Thursday brought a sea of red as bitcoin dropped to a two-week low. Altcoins also saw bearish sell-offs coupled with the BTC drop.

Bitcoin saw its worst day in two weeks as the cryptocurrency dropped to $50,000. The drop saw bitcoin decline for the fifth straight day. Market sentiment has quickly shifted from bullish to bearish as bitcoin struggles to hold up. The $50,000 support appears to have held firmly for the meantime. However the weekend could see more volatility.

Mass Liquidations as Volatile BTC Dumps

Bitcoin volatility has spared no over-leveraged traders on Thursday as it declined up to 8% on the day. The price decline saw a whopping $2.4 billion in liquidations on the day. It appears the bull market has created a wave of leverage traders over-extending their portfolios to capitalize on the surge in prices. However, small downward moves appear to be doing their damage to traders. While choppy, bitcoin even managed to liquidate some short positions.

Majors Trend Down with Bitcoin

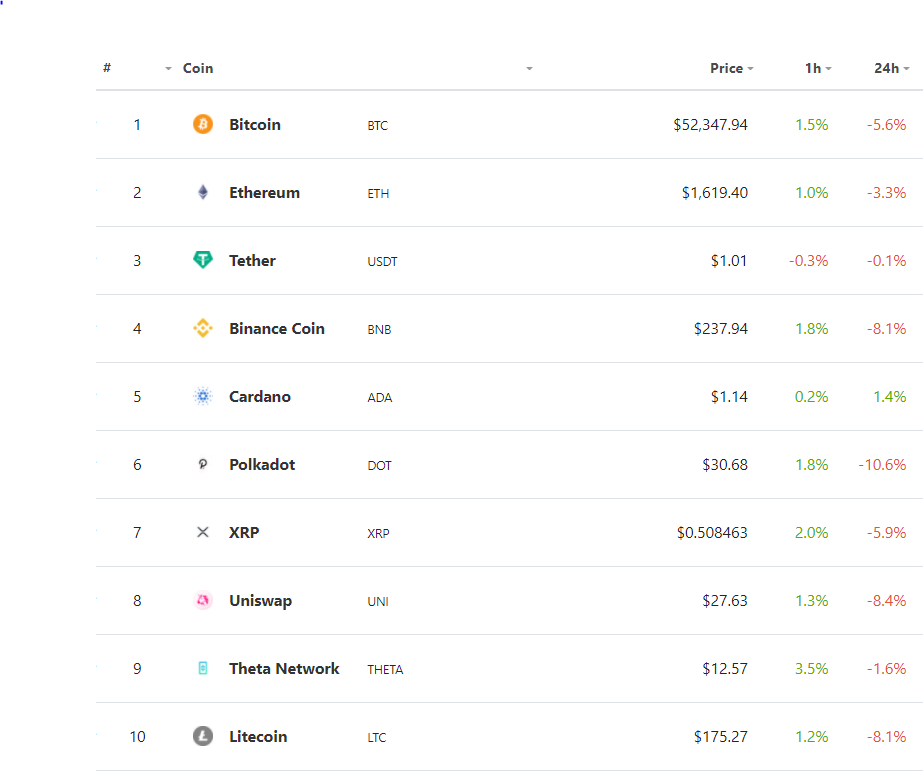

While bitcoin had a bad day on Thursday, the rest of the top ten major caps saw the same fate as bitcoin. Only Cardano (ADA) managed to remain green in the top 10. Litecoin (LTC), Binance Coin (BNB), and Uniswap (UNI) saw drops of over 8%. At the same time, Polkadot (DOT) suffered the biggest decline on Thursday, with a 10.6% drop in price. However, it still managed to hold onto the sixth spot.

Top 100 Biggest Gainer and Biggest Loser

With over 98% of the top 100 seeing red on Thursday. The biggest gainer saw QTUM climb 2.2% on the day. A measly increase. The lack of green was evident as three stable coins featured as top gainers on the day.

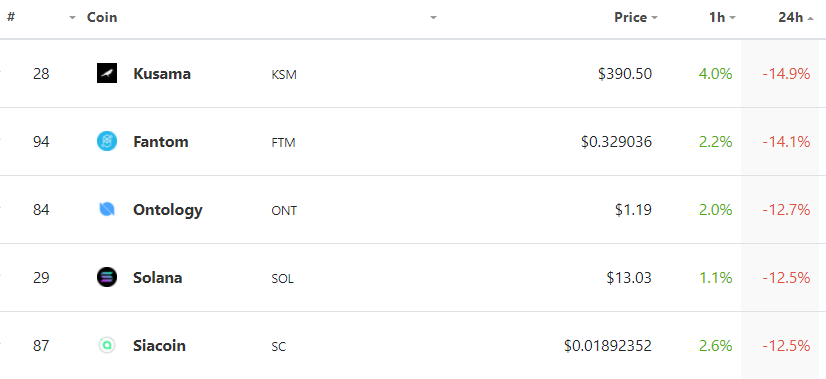

Like much of the market on Thursday, most of the top 100 saw double-digit losses. Kusama (KSM) was the biggest loser with a price drop of over 14.9%, with FTM not far behind.

Thursday was clearly one of the worst days in recent memory in terms of price action being negative. The market appears to be seeing a major correction, and Friday will offer more insight into how bitcoin will trend. However, in the meantime, traders remain optimistic about bitcoin recovering from here. All eyes will be on bitcoin over the weekend as volatility is likely to continue.

Friday will also see a record $6 billion worth of bitcoin options expire. The event could yield further pain in the market as options traders look to capitalize. However price remains firm as bulls appear to be defending $50,000 for now.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.