Meme coin Mog Coin (MOG) is trading at $0.0000019, up 14% in the last 24 hours, positioning it as the market’s top gainer in that period.

BeInCrypto’s analysis of MOG’s on-chain activity shows a notable increase in engagement among its long-term holders (LTHs) over this timeframe. This analysis examines the renewed demand and its potential short-term effects on MOG’s price trajectory.

Mog Long-Term Holders Propel Price

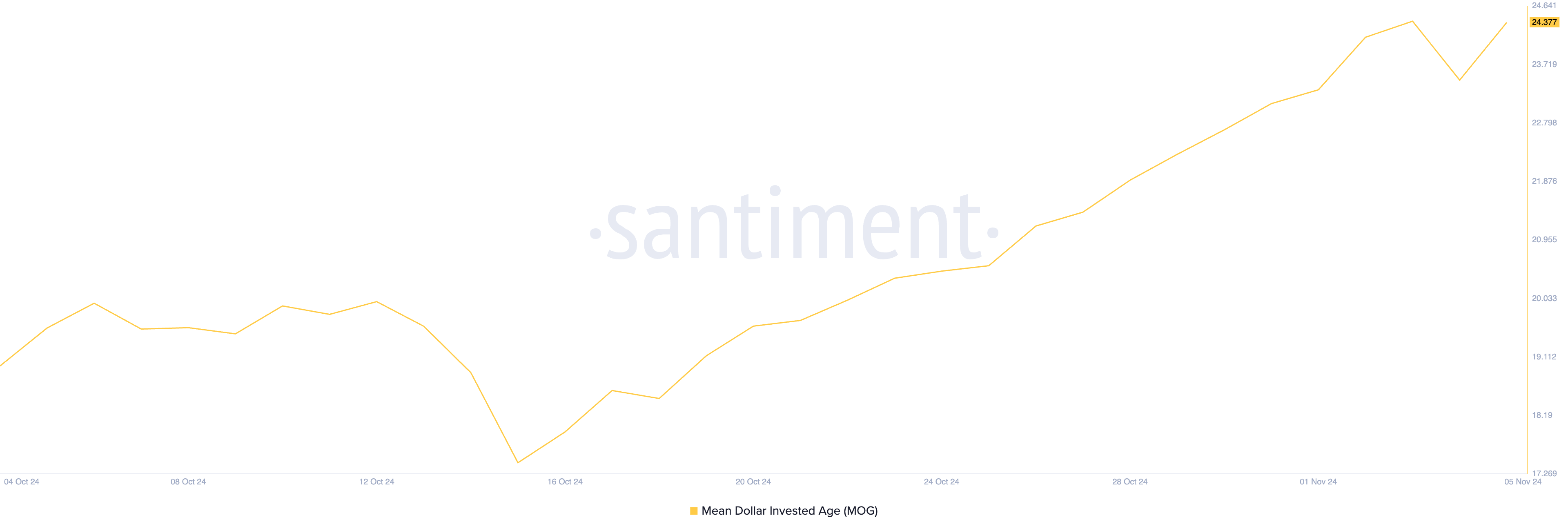

The spike in MOG’s Mean Dollar Invested Age (MDIA) over the past 24 hours highlights increased accumulation among its LTHs. According to Santiment’s data, this metric increased by 4% during the period under review.

An asset’s MDIA measures the average age of dollars invested in all its coins held on the blockchain. A rising MDIA signals that holders are keeping assets in wallets instead of actively trading them.

When older coins are sold or transferred, the Mean Dollar Invested Age (MDIA) decreases, signaling profit-taking or a shift in market sentiment as long-term holders (LTHs) start liquidating their positions. Conversely, a spike in MDIA indicates a HODLing trend, suggesting that holders feel confident enough to keep their assets.

Read more: What Are Meme Coins?

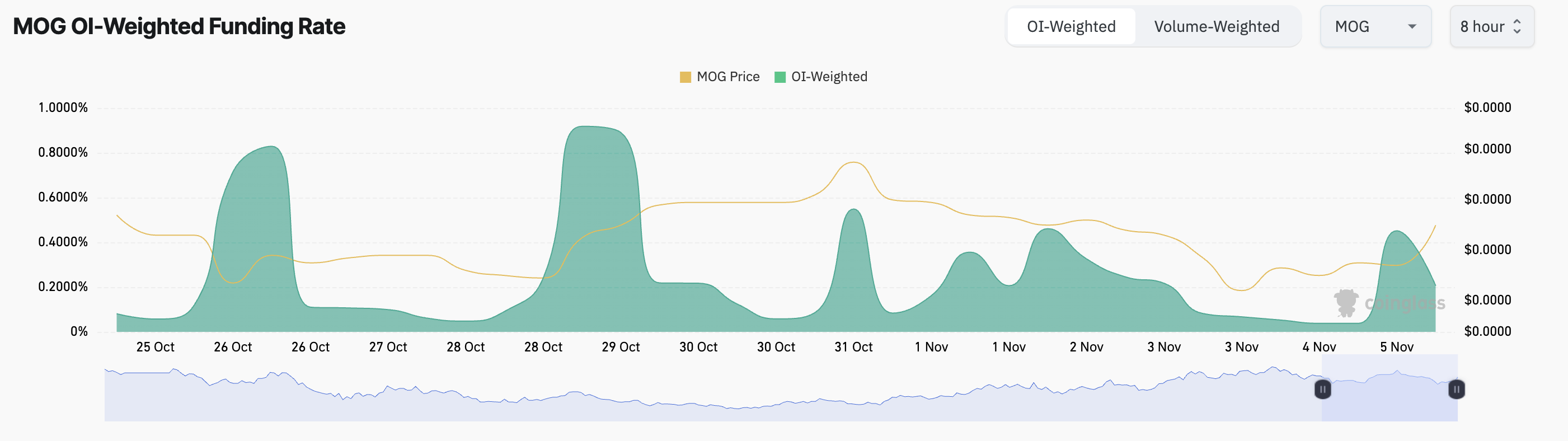

Moreover, for meme coins, which can be highly volatile, a spike in MDIA could imply speculative anticipation of a price rally. This is reflected in MOG’s positive funding rate, which signals a rise in demand for long positions. At press time, the meme coin’s funding rate is 0.20%.

The funding rate in perpetual futures markets is a tool designed to keep the futures contract price aligned with the underlying asset’s spot price. A positive funding rate indicates that long positions (betting on a price increase) are paying fees to short positions (betting on a price decrease).

MOG Price Prediction: Meme Coin May Reclaim Year-To-Date High

If these long bets prove accurate and MOG continues its trend, it will aim to break through the $0.0000021 level. This represents the last major resistance before its year-to-date high of $0.0000024. Successfully crossing this level would allow MOG to reclaim its year-to-date peak.

However, if market sentiment shifts from bullish to bearish, this BULLISH projection could be invalidated. In that scenario, MOG’s price may lose its recent gains and potentially fall toward $0.0000015.