Bitcoin’s (BTC) price marked an all-time high last week and has since triggered a correction that has led to the cryptocurrency declining by 7.74%.

However, amidst the chaos of bearish sentiment, one move from BTC investors could prevent a catastrophic correction.

Bitcoin Price Saved by Its People

The Bitcoin price is already trading at $67,768 at the time of writing, falling from $68,393 since the beginning of the trading session. This adds to the ongoing corrections that resulted in the cryptocurrency losing the 50-day Exponential Moving Average (EMA).

BTC, however, is still above the critical support level marked at $63,724, which would result in significant losses for investors. The reason behind this is the conviction of BTC holders who have been consistently adding to their wallets despite the market conditions.

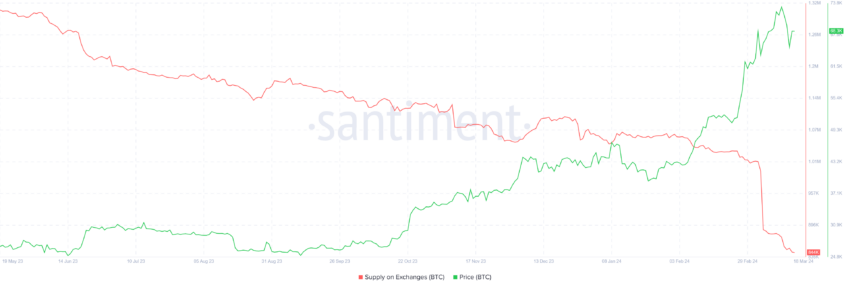

In the last week alone, nearly 36,640 BTC worth more than $2.5 billion has left the exchange wallets. Interestingly, whales have not been accumulating at this time, which means that retail investors are the ones accumulating at the moment.

In fact, their conviction is also as strong in the derivative market. The lack of long liquidation has kept their optimism alive, suggesting traders are still betting on increasing prices.

Read More: What Is a Bitcoin ETF?

These efforts will be key in helping Bitcoin price stay its course of sideways movement on the daily chart and prevent a catastrophic crash.

BTC Price Prediction: Watch out for This Level

Bitcoin price is more than likely to sustain above $60,000 and maintain $63,724 as a support floor.

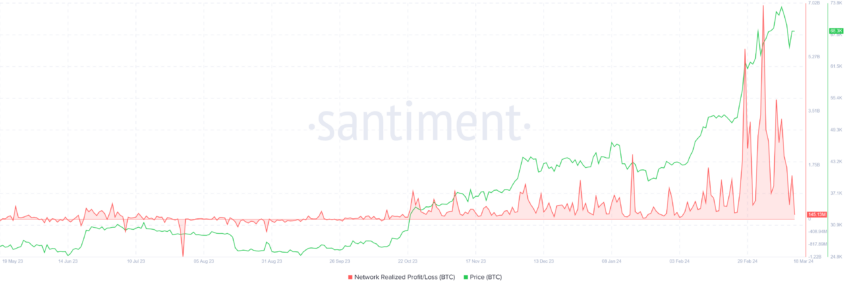

However, the fact that profits are still running high cannot be ignored. Realized profits, which refer to the gains recorded on the chain post movement of the coins through addresses, exhibit a high potential for booking profits.

This adds to the declining prices and signals that BTC investors might opt to sell their holdings to book profits.

Read More: Bitcoin Price Prediction 2024/2025/2030

Consequently, Bitcoin price will take a hit from this and could fall through $63,724. Losing this support would invalidate the bullish thesis and leave BTC vulnerable to falling to $60,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.