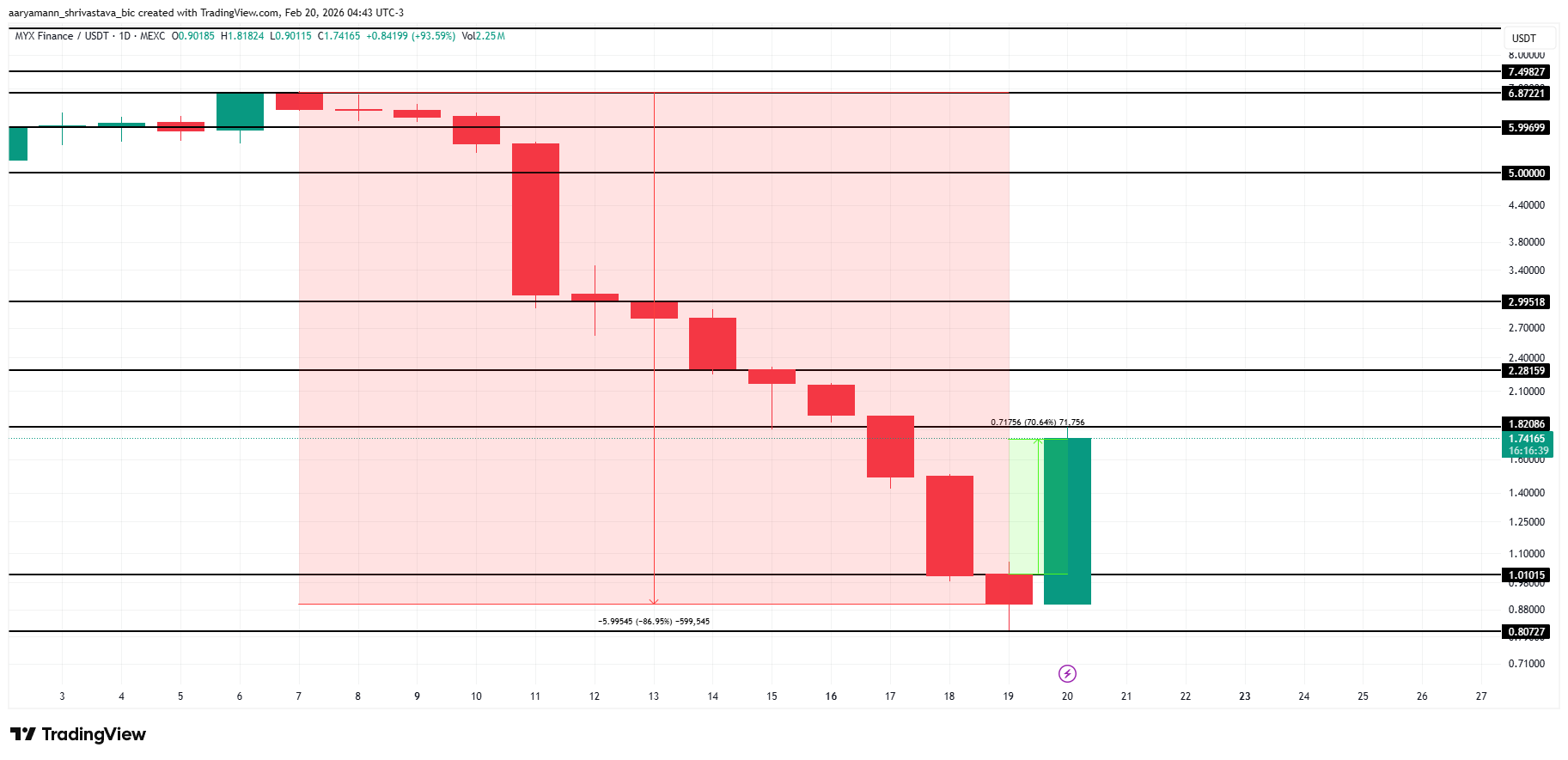

MYX Finance delivered one of the most aggressive intraday rallies in the crypto market this week. After nearly two weeks of persistent decline, the altcoin surged 90% in less than 12 hours. The sharp reversal caught short sellers off guard and reignited speculative interest.

The rally followed news of MYX Finance’s strategic funding round led by Consensys, with participation from Consensys Mesh and Systemic Ventures. The announcement came ahead of the MYX V2 launch. Investors interpreted the backing as a validation of long-term viability, triggering immediate demand.

MYX Finance’s Recovery Was Foretold

BeInCrypto’s analysis highlighted how a rebound was already likely. The Money Flow Index, which measures buying and selling pressure using price and volume, fell below the 20.0 threshold. This marked the first time MYX entered extreme oversold territory since launch.

Oversold readings often indicate selling exhaustion. When MFI drops under 20.0, downside momentum typically weakens. The data suggested that panic-driven distribution had reached saturation. As selling pressure faded, fresh accumulation began, creating the conditions for a sharp recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

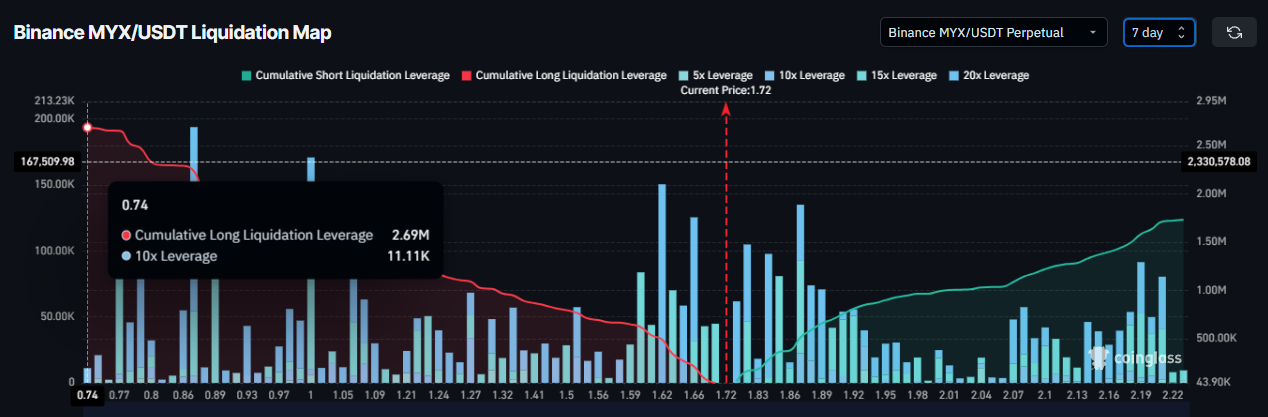

Derivatives positioning reinforces the bullish shift. The liquidation map shows MYX contracts currently skewed toward long exposure. Approximately $2.46 million in long positions are active, reflecting growing optimism among traders.

Funding rates have also turned positive. Positive funding indicates that long traders are paying to maintain positions. This dynamic signals confidence in continued upside. However, elevated leverage can increase volatility if momentum stalls.

MYX Price Needs To Breach a Few Barriers

MYX price surged 90% on Friday, pushing the 24-hour gain to 70.6%. At the time of writing, the token trades at $1.74. The move partially offsets the 87% correction recorded over the previous 12 days.

The next resistance stands at $1.82. A decisive break above this level could open the path toward $2.28. Sustained volume and capital inflows will be necessary to validate the breakout. Without confirmation, upside may remain fragile.

If the rally was fueled primarily by speculation surrounding the funding round, selling pressure could return quickly. A failure to sustain gains may send MYX back toward $1.01. Such a decline would invalidate the bullish thesis and erase much of the recent recovery.