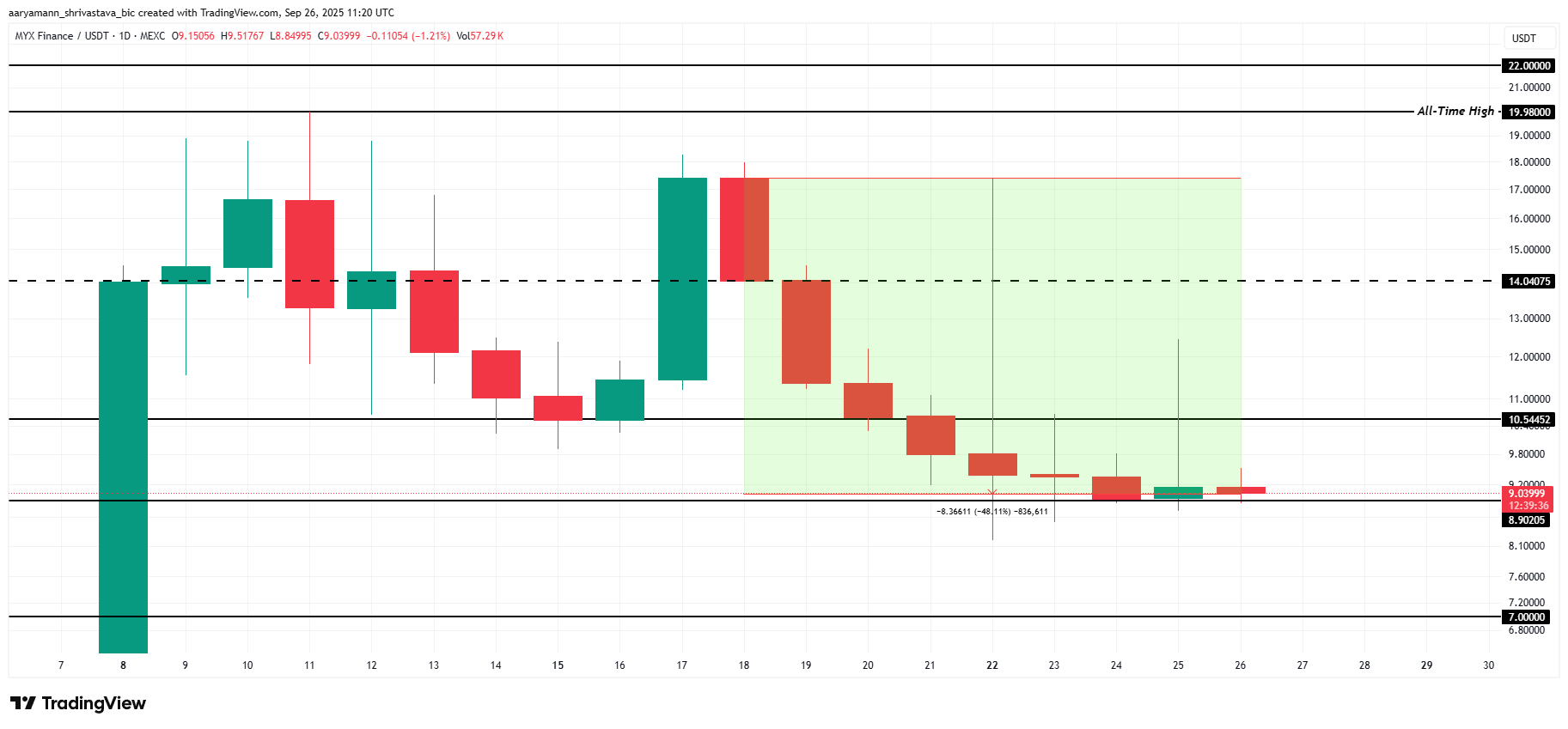

MYX Finance has faced heavy selling pressure recently, with the altcoin plunging 48% from its highs and falling below $10. The drop comes as market conditions remain broadly bearish.

However, technical indicators and a shift in correlation with Bitcoin suggest a potential rebound may be on the horizon.

MYX Finance Is Still Running Strong

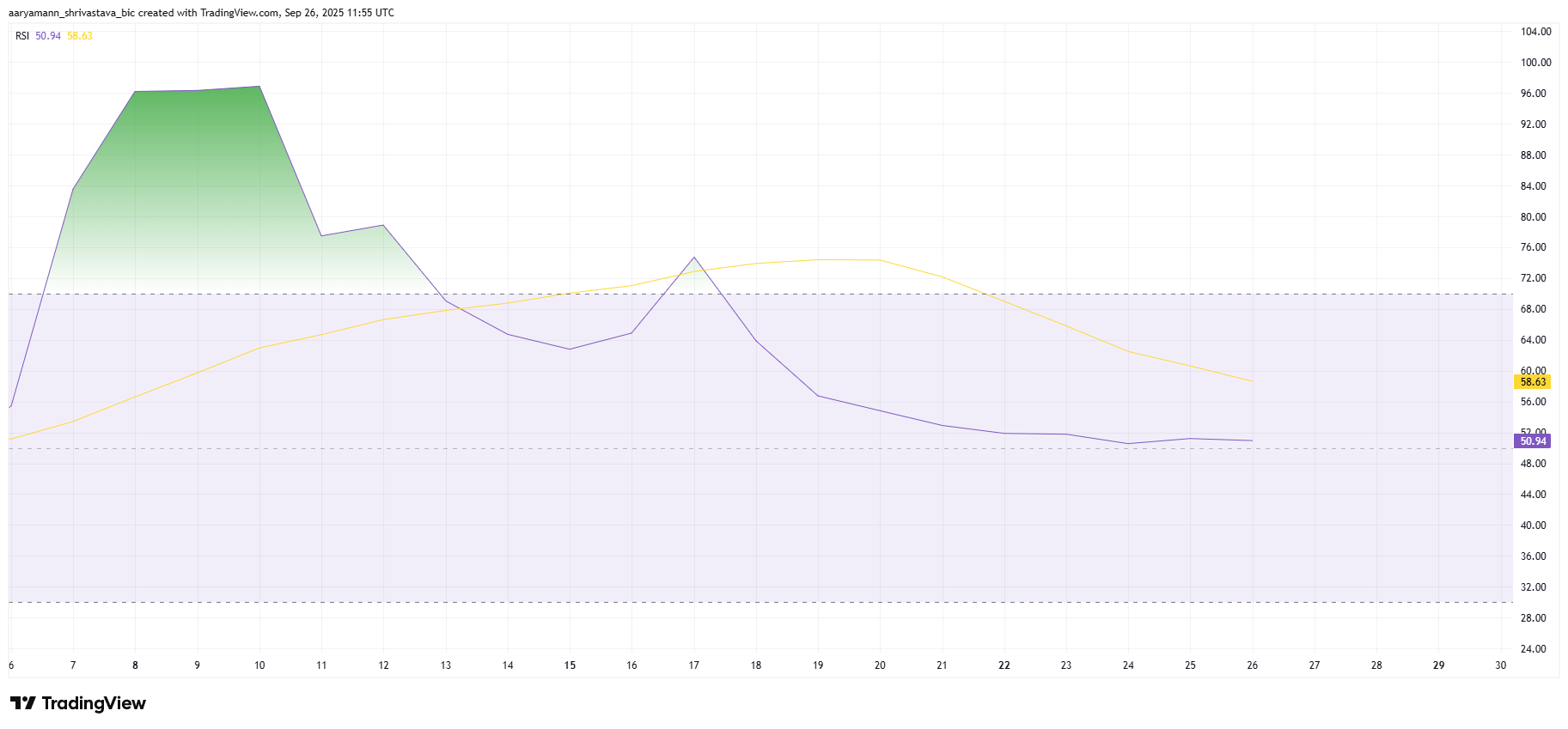

The Relative Strength Index (RSI) shows that bullish momentum in MYX remains intact despite the heavy decline. The indicator continues to hold above the neutral 50.0 mark, signaling resilience. This strength suggests that even with volatility in the broader market, MYX is positioned to stage a recovery.

For the past several days, MYX has hovered above this threshold, resisting deeper bearish pressure. This steady performance highlights investor confidence in the altcoin’s medium-term prospects. Should this positive momentum be sustained, MYX could be among the few tokens that can decouple from negative macro market conditions and post gains.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

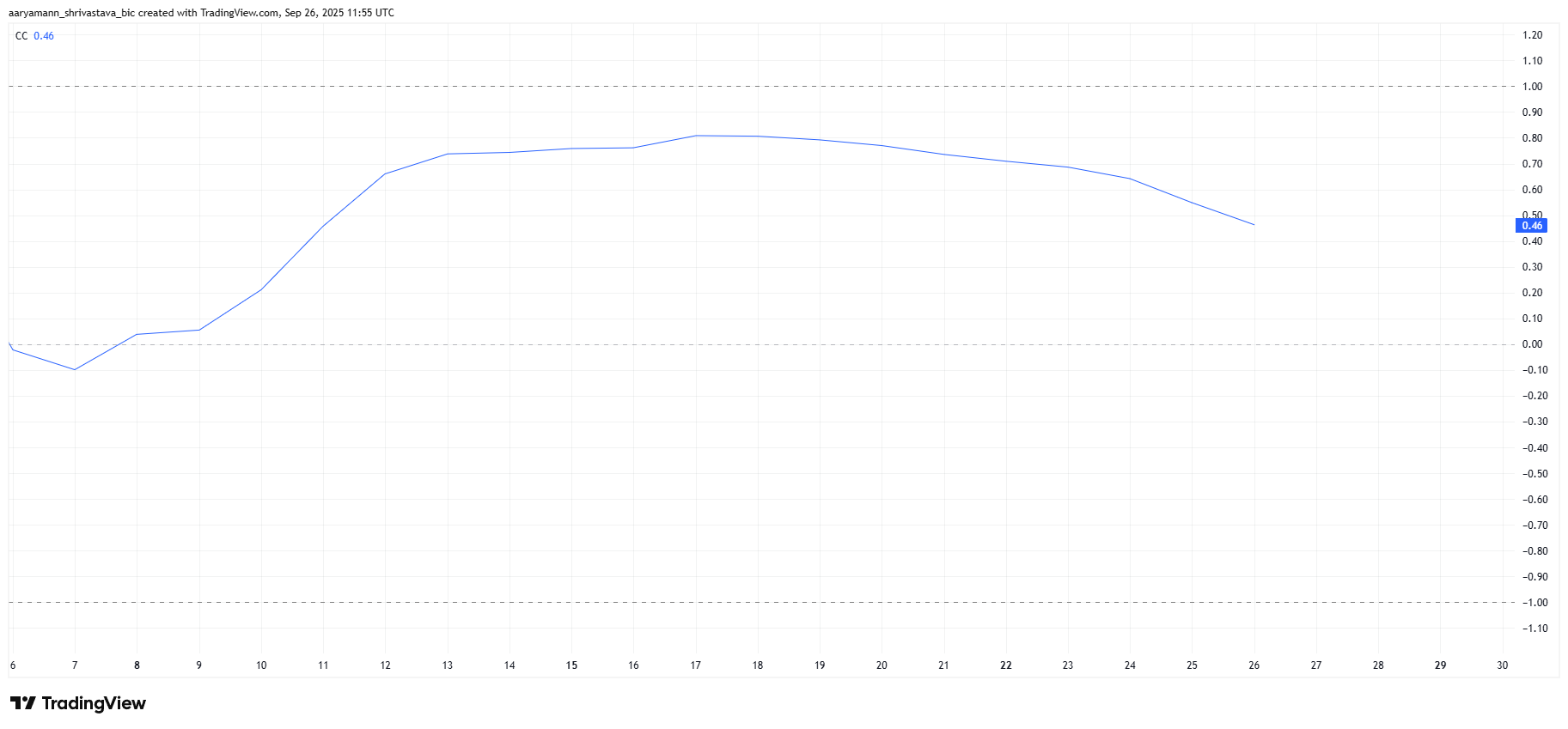

MYX Finance is also showing divergence from Bitcoin, which could play a decisive role in its price trajectory. The correlation between MYX and Bitcoin has slipped to 0.46, indicating weakening dependency on the crypto king’s moves. This decoupling is significant given Bitcoin’s recent struggles.

If the correlation declines further and turns negative, MYX could chart its own course independent of BTC’s bearish momentum. Such divergence has historically benefited altcoins with strong fundamentals, allowing them to recover even as Bitcoin consolidates or dips further. MYX may be heading into that scenario.

MYX Price Establishes Crucial Support

MYX is currently priced at $9.03, holding just above the critical $8.90 support. The altcoin’s decline came after failing to breach its all-time high of $19.98, leaving it nearly halved in value. Holding above $8.90 will be essential for recovery attempts.

If the bullish signals play out, MYX could rebound from support and break through resistance at $10.54. Clearing this level would open the path toward $14.04, helping the token erase much of its recent 48% decline. Strong demand will be key to sustaining this move.

However, downside risks remain. If investors withdraw support, MYX could slip below $8.90 and extend its decline toward $7.00 or lower. Such a move would invalidate the bullish thesis and place the altcoin back into a heavy downtrend.