Business intelligence firm MicroStrategy has just released its second quarterly earnings report and things are looking up. Additionally, the world’s largest corporate holder of Bitcoin wants to add more to its burgeoning stash.

On Aug. 2, MicroStrategy released its Q2 financial results, adding that it acquired an additional 467 BTC for $14.4 million in July and now holds 152,800 BTC.

MicroStrategy Still Keen on Bitcoin

MicroStrategy added that it acquired 12,800 Bitcoins since Q1 for $361.4 million, or $28,233 per BTC. As of July 31, the total cost of its Bitcoin holdings was $4.53 billion, or $29,672 per coin.

MicroStrategy reported a net income of $22.2 million for the period. This is a stark contrast to the net loss of $1.1 billion it reported for the same period last year. However, its total revenue remained flat at $120.4 million.

The largest growth was for subscription services revenues which saw a 42% increase year-over-year to $19.9 million.

Andrew Kang, Chief Financial Officer at MicroStrategy, commented on Bitcoin buying:

“We efficiently raised capital through our at-the-market equity program and used cash from operations to continue to increase bitcoins on our balance sheet.”

He added that this was achieved “against the promising backdrop of increasing institutional interest, progress on accounting transparency, and ongoing regulatory clarity for Bitcoin.”

In a recent filing to the Securities and Exchange Commission, MicroStrategy outlined intent to sell up to $750 million in class A common stock.

The proceeds from the sale will be used to purchase more Bitcoin and fund other company operational expenses.

BTC and MSTR Price Outlook

MSTR stock traded up 1% on the day to end at $436 during after-hours trading. Shares in the firm have outperformed Bitcoin itself this year with a gain of 200% since Jan. 1. BTC has managed just 80% over the same period.

Crypto markets are back in the green today following the recovery of the CRV token, quashing fears of a DeFi black swan event.

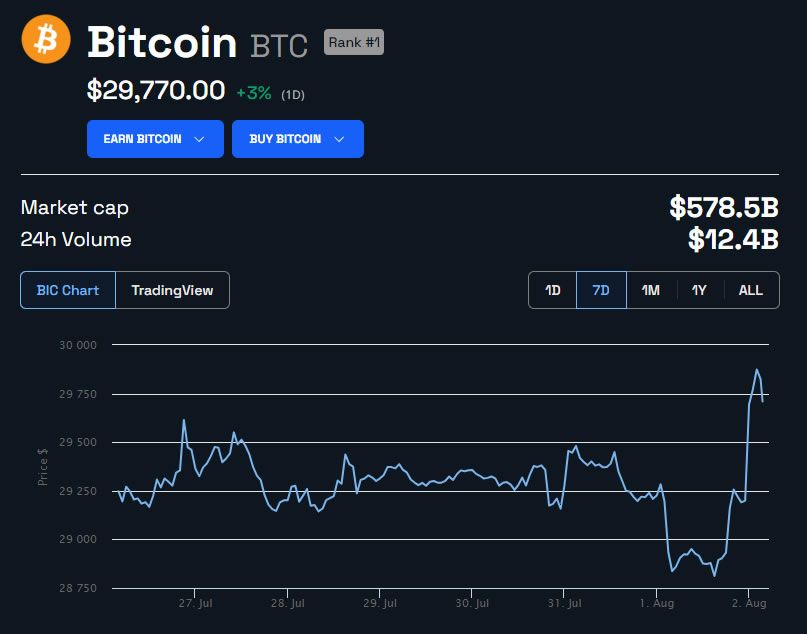

Bitcoin prices were up 3% on the day at $29,770 at the time of writing. However, the asset still remains tightly range-bound.

Bitcoin is currently at a ten-day high. However, it failed to break $30,000 and has already started to retreat.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.