Solana-based meme coin Cats in a Dog’s World (MEW) soared to a new all-time high of $0.011 today, driven by a 12% price increase over the past 24 hours.

However, with market conditions heating up, signs of buyer exhaustion are emerging, and a price correction may be on the horizon. This analysis outlines key price targets that MEW holders should monitor as the potential pullback looms.

cats in a dogs world Buyers May Soon Witness Exhaustion

MEW briefly surged to a new all-time high of $0.01066 on Thursday before experiencing a slight pullback. As of this writing, the meme coin is trading at $0.01056, down 2% from its peak.

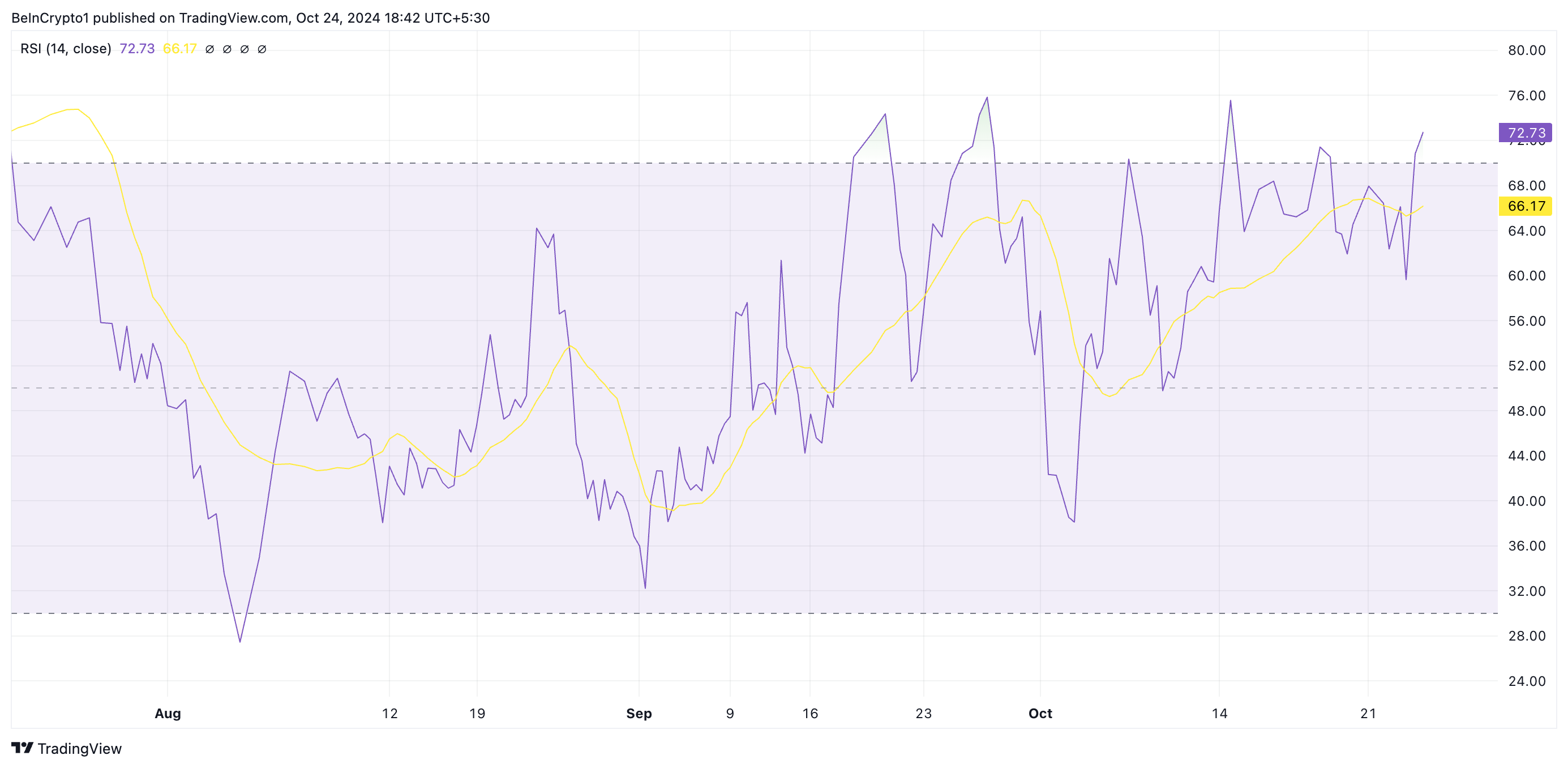

While the rally has brought gains for many holders, BeInCrypto’s analysis of the MEW/USD 12-hour chart suggests a potential short-term price correction. A key indicator of this is MEW’s overbought condition, as reflected by its Relative Strength Index (RSI), which currently sits at 72.73.

Read more: Top 9 Safest Crypto Exchanges in 2024

This indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a correction. On the other hand, values below 30 indicate that the asset is oversold and may soon witness a rebound.

MEW’s RSI reading of 72.73 signals that it is overbought. It hints at potential buyer exhaustion and suggests the likelihood of a price pullback in the short term as traders start to sell to lock in profits.

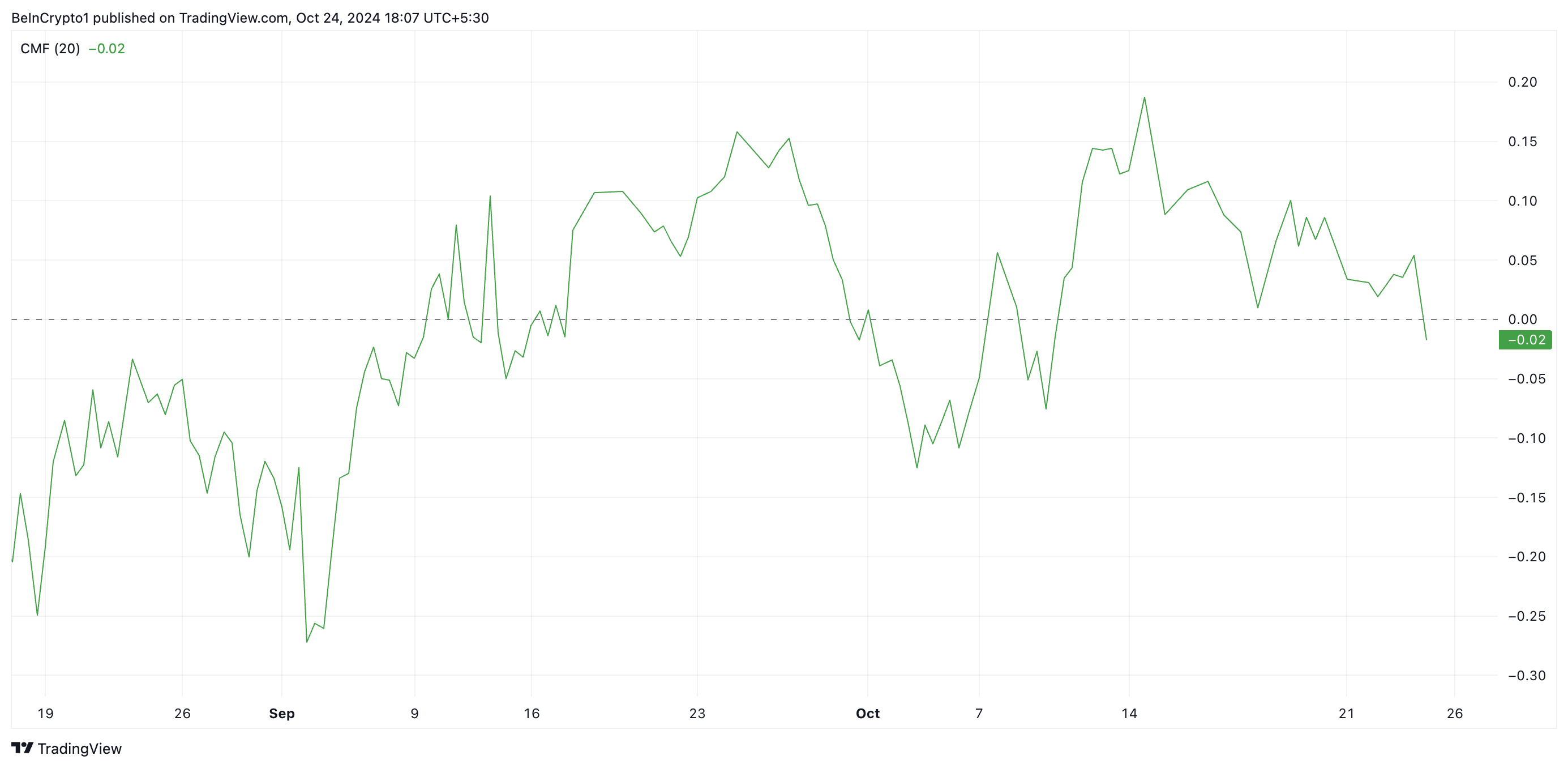

Additionally, MEW’s plummeting Chaikin Money Flow (CMF) confirms this rise in profit-taking activity among market participants. As of this writing, MEW’s CMF rests below its zero line at -0.02.

The CMF measures money flow into and out of an asset. When its value is below 1, it suggests that selling pressure is dominant, indicating that more money is flowing out of the asset than into it. It is a sign that investors are offloading positions, reducing the likelihood of a continued upward trend.

MEW Price Prediction: The Bulls Must Defend These Levels

MEW is currently trading at $0.010, just below its all-time high resistance of $0.011. With buying pressure fading, the meme coin could experience a pullback toward support at $0.009, marking a 13% drop from its current price. Should demand fail to materialize at this level, MEW’s price could fall further to $0.0081.

Read more: 11 Top Solana Meme Coins to Watch in October 2024

However, this bearish outlook could be invalidated if profit-taking subsides and new demand emerges. In that case, MEW’s price could reclaim its all-time high of $0.011 and potentially push beyond it.