Bitcoin (BTC) in 2025 is buzzing with activity as long-dormant Bitcoin wallets, often referred to as “old whales,” spring back to life after years of inactivity.

Recent large transactions from untouched wallets for over a decade and significant Bitcoin movements to exchanges are capturing the crypto community’s attention. These developments reflect changes in the behavior of major investors and may signal potential price volatility on the horizon.

Old Bitcoin Whales Suddenly Active Again

Recently, 3,422 Bitcoins, equivalent to $324 million, were transferred from a wallet that had been dormant for 12 years to a new address. These Bitcoins originated from BTC-e, one of the oldest shut-down exchanges.

Back in 2012, the initial value of these BTC was just $46,000. Today, their value has surged 7,018 times, a clear result of Bitcoin’s long-term growth potential.

Around the same time, another wallet holding 2,343 BTC, valued at over $221 million, activated again after 11.8 years of dormancy. Transactions from these “sleeping” wallets often draw significant attention within the community, as they may indicate that veteran investors are starting to liquidate assets or preparing for other strategic moves in the market.

Bitcoin Movements to Exchanges: Rising Selling Pressure?

In addition to the reactivation of long-dormant wallets, the market has also seen a series of large Bitcoin transfers to major exchanges. According to data from Whale Alert, these transactions spiked in early May 2025.

Specifically, 2,402 BTC were moved from Ceffu to Binance, 600 BTC ($56.65 million) were transferred from an unknown wallet to Bitfinex, and 1,636 BTC ($154.05 million), along with 1,385 BTC ($130.74 million), were sent from Cumberland to Coinbase Institutional. Another transaction involving 1,142 BTC ($107.68 million) was also recorded from an unknown wallet to Coinbase Institutional.

These movements suggest that Bitcoin whales actively shift their assets to exchanges, a behavior often interpreted as a sign of potential selling pressure.

Beyond individual whales, Riot Platforms, a leading Bitcoin mining company, sold 475 BTC in April 2025 to cope with industry pressures. This move comes as the Bitcoin mining sector faces rising operational costs following the 2024 halving event, forcing many companies to liquidate portions of their holdings to sustain operations. Meanwhile, MicroStrategy, an institutional investor known for its Bitcoin accumulation strategy, continues to buy in despite criticism of its high-risk investment approach.

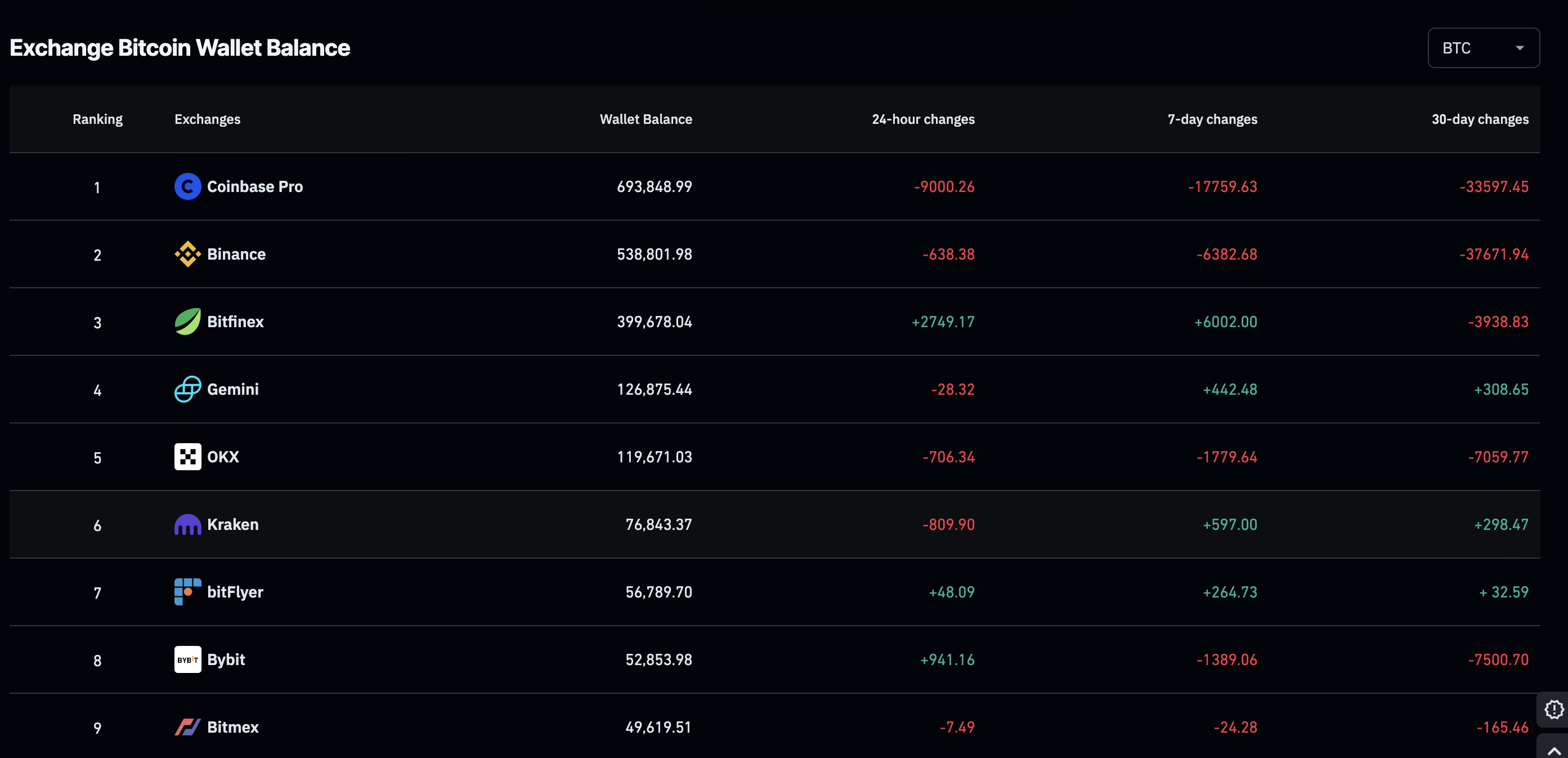

However, data from Coinglass reveals that last week, exchanges recorded a net outflow of 15,700 BTC, with total balances dropping to 2.2 million BTC. This could reflect a long-term accumulation trend among large investors, as they withdraw Bitcoin from exchanges to store in cold wallets, reducing the circulating supply in the market.

What did These Movements mean for the Bitcoin Market?

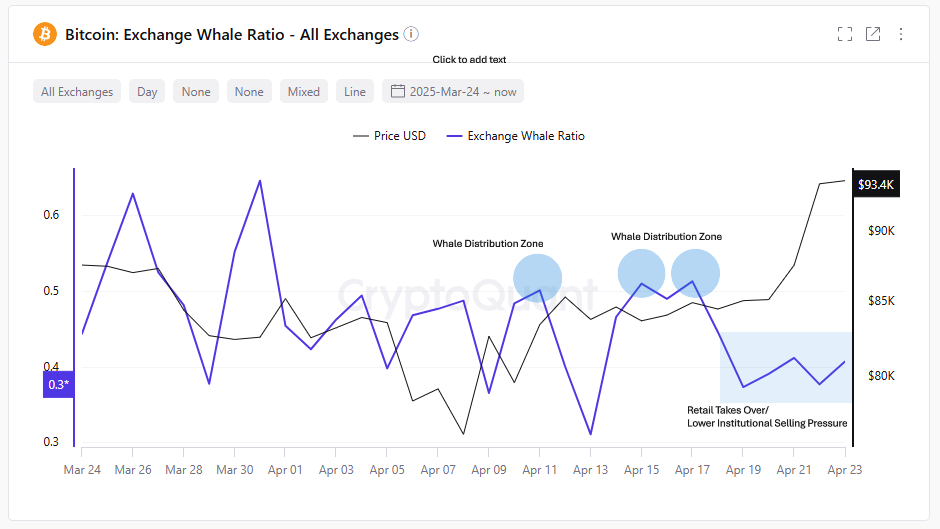

The activities of old whales and major institutions fuel speculation about the Bitcoin market’s future direction. According to a CryptoQuant report from March 2025, the Exchange Whale Ratio on Binance has recently declined, indicating a reduction in selling pressure from large investors, a positive signal for BTC’s price.

The Exchange Whale Ratio, which fell below 0.3 on April 23, indicates a major shift in participation, from institutional or big traders to more retail-dominant flows.

“This suggests less whale selling and, perhaps, a “cleaner” market environment in which price movements are driven by organic demand rather than large-volume sell-side pressure.” Analysis shows that

Short-term Bitcoin holders have not yet taken significant profits to form selling pressure, and upward momentum is still accumulating.

“The current NUPL is 8%, while its 30-day SMA remains negative and holds at -2%. Until NUPL exceeds 40%, selling pressure from this cohort will remain minimal, which is a bullish signal.” Analysis shows that

However, the recent transfers of Bitcoin to exchanges suggest that short-term selling pressure may increase, particularly as Bitcoin hovers around $95,000, with key support levels at $93,000 and $83,000.

The reactivation of long-dormant wallets also signals confidence from veteran investors, who are gearing up for a new bullish cycle. These developments paint a complex market picture, with both opportunities and risks on the horizon.

The resurgence of old Bitcoin whales, significant transfers to exchanges, and actions from institutions like Riot Platforms are heating the crypto market in 2025. These movements reflect shifting sentiments among major investors and could shape Bitcoin’s price trends in the coming months. While the potential for growth remains, investors must stay vigilant and prepared for unexpected market fluctuations.