted a lot of investors. Ethereum’s price is now above $3,300, and this spike could in turn pull in more traders.

Vitalik sees challenges for Ethereum and hopes ahead for crypto

Vitalik Buterin, the co-founder of Ethereum and a poster child for the project, was interviewed by Time recently. The interview contained a lot of interesting insights, with Vitalik sharing his concerns and hopes for the future of the crypto space.

One of the highlights of the interview related to Ethereum’s gas fees problem, which ETH2 hopes to fix. Vitalik said,

“Fees are a huge problem for Ethereum’s usability, especially for things other than some of the financial applications that have dominated recently.”

He said that sharding is just as important as proof-of-stake and that it would make all the difference in making Ethereum more scalable. The “full vision” is years away, he says, because of a number of problems that need to be solved. On the whole, the interview shows that the Ethereum co-founder is very optimistic and that he believes there is a lot to look forward to.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.