Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as the latest US labor data delivers mixed signals on jobs, wages, and unemployment. Traders are weighing what it all means for risk assets, from equities to Bitcoin, as volatility sets the tone.

Crypto News of the Day: October Jobs Collapse and November Modest Gain Signal Uneven Market

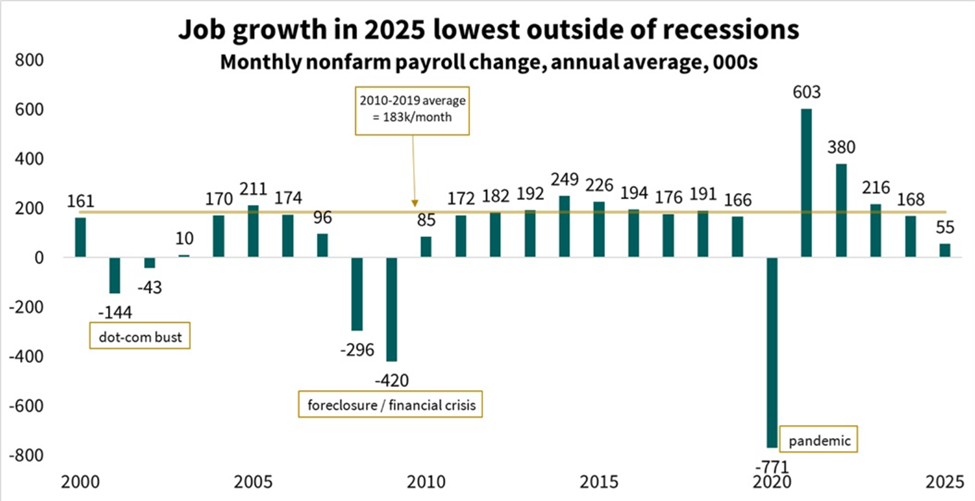

The US Nonfarm Payrolls (NFP) report for October and November 2025 delivered a shock to markets, as it is one of the crucial economic data points this week. It revealed a cooling labor market that could reverberate through both equities and crypto.

According to the US Bureau of Labor Statistics (BLS),October saw a sharp decline of 105,000 jobs, far below the estimated -25,000. This marks a pronounced slowdown in labor market momentum.

Analysts are labeling it an outlier, reflecting disruptions from delayed government data collection and seasonal adjustments.

November posted a 64,000 gain, slightly above the 50,000 consensus, but with the unemployment rate climbing to 4.6% from 4.4% in October, higher than the expected 4.5%.

While November’s rise offers some relief, it highlights the uneven nature of recent US labor market activity.

Fed and Market Implications For Bitcoin and Risk Assets

The data is likely to reinforce dovish narratives for the Federal Reserve. Powell previously cited a weakening labor market as justification for rate cuts, and today’s figures suggest the economy is far from overheated.

Traders may interpret the report as a signal that further easing in 2026 is plausible, which could support risk assets, including Bitcoin, if liquidity expectations remain intact. Bitcoin has been trapped near $90,000, and today’s data could trigger short-term volatility.

A weak October print followed by a modest November recovery may fuel a relief rally toward $95,000 as markets price in potential Fed accommodation.

Conversely, the unexpectedly high unemployment rate could reignite recession fears, creating whipsaw moves in crypto, equities, and FX.

“While markets typically cheer the resolution of uncertainty, this specific data dump is unique. The cooling trend might spark an initial crypto rally on renewed hopes for aggressive Fed cuts in 2026. But if the numbers are too weak, the narrative could quickly pivot from liquidity hopes to recession fears, historically dampening risk appetite across the board,” Jimmy Xue, COO and Co-founder at Axis, told BeInCrypto.

Market participants remain wary. With October’s data representing an outlier and November’s figures collected late, statistical distortions and revisions are possible.

Algorithm-driven trading and lean liquidity could amplify volatility in the near term, making measured positioning critical.

Amid mixed signals, traditional safe havens like gold may continue to attract flows, as the US dollar faces pressure and risk sentiment remains fragile in tech-heavy sectors.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Why Scott Bessent is cracking down on Congress’s stock trading.

- The final trade of 2025: What Wall Street’s rotation means for crypto.

- Grayscale predicts 10 key crypto investment themes for 2026 as institutional era begins.

- Trump hints at Samourai Wallet pardon — Another after CZ, Ulbricht

- XRP ETFs log one month of inflows as BTC, ETH funds bleed $4.6 billion.

- Gold nears ATH again as Bitcoin hits historic low—Rotation ahead?

- Markets rethink rate bets as Miran challenges inflation narrative before November CPI release.

- JPMorgan’s Ethereum push meets a critical chart test — Rebound or breakdown?

Crypto Equities Pre-Market Overview

| Company | At the Close of December 15 | Pre-Market Overview |

| Strategy (MSTR) | $162.08 | $165.23 (+1.94%) |

| Coinbase (COIN) | $250.42 | $253.61 (+1.27%) |

| Galaxy Digital Holdings (GLXY) | $24.54 | $24.59 (+0.20%) |

| MARA Holdings (MARA) | $10.70 | $10.82 (+1.12%) |

| Riot Platforms (RIOT) | $13.71 | $13.81 (+0.73%) |

| Core Scientific (CORZ) | $15.28 | $15.27 (-0.065%) |