Amid escalating volatility, Notcoin’s (NOT) price has decreased by 52% in the last 90 days. As a result, some market participants view the massive Notcoin price plunge as an opportunity to scoop more tokens at discount prices.

Despite occasional speculation suggesting Notcoin (NOT) could rebound to $0.012, recent on-chain analysis casts doubt on the feasibility of such a quick recovery.

Notcoin Loses Liquidity, Faces Roadblocks

In June, the token associated with The Open Network (TON) blockchain surged to an all-time high of $0.028, largely driven by derivatives market activity. During that rally, Open Interest (OI) peaked above $200 million, indicating heightened liquidity and significant trader activity.

Open Interest measures the total number of open contracts related to a cryptocurrency, and a high OI generally signals enhanced market liquidity. This allows traders easier entry and exit points. However, when OI decreases, it suggests traders are closing positions, leading to a less liquid market.

According to Santiment, Notcoin’s Open Interest has since dropped to $67.57 million. This reduction implies that the market lacks sufficient capital to support a 70% price increase that would push the token back up to $0.012.

Read more: Top 7 Telegram Tap-to-Earn Games to Play in 2024

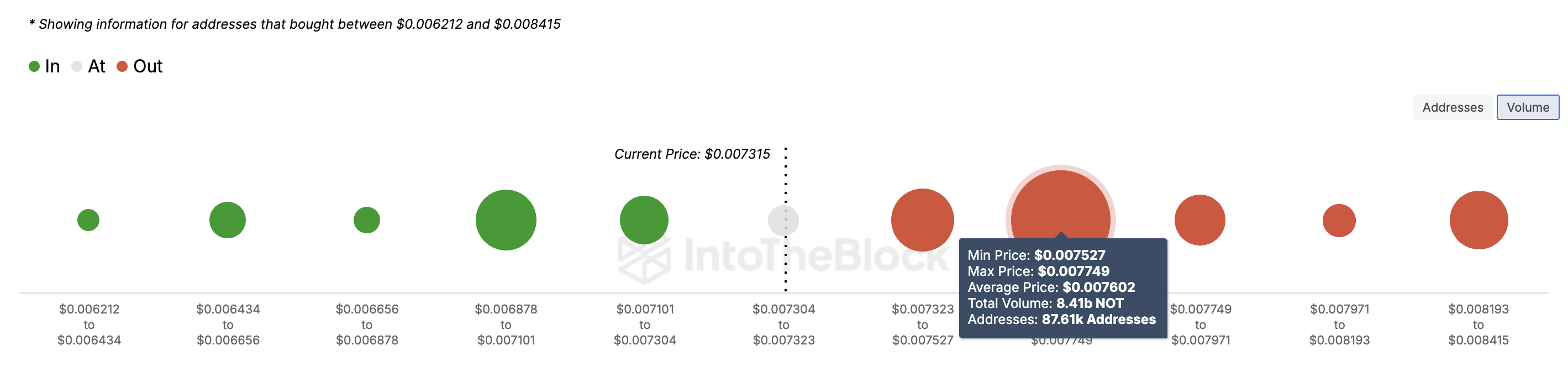

Currently, NOT is trading at $0.0073, and data from the In/Out of Money Around Price (IOMAP) suggests that it could face downward pressure.

The IOMAP tool evaluates the average price at which tokens were purchased and compares this with the current market price to determine the volume of addresses holding in profit, loss, or breakeven. At the moment, the token faces significant resistance at $0.0076, as 87,610 addresses holding a total of 8.41 billion tokens are currently at a loss.

This volume exceeds the amount held by addresses in profit, which bought between $0.0062 and $0.0073.

NOT Price Prediction: Time to Go Below $0.0070

On September 14, Notcoin (NOT) briefly rose to $0.0080 before encountering resistance and entering a downward trend. In the 4-hour timeframe, NOT faces resistance at both $0.0073 and $0.0074, as these levels have consistently hindered upward movement.

The Relative Strength Index (RSI) has dropped to 37.54, suggesting a bearish outlook, as readings below 50 indicate momentum is skewed towards selling pressure.

Read more: Where To Buy Notcoin: Top 5 Platforms In 2024

If this momentum continues or worsens, NOT could slip below the $0.0071 support level, potentially dropping further to $0.0066. However, if buyers step in and purchase significant volumes, Notcoin may resist the downward pressure and surge back toward $0.0080.