Shares of Netflix (NFLX), the US streaming service and producer, fell more than 30% yesterday. The giant’s share valuation is now 69% below the all-time high set in November 2021. What caused the crash?

Netflix share price collapse

Netflix shares fell more than 35% yesterday. This happened after a financial report stated that the company lost subscribers for the first time since 2011.

The drop in stock prices resulted in the loss of over $40 billion of Netflix’s market capitalization. Moreover, this has led many analysts to downgrade the stock. Currently, the stock price is trying to find support near $225.

Back in late 2021, Netflix set the all-time high (ATH) of $700 on November 17. From that peak to yesterday’s low, the stock was down 69% in just 6 months.

The situation was only exacerbated by Elon Musk’s tweet under the news of the report. The world’s richest man wrote: “The woke mind virus is making Netflix unwatchable.”

Benjamin Cowen, a well-known cryptocurrency market analyst, also posted an interesting comment on Twitter. He stated that the decline in Netflix’s stock price makes traditional markets look more and more like the cryptocurrency market, rather than the other way around. Moreover, in his YouTube video, he added that more than 35% drop in a period of several hours is a behavior characteristic of altcoin, not the leader of the fintech sector.

Reasons for declines and the end of password sharing

The company reported that several factors contributed to the loss of subscribers. Among them is competition from other streaming services and people spending less time at home in front of the TV due to the removal of pandemic restrictions.

Netflix also blamed sharing slogans for its growth problems. The company said 100 million households were sharing passwords rather than paying for more than one account. Account sharing by multiple users “means it’s harder to grow membership in many markets,” – the company wrote in a letter to shareholders.

Another two million subscribers are expected to cancel their Netflix services in the coming quarter. That’s why Netflix has laid out a two-pronged plan to get the business back on track that could bring major changes for users.

For years, Netflix tolerated users sharing access to their accounts. Recently, the company even stated that it “helped fuel our growth by getting more people using and enjoying Netflix.” However, it is now preparing to move away from this.

The company is already testing ways to charge users who share passwords additional fees. Users in Chile, Costa Rica and Peru are paying an extra $3 a month to add additional profiles to their accounts.

Netflix COO Greg Peters spoke at this week’s press conference. He said the company “will go through a year or so of iterating, and then deploying that.” Peters did not say what Netflix’s plan would look like, but said the company is trying to find a “balanced approach” to combat password sharing.

Not the first correction of Netflix stock

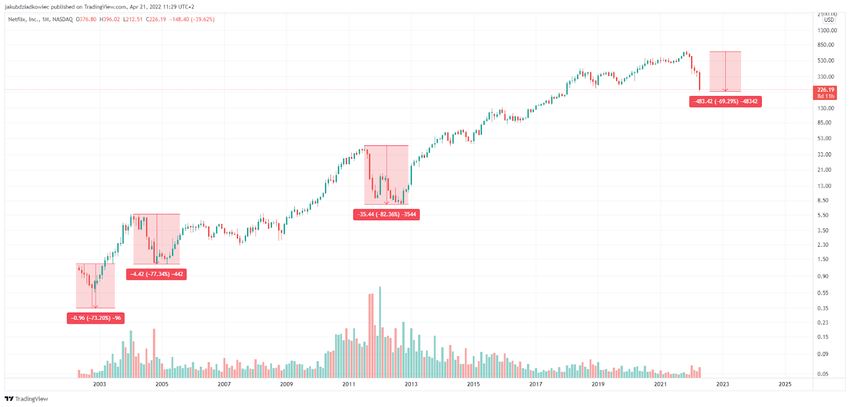

On the long-term chart of Netflix share price, we can see that this is not the first such deep correction of the price of the leader in streaming movies and series. In the 20-year stock market history of the company’s shares, more serious corrections have happened as many as 3 times:

- 73% decline right after the IPO from May to October 2002,

- 77% decline between February 2004 and March 2005,

- 82% decline in the period from July 2011 to August 2012.

However, that doesn’t change the fact that this is the most serious plunge in the giant’s stock price in a decade. The current declines have negated the last 1550 days or 4 years of Netflix price increases.

What do you think about this subject? Write to us and tell us!