First Neiro on Ethereum (NEIRO) has experienced a 12% increase in the past 24 hours. It briefly reached an all-time high of $0.0023 early Tuesday before pulling back 4% to trade at $0.0022.

As the meme coin trends toward being overbought, a correction could be on the horizon. This analysis outlines potential price targets token holders need to look out for.

First Neiro on Ethereum Experiences an Overheated Market

NEIRO’s price, as assessed on a 12-hour chart, is poised to cross above the upper bands of its Bollinger Bands indicator. When an asset’s price trends toward the upper band of the Bollinger Bands, it indicates that the asset is experiencing increased volatility and may be approaching overbought territory.

While trending toward the upper band is often a sign of market strength, it also indicates that the asset may soon witness a correction, especially if other indicators confirm overbought conditions.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in October 2024

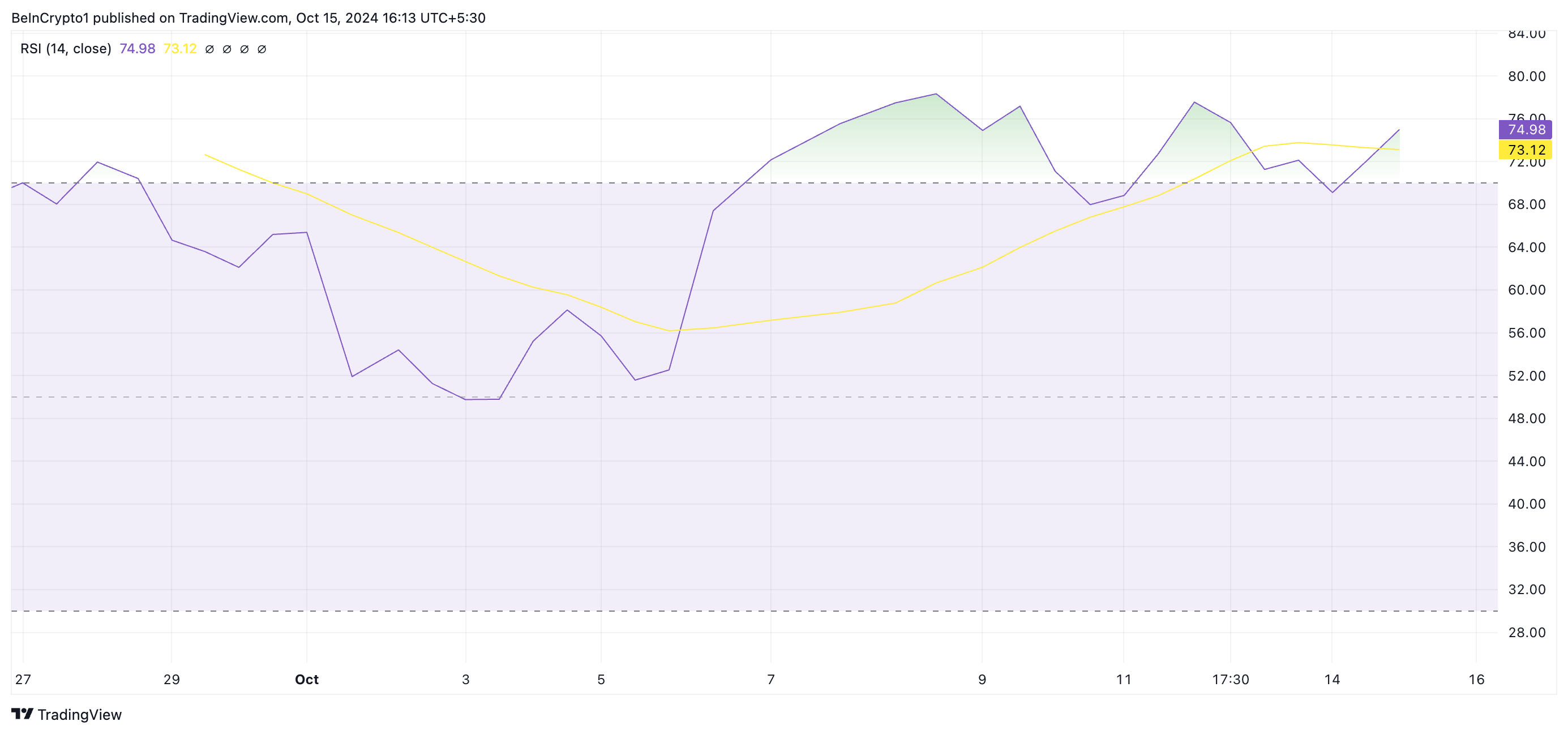

Moreover, NEIRO’s surging Relative Strength Index (RSI) confirms this. This indicator measures an asset’s overbought and oversold market conditions.

It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a correction. In contrast, values below 30 indicate that the asset is oversold and may witness a rebound.

At press time, NEIRO’s RSI is sitting at 74.93, indicating that the meme coin may shed some of its gains soon.

NEIRO Price Prediction: Price Targets to Watch

Increasing selling pressure will likely cause NEIRO’s price to pull back. Based on Fibonacci Retracement levels, the price may decline by 18%, potentially settling at $0.0018.

If the bulls fail to defend this support line, the meme coin’s value could plummet by an additional 51%, dropping to $0.00091.

Read more: Best Crypto To Buy Now: Top Coins To Keep an Eye on in October 2024

Conversely, if buyers resume activity, NEIRO could reclaim its all-time high of $0.0023. It may then attempt to break through this resistance level.