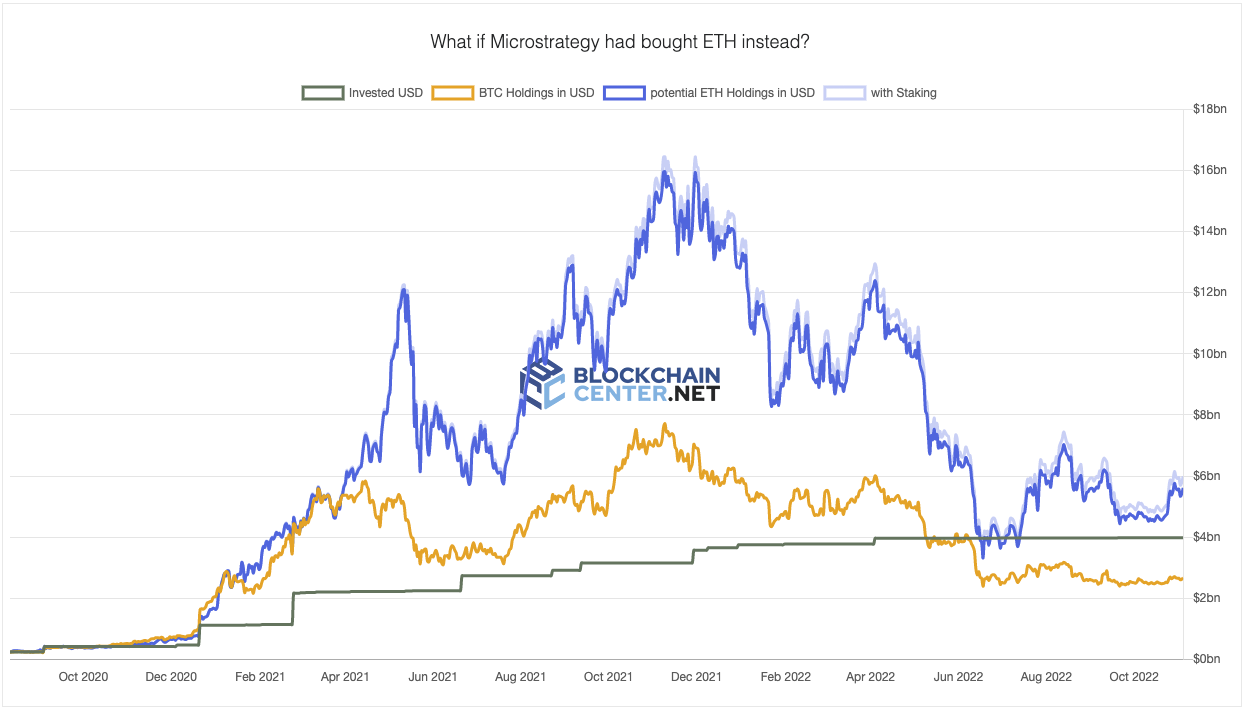

Hindsight is a wonderful thing. If MicroStrategy had chosen to invest in Ethereum instead of Bitcoin, things might have worked out differently.

The Blockchain Center has provided a comparison page for MicroStrategy’s crypto investments. It has used the Bitcoin purchases the firm made and overlaid them with what would have happened if they had been Ethereum instead.

The software firm currently holds 130,000 BTC and is the largest corporate holder of the asset. That investment, which began in August 2020 with a quarter of a billion dollar buy, is worth $2.63 billion at today’s prices.

Furthermore, the firm is down $1.34 billion on its cumulative investments. According to the comparison site, it would be up $1.47 billion if it had bought Ethereum instead.

Ethereum Fundamentals Strengthen

If MicroStrategy had loaded up on ETH at the same times it did with BTC, it would now have 3.54 million ETH. This would be worth approximately $5.45 billion, about twice as much as its BTC holdings value.

This does not include earnings from staking. With ETH staking included, MicroStrategy would have earned an additional 239,690 ETH worth around $370 million.

Furthermore, swapping its BTC holdings for ETH now would convert to 1.7 million ETH. Staking this would earn the company $132 million annually (approximating at about 4% APY). “MicroStrategy never had this much operating income,” said ‘Holger,’ the analyst who created the page.

Ethereum fundamentals continue to strengthen, and there are three main reasons that it has outperformed Bitcoin over the past month.

Firstly, there is no selling pressure from miners since it is now a proof-of-stake consensus. Secondly, according to the tracker, it is now deflationary, with supply growth at -0.09% per year. Thirdly, network energy consumption has dropped by 99.9%. This makes the asset much more appealing to ESG (environmental, social, and governance) conscious corporates and institutions.

ETH Price Outlook

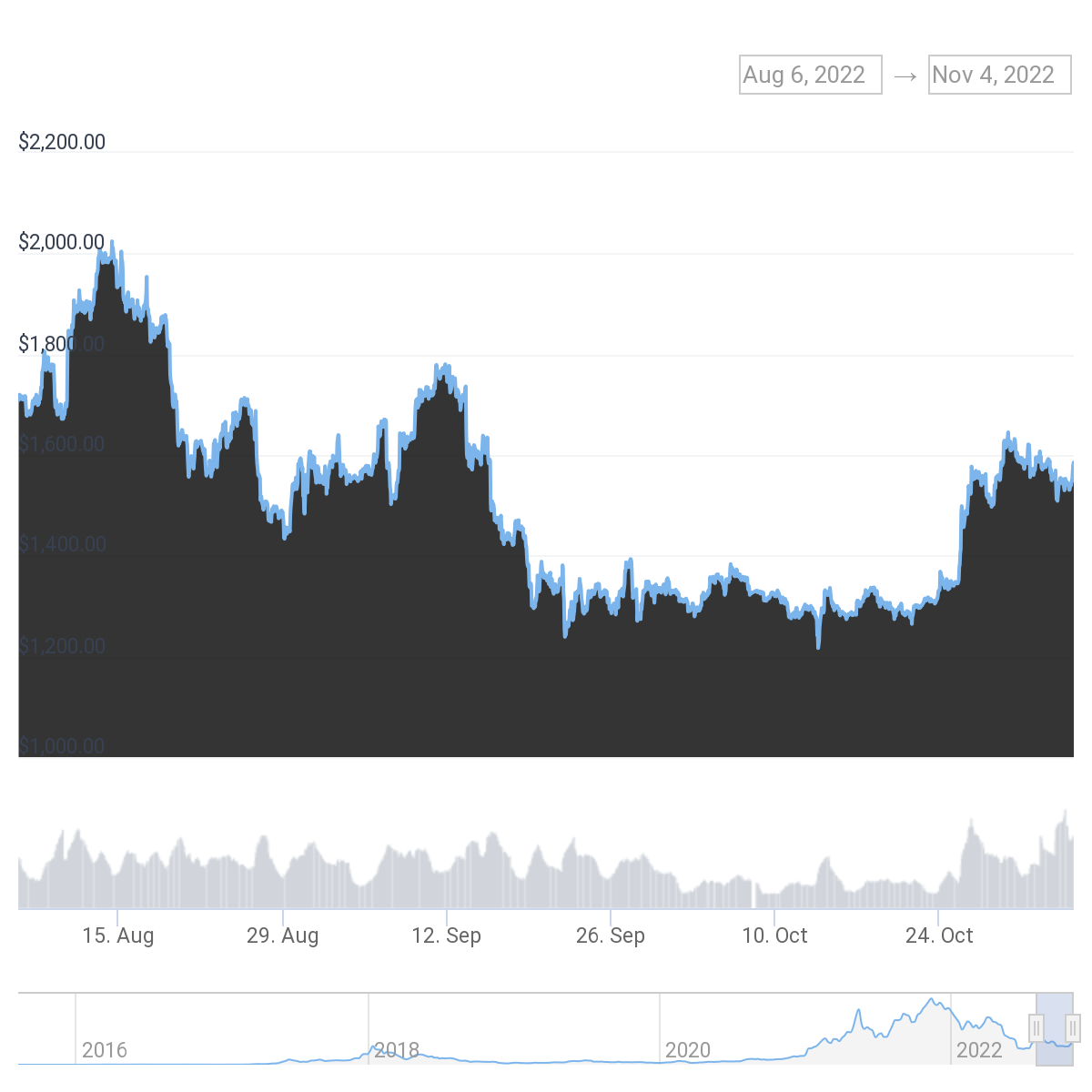

Over the past fortnight, ETH has gained 20.6%, according to CoinGecko. Comparatively, Bitcoin has only managed 6.8% over the same 14 days.

Ethereum is currently trading flat on the day at $1,549 at the time of writing. Furthermore, it has been on a downtrend so far this month, having run out of steam from the relief rally.

Ethereum is still consolidating along with the rest of the crypto market. With that in mind, the asset is unlikely to show any short-term recovery, but when the crypto winter ice does finally melt, ETH could be leading the upward charge.