Digital asset and crypto broker NYDIG is the latest to suffer the big freeze of crypto winter, as it has reportedly shed a third of its staff.

Crypto trading and banking firm New York Digital Investment Group has been shedding staff as the bear market deepens, with as much as a third of all employees being let go. According to a WSJ report on Oct. 13, employees were told the firm was “seeking to trim expenses and narrow its focus to more-promising businesses.”

By late September, the number of employees affected by job cuts was 110, the report added. The layoffs come a fortnight after the firm announced that it was replacing its top two executives.

Earlier this month, NYDIG stated that Chief Executive Robert Gutmann and President Yan Zhao had stepped down, but no reason was given.

NYDIG revenue up, staff down

The move to cut staff comes at a time when the crypto industry is in a deep bear market, yet NYDIG claims that it is on pace for record revenue this year. According to the company’s founder Ross Stevens, “the firm’s balance sheet is the strongest it’s ever been, and now we’re investing aggressively into a capital-starved market.”

NYDIG has also been buying the dip and maintaining its confidence in digital assets. According to an SEC filing late last month, the company has raised $720 million for its institutional Bitcoin fund.

The document states that 59 unnamed investors contributed to the fund but did not specify purchase details. NYDIG launched its Bitcoin Fund in 2018 and raised $190 million in 2020. The firm raised $1 billion in December 2021, resulting in a valuation of $7 billion at the time.

NYDIG is not the only company shedding staff this crypto winter, however, as employees have been shown the door at Coinbase, Gemini, Robinhood, Immutable, Celsius, Crypto.com, and BlockFi.

According to Raman Shalupau, the founder of CryptoJobsList, things are actually improving, and the worst of the layoffs are now over.

Crypto bear market blues

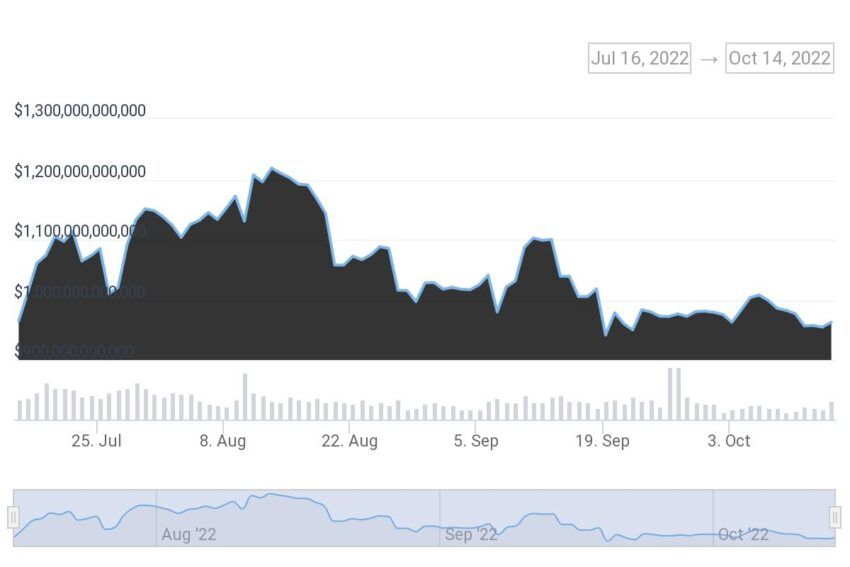

Crypto markets are showing no signs of thawing from a winter that is lengthening and likely to continue into 2023.

The consolidation has continued for 4 months now with no breaks above resistance or below support. Total market capitalization is up 2.9% on the day to $985 billion, but the figure remains almost 70% down from its peak in November.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.