Near (NEAR) has been on a downward trajectory over the past week. Its price briefly fell to a seven-day low during the early trading hours on Wednesday.

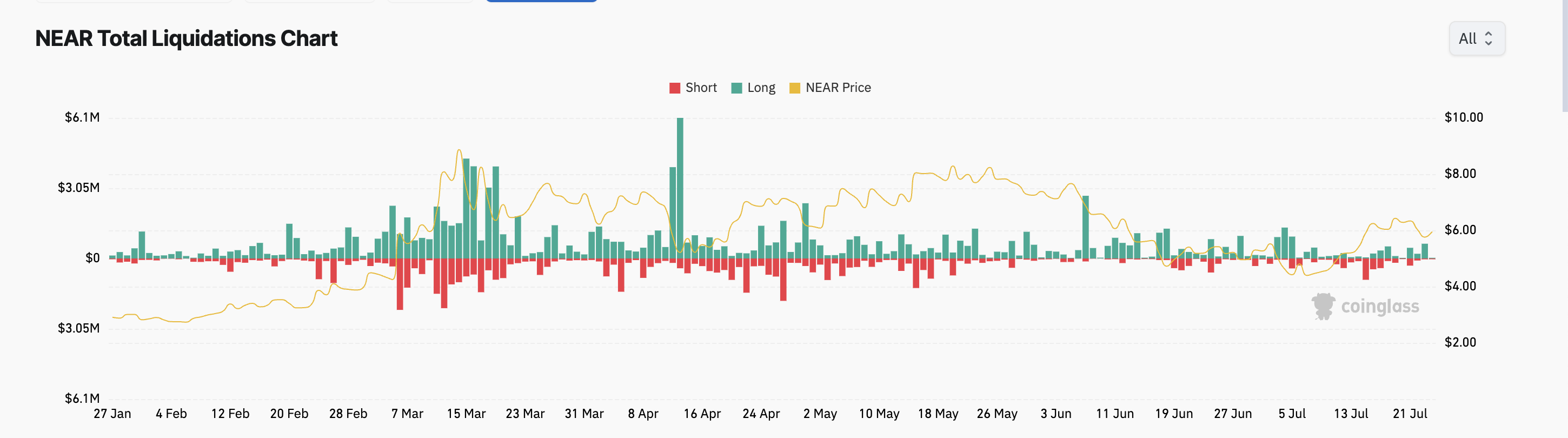

The steady fall in the token’s value has led to a surge in long liquidations in its futures market, as traders caught on the wrong side of the market have been forced to close their positions.

Near Long Traders Record Losses

As of this writing, NEAR trades at $5.94. The coin’s value has plummeted by almost 5% in the past week.

This decline has led many futures traders, who had bet on a price rally, to witness liquidations.

Liquidations occur in an asset’s derivatives market when the asset’s value moves against the position held by a trader. When this happens, the trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations occur when traders with long positions are forced to sell the asset at a lower price to cover their losses as the price falls. This typically happens when the asset’s price decreases beyond a certain level, forcing traders with open positions betting on a price increase to exit the market.

According to Coinglass’ data, in the past seven days, the amount of NEAR long liquidations has totaled approximately $2.31 million.

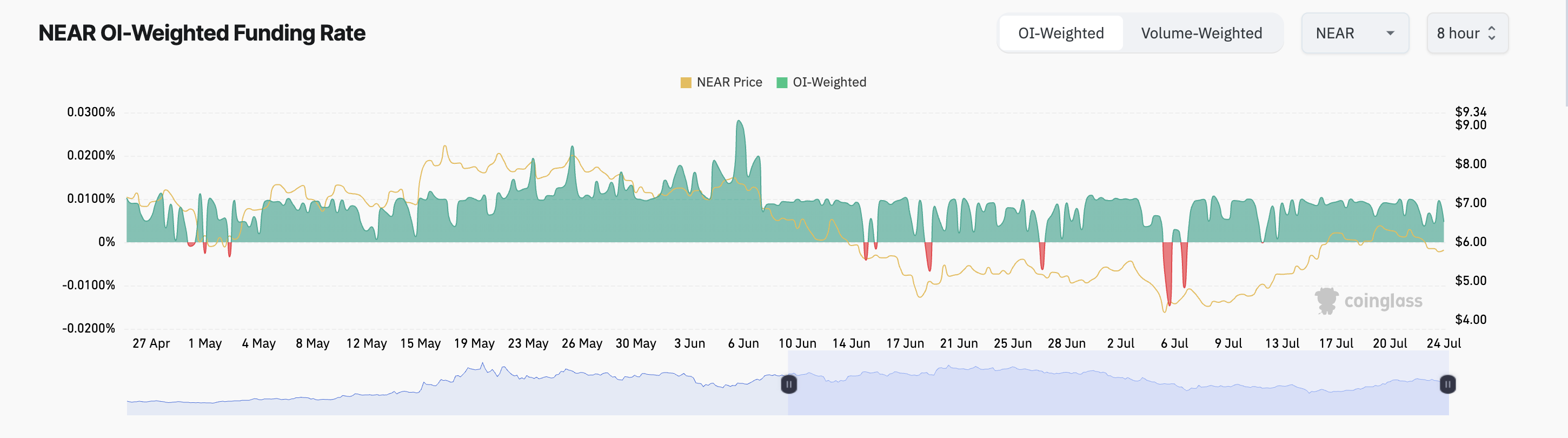

Interestingly, despite this, NEAR’s futures market participants have continued to demand long positions. This is evidenced by the coin’s funding rate across cryptocurrency exchanges, which is 0.0047% at press time.

Read More: What Is NEAR Protocol (NEAR)?

When an asset’s funding rate is positive, it is a bullish signal. It means there is more demand for long than short positions.

NEAR Price Prediction: Negative Sentiment Puts Asset at Risk

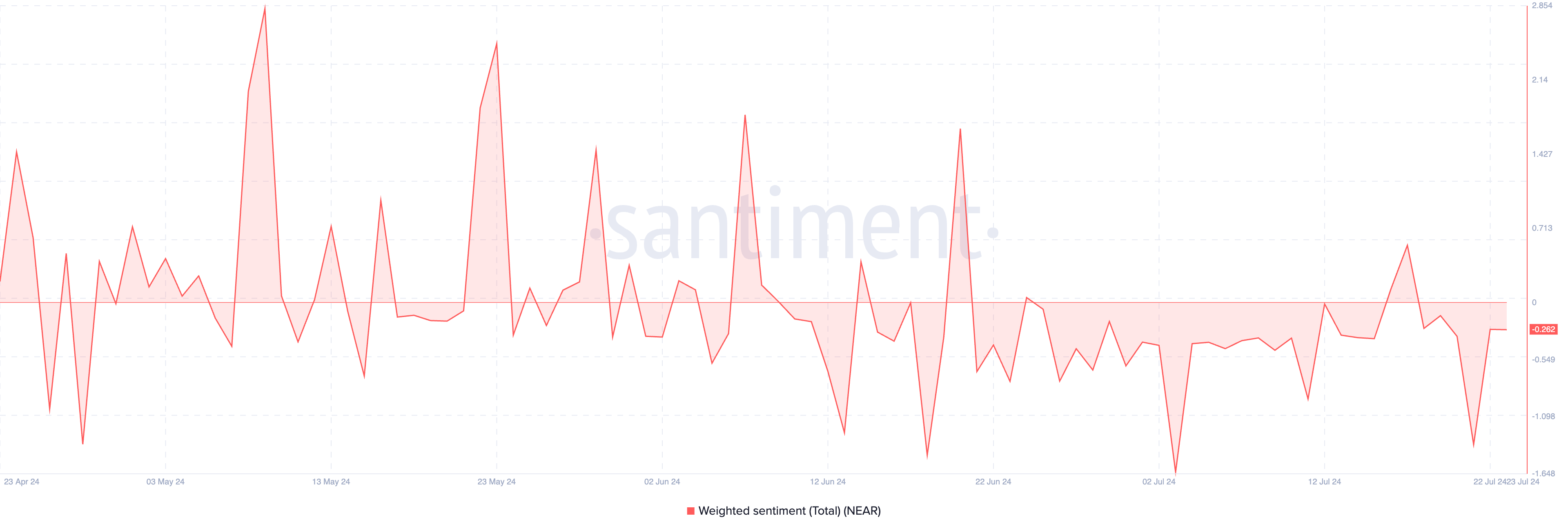

This demand for long positions has persisted despite the bearish sentiments that continue to trail NEAR. For context, the coin’s weighted sentiment has been predominantly negative since June 24. As of this writing, it is -0.26.

An asset’s weighted sentiment metric tracks the overall mood of the market regarding it. When the value of an asset’s weighted sentiment is below zero, most social media discussions are fueled by negative emotions like fear, uncertainty, and doubt.

If the sentiment shifts from negative to positive, NEAR’s price will rally to a monthly high of $6.49, driving up demand for the altcoin.

However, if the ongoing decline persists, the token’s price may fall to $5.17.