Onyxcoin (XCN) has experienced an extraordinary price surge over the last week, posting a 141% rally that brought its value to $0.0202.

This rapid increase has led many investors to speculate whether the altcoin has reached its saturation point. Despite the impressive gains, signs point to a potential reversal ahead.

Onyxcoin Investors Are Skeptical

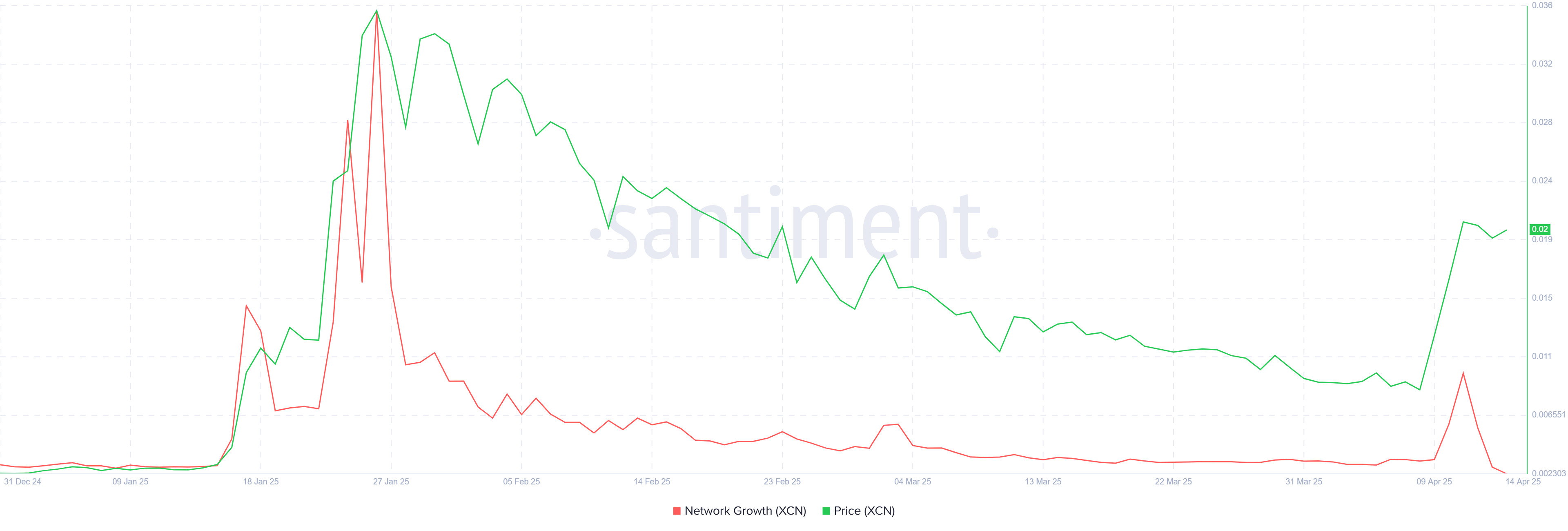

The network growth of Onyxcoin saw a spike earlier in the week, but this momentum quickly dwindled, leaving the coin at a three-month low. This sharp decline indicates that demand for the token is fading after the rally, with investors seemingly anticipating a pullback. The increased market volatility is also discouraging new investors as the uncertainty surrounding the broader cryptocurrency market continues to loom.

Additionally, the rise in volatility has triggered caution among potential buyers. This, combined with the recent gains, makes investors wary of further price fluctuations. Given the lack of investor confidence, the market sentiment around XCN is beginning to shift from optimistic to more cautious.

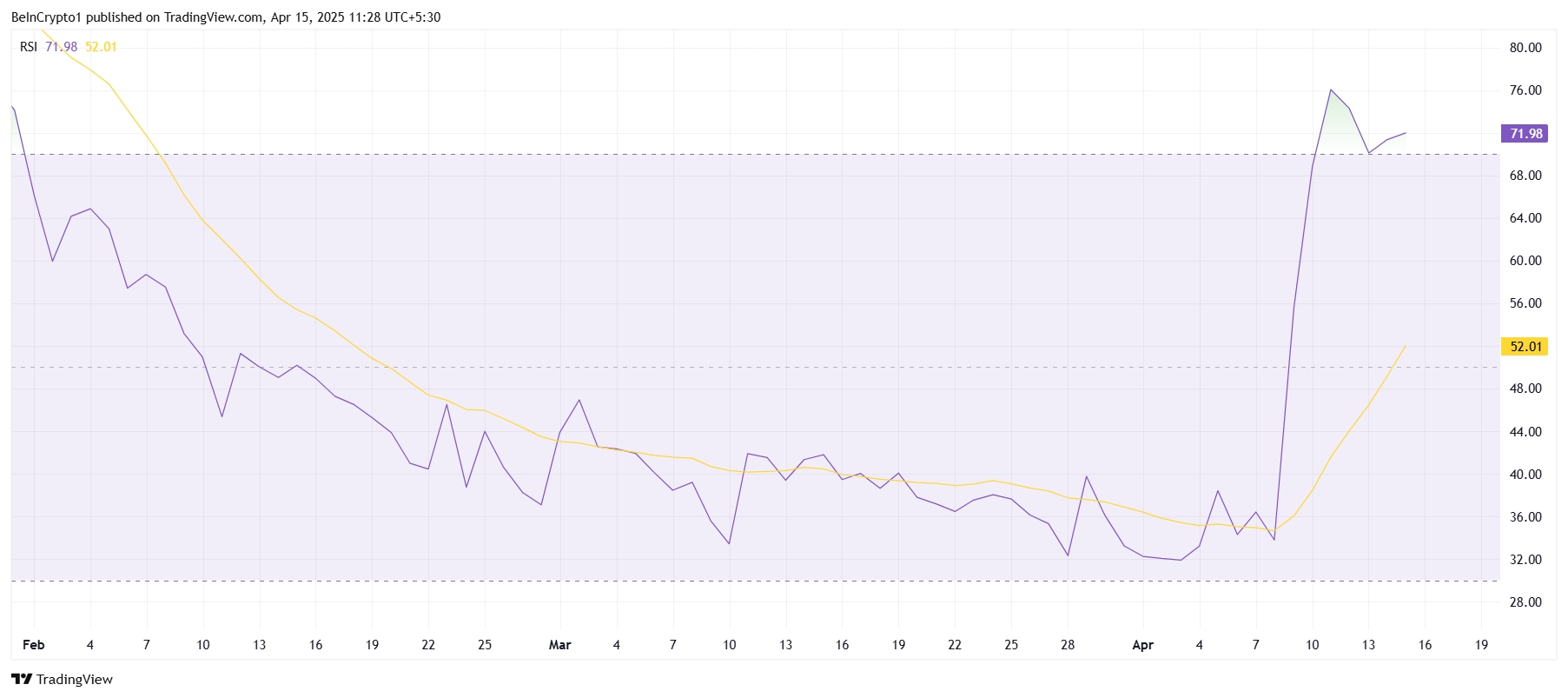

Looking at technical indicators, the Relative Strength Index (RSI) for Onyxcoin is currently in the overbought zone, above the 70.0 threshold. This is typically a signal that the asset has been overbought, and a price correction could be imminent. The RSI reading suggests that many early investors may begin cashing out to lock in profits, which could lead to a significant price drop.

Historically, whenever assets enter the overbought zone, it often marks the point where bullish momentum stalls. As the market corrects itself, we could see a shift in sentiment from bullish to bearish, especially if XCN fails to break through its current resistance levels.

XCN Price Needs A Push

XCN’s price has surged by 141% over the past seven days, reaching $0.0202. This impressive rally has brought the token closer to the key resistance level of $0.0237. This level has proven difficult to break for the past two months, making it a crucial point for the altcoin’s potential continuation.

If XCN successfully breaches the $0.0237 resistance, it could pave the way for further gains, possibly reaching $0.0250. This would confirm that the recent rally isn’t just a short-term spike and that the upward momentum has the potential to continue.

However, if the XCN price fails to break through the $0.0237 barrier, it may drop back to $0.0182, and a further decline to $0.0150 could follow. This would invalidate the bullish thesis, signaling that the recent rally was unsustainable and reinforcing the notion of a price correction.