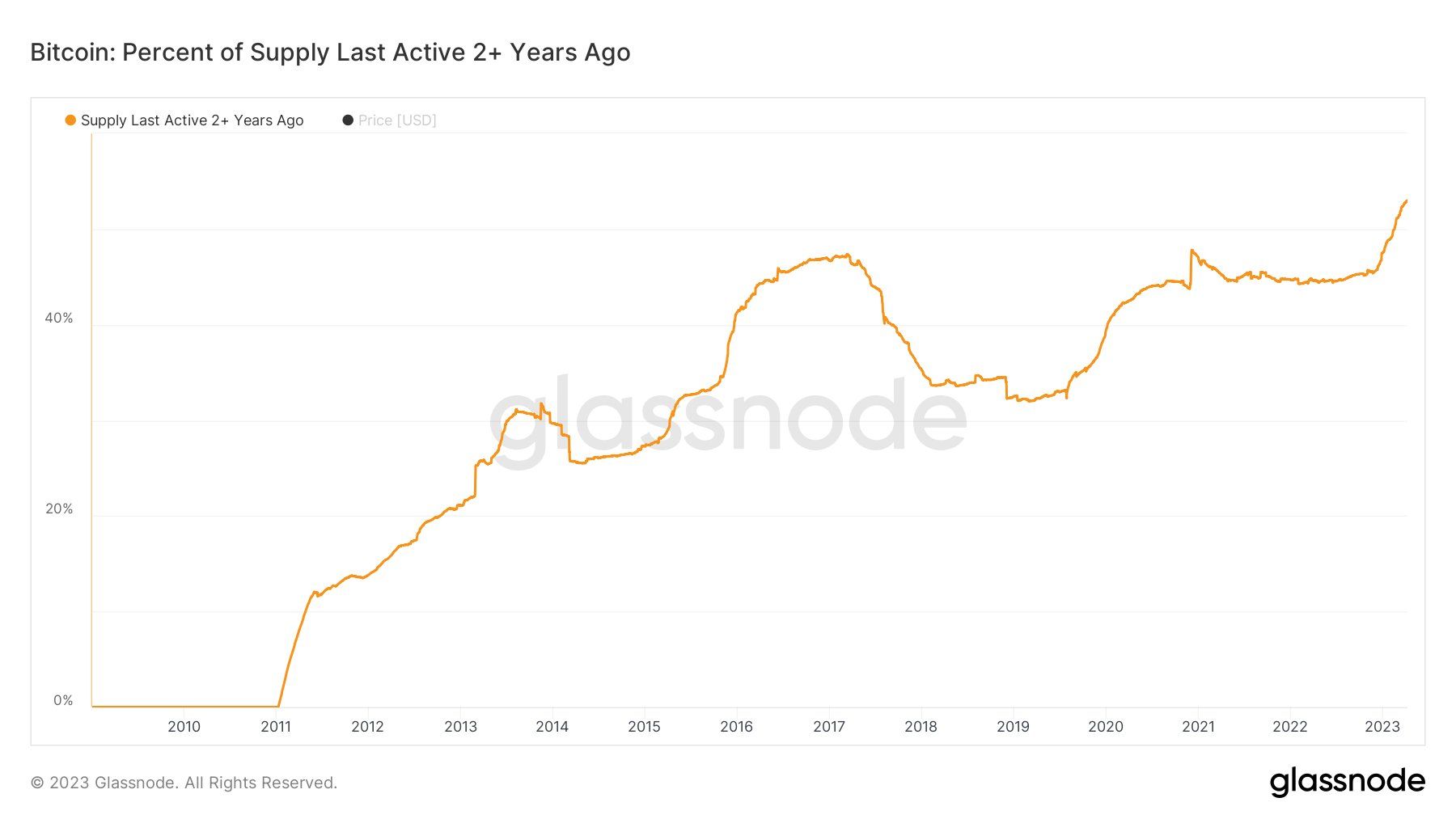

Bitcoin accumulation and holding are continuing, and a reluctance to sell means that more of the asset is becoming dormant.

According to data from on-chain analytics provider Glassnode, more than half of the Bitcoin supply is inactive.

By inactive, it means that the coins have not moved for the past two years. Furthermore, The percentage of supply last active more than two years ago has hit an all-time high of 53%.

After almost two years of hovering around 45%, the number of dormant BTC jumped in 2023. This suggests that those who bought more than two years ago are unwilling to sell.

Many that bought during the last bull market would still be underwater right now. After all, Bitcoin is still trading down almost 60% from its all-time high in November 2021.

Bitcoin On-Chain Movements

Industry influencer Anthony Pompliano tweeted the data on April 10. Additionally, he observed that almost 29% of all Bitcoin in circulation has not moved in the last five years.

“That is over $150 billion in market cap that hasn’t moved in half a decade,” he said.

Glassnode data also suggests that just under 15% of all Bitcoin in circulation has not moved in a decade.

There is more than 2.7 million BTC lost, forgotten, “or in the hands of the most disciplined investors in the world,” said Pompliano.

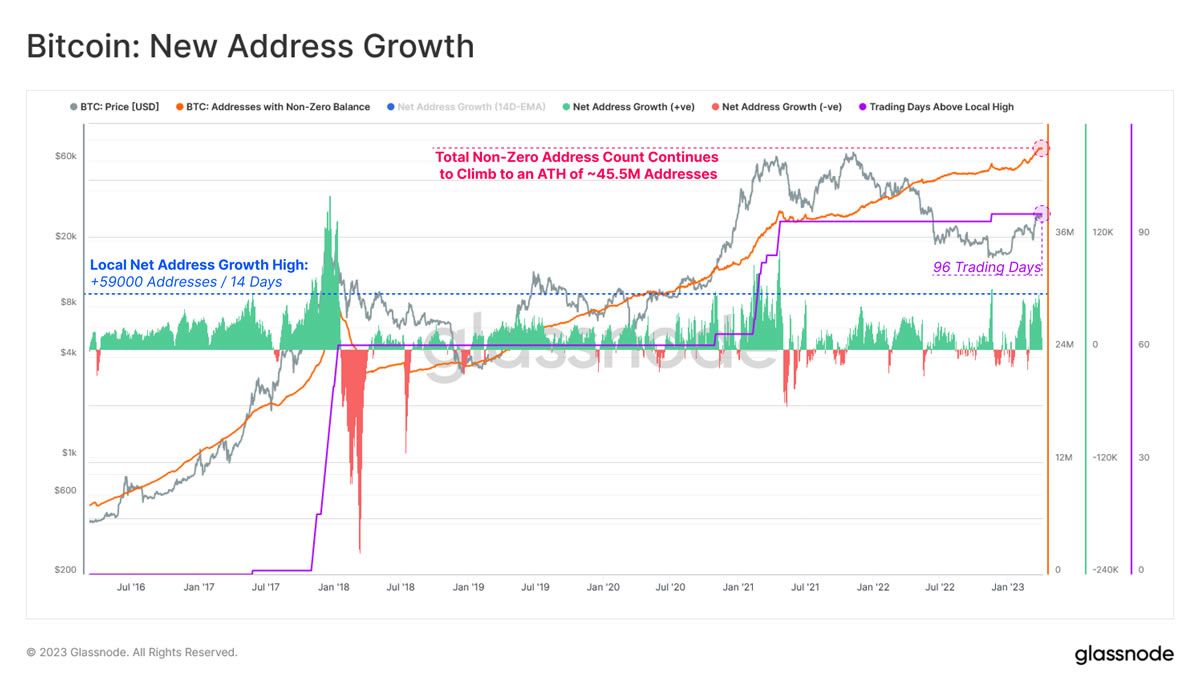

Over the weekend, Glassnode reported that the number of non-zero Bitcoin addresses had been propelled to an all-time high of 45.5 million.

“This suggests the degree of on-chain activity is currently improving,” it noted.

Furthermore, it reported that Bitcoin to exchange inflow volumes have just hit a monthly low. This also suggests that more holding and self-custody are occurring. High inflows to centralized exchanges often signal an increase in selling pressure.

The opposite may be the case when inflow volumes are as low as they are now.

BTC Price Outlook

Bitcoin prices gained a couple of percent during the Monday morning Asian trading session. As a result, BTC tapped a five-day high of $28,500 before falling back slightly.

At the time of writing, the asset was changing hands for a little under $28,300.

BTC has been consolidating in a tightly range-bound channel for the past three weeks. Previous extended periods of consolidation have ended in a large move, and on-chain data has suggested a trend reversal to the upside this year.