Nvidia is close to finalizing a $30 billion investment in OpenAI, replacing an earlier plan for a massive $100 billion multi-year partnership.

According to Financial Times, the deal would be part of OpenAI’s latest funding round, which could value the company at roughly $830 billion. OpenAI is expected to reinvest much of that capital into AI infrastructure, including Nvidia’s GPUs.

The shift from a $100 billion commitment to a smaller $30 billion equity investment changes the financial risk profile.

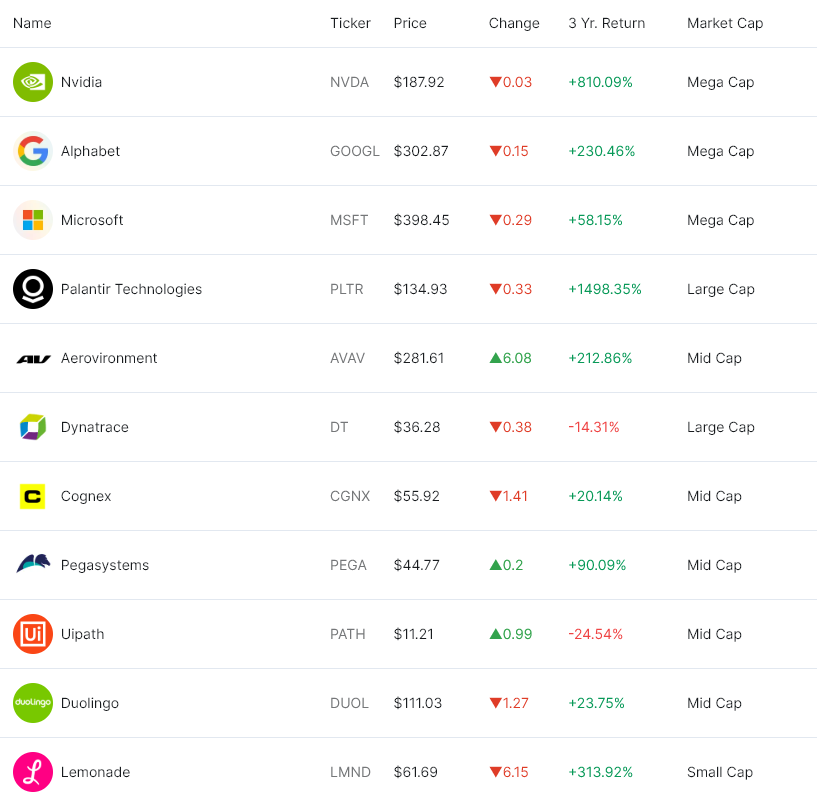

Instead of funding massive infrastructure directly, Nvidia gains ownership exposure while still securing demand for its hardware. This restructuring has drawn close attention from investors already watching Nvidia’s volatile stock movements.

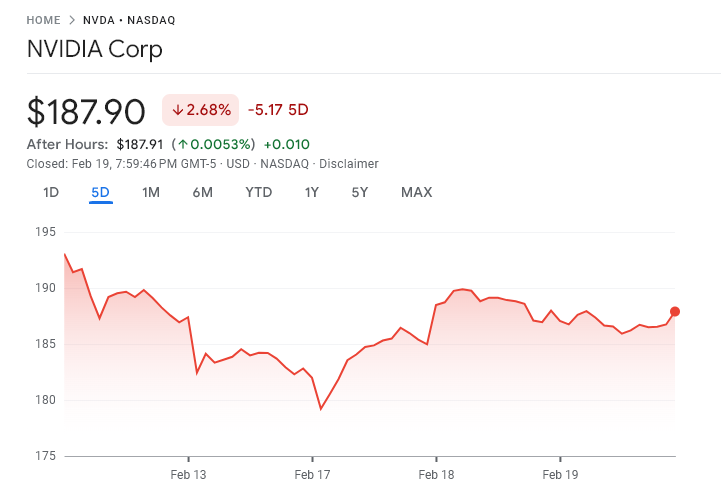

From Six-Week Lows to Strategic Rebound: Nvidia’s Volatile Month

Nvidia’s stock has moved sharply over the past several weeks. In early February, shares fell to around $177, marking a six-week low.

The decline followed uncertainty over the original $100 billion OpenAI deal, concerns over US export restrictions on AI chips to China, and broader investor worries about the sustainability of AI spending.

However, the stock rebounded after Nvidia announced a smaller investment commitment, new partnerships, and major chip supply deals.

A multi-year agreement to supply millions of AI chips to Meta also helped restore confidence. By mid-February, Nvidia shares recovered toward the high-$180 range.

Still, volatility persisted. Investors remained cautious about regulatory risks, high valuation levels, and whether AI infrastructure spending could deliver sustained returns.

Nvidia Commits to a Much Smaller Deal With OpenAI, But it Has a Bigger Signal

The latest $30 billion investment is widely seen as strategically bullish for Nvidia. First, it removes the financial burden of the original $100 billion plan, which could have strained Nvidia’s balance sheet.

Second, it strengthens Nvidia’s position as OpenAI’s primary hardware partner.

This means Nvidia benefits in two ways. It gains equity exposure to one of the world’s most valuable AI companies while continuing to sell the chips powering OpenAI’s models.

However, short-term reactions may remain mixed. Large investments always carry risk, and some investors prefer Nvidia to focus purely on chip sales.

Still, the deal reinforces a key point: AI infrastructure spending continues to accelerate.

Ultimately, the investment strengthens Nvidia’s long-term outlook. It confirms that Nvidia remains at the center of the global AI boom, even as markets navigate short-term uncertainty.