Ethena Labs has successfully secured $14 million in a strategic funding round. It was led by heavyweights such as Dragonfly, Brevan Howard Digital, and Arthur Hayes’ family office, Maelstrom.

Given the increasing interest in this new stablecoin, Ethena Labs’ valuation soared to an impressive $300 million.

How Ethena Labs Aims to Challenge Tether’s Dominance

The investment round saw participation from notable entities, including PayPal Ventures, Franklin Templeton, and Fidelity through Avon Ventures. Several leading crypto exchanges, such as Binance, Deribit, Gemini, and Kraken, contributed. This diverse investor base lends significant credibility and expertise to the stablecoin project.

With commitments surpassing $50 million starting in December, the stablecoin project was forced to cap the funding round at $14 million.

“Ethena had commitments of over $50 million for the round but capped it at $14 million as it did not need more cash at the moment,” CEO Guy Young explained.

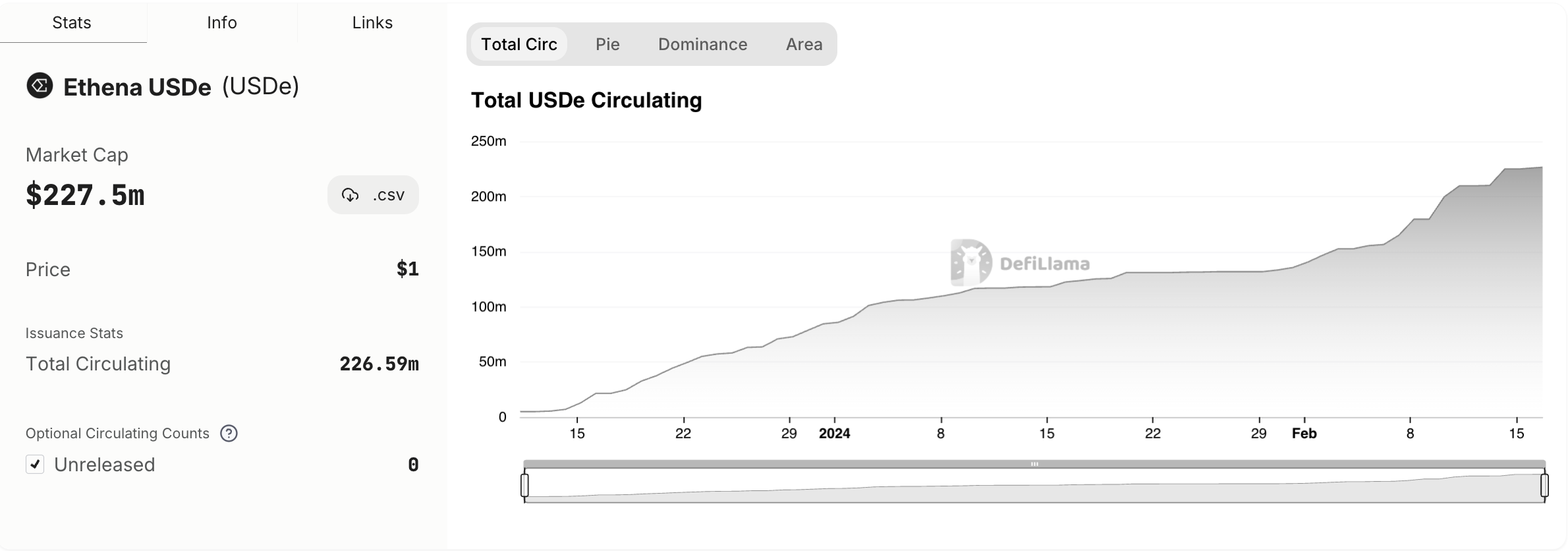

Following a stealth launch, Ethena’s USDe stablecoin has grown remarkably. It quickly amassed over $227 million in market capitalization. Arthur Hayes, an early supporter and founding advisor, believes USDe could surpass the $1 billion market capitalization soon. He also sees it as a strong competitor to stablecoins like Tether‘s USDT.

Read more: A Guide to the Best Stablecoins in 2024.

Ethena was inspired by Hayes’ vision for a new stablecoin, detailed in his blog post “Dust on Crust.” USDe operates independently of traditional banking systems. It maintains stability through a “delta-neutral” hedging strategy, balancing long and short ether positions.

Binance’s involvement through Binance Labs highlights the significance of this investment. Binance Labs is known for its substantial contributions to the Web3 ecosystem, achieving a 14x return on investment across various projects.