Orbiter Finance secured over $50 million in annual revenue, driven by growing Layer-2 (L2) adoption. This milestone positions it among the most profitable decentralized cross-chain L2 protocols.

L2 solutions enhance blockchain scalability by offloading transaction processing from the main chain. This reduces congestion, lowers fees, and boosts transaction throughput, driving demand for such solutions.

Orbiter Finance Records $50 Million Annual Revenue

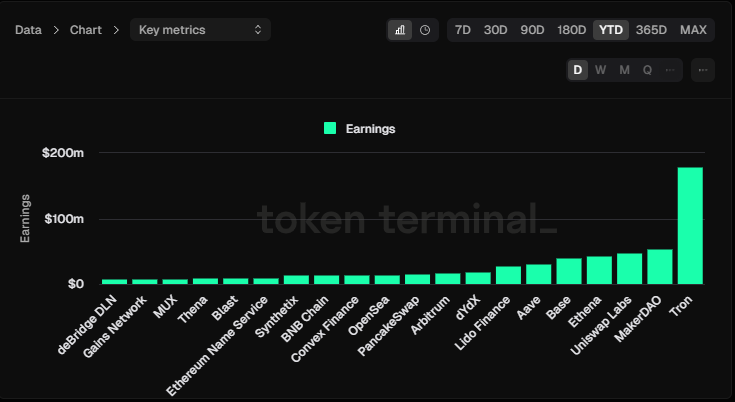

Orbiter Finance generated over 20,000 Ethereum (ETH) (around $52.7 million) in year-to-date revenue, surpassing the combined earnings of all other third-party cross-chain bridges. This achievement positions Orbiter above Base, the second-largest Layer-2 scaling solution by total value locked (TVL), which reported $39.075 million over the same period.

Orbiter Financer operates within the Ethereum ecosystem, providing connections within the mainnet. It facilitates asset transfers across multiple L2 networks, such as zkSync and Arbitrum, among others. The team says the protocol has processed over 24 million transactions so far, with more than 4 million users globally.

“Cross-chain transactions are increasingly expected to occur without users directly interacting with a bridging protocol’s interface. The Orbiter team is currently focused on enabling seamless cross-chain transactions and ensuring that users can interact with the blockchain without perceiving any fragmentation among Layer-2 solutions,” Iris Cheung, Orbiter Co-Founder, told BeInCrypto.

Read more: A Beginner’s Guide to Layer-2 Scaling Solutions

Reportedly, Orbiter Finance has processed over $16 billion in transaction volume. This success is partly attributed to the Maker system, a key revenue generation engine within the protocol.

“We saw firsthand the potential of their innovative cross-chain liquidity approach. Their bold integration of zk technology paid off, with Orbiter now holding over 50% of the cross-chain market share. Orbiter’s bet on zk and Ethereum L2s in 2023 has driven their impressive growth. With an ambitious roadmap for a fully interoperable cross-rollup ecosystem in 2024, Orbiter is set to remain a leader in DeFi, and we’re excited to see their continued success,” said Suji Yan, the founder of Mask Network.

L2s remain a popular narrative in the crypto market due to the push for better scalability. These solutions tackle blockchain challenges, especially on networks like Ethereum, by enabling faster and cheaper transactions while ensuring strong security and decentralization.

The Allure of Ethereum L2 Scaling Solutions

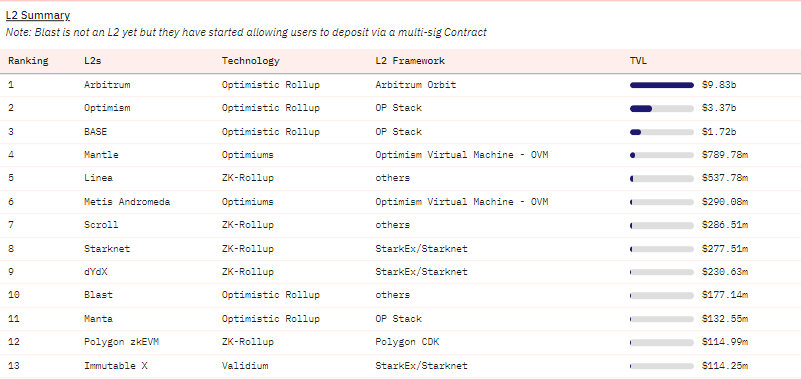

Based on the L2 dashboard on Dune Analytics, the total bridged TVL in L2 networks is $18.19 billion. This figure highlights the growing adoption and utilization of L2 solutions by users and decentralized applications (dApps), showing their importance in strengthening blockchain scalability and efficiency.

Major players in the L2 space include Arbitrum (ARB), Optimism (OP), and Base, which all use optimistic rollups. These rollups are often associated with long withdrawal periods; for instance, Base withdrawals can take about seven days, which is a considerable wait for users wanting quick access to their funds.

Read more: What Is Arbitrum? Everything You Need To Know

The delay may be caused by Optimism’s anti-fraud system, which is reportedly ‘optimistic’ about participants’ honesty. It considers all transactions valid, bundles them together, and submits them to the L1 blockchain.

However, users can challenge transactions and submit potential fraud proofs as part of the optimistic rollup’s security mechanism. This leads to a delay in the form of a ‘Challenge period.’ This explains why withdrawals from Ethereum to Base may take a few minutes, whilst those from Base to Ethereum could take days.