MNT, the native token of Mantle Network, the Layer 2 (L2) technology stack for scaling Ethereum, has witnessed a resurgence in its demand in the past few weeks.

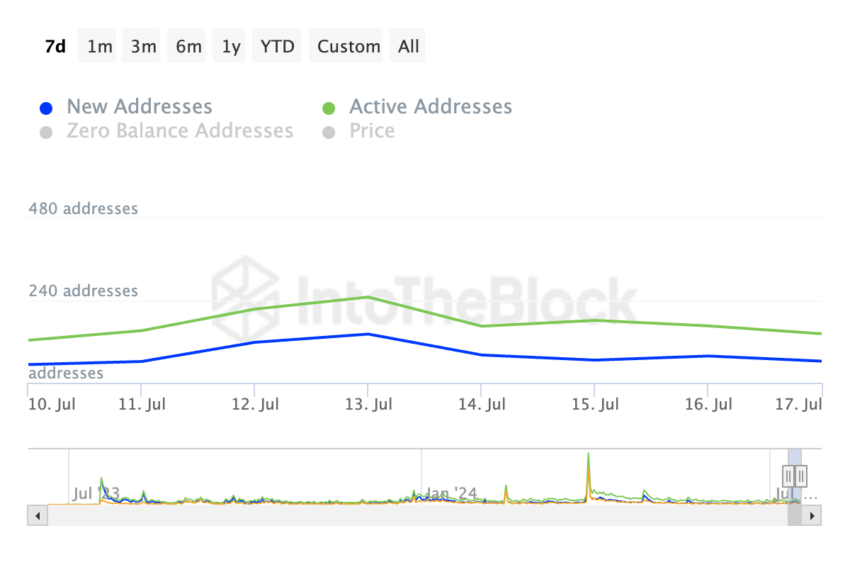

On-chain data has shown an uptick in the daily count of active and new addresses involved in MNT transactions during that period.

Mantle Whales Take Charge

As of this writing, MNT trades at $0.79. The altcoin’s price has risen by almost 15% in the past seven days. The reason for this rally is not far-fetched. Apart from the broader market correction during that period, MNT has also seen an uptick in demand.

On-chain data from IntoTheBlock reveals a 19% increase in the daily count of active addresses completing at least one MNT transaction over the past week. Additionally, the number of new addresses created to trade the altcoin has risen by 15% during the same period.

When an asset’s daily active addresses and new addresses climb, it typically indicates increasing network activity and growing interest in the asset. It means there is an increased demand for the asset, potentially driving up its value over time.

The double-digit spike in MNT’s price has also caught the attention of its whales. As the spike in the token’s large holders’ netflow points out, they have increased their accumulation.

Read More: What Is Mantle Network? A Guide to Ethereum’s Layer 2 Solution

Large holders refer to addresses that hold over 0.1% of an asset’s circulating supply. An asset’s large holder netflow measures the difference between the coins these investors buy) and the amount they sell over a specific period.

When an asset’s large holder netflow spikes, it signals that whale addresses are buying it. This is a bullish signal. According to IntoTheBlock’s data, MNT’s large holders’ netflow has risen 134% in the past seven days.

MNT Price Prediction: The Bulls Can Push Price Above $0.80

As of this writing, MNT’s Elder-Ray Index rests above zero at 0.08. It has consistently returned positive values since July 13.

This indicator measures the relationship between the strength of buyers and sellers in the market. When its value is positive, it means that bull power dominates the market.

If MNT bulls remain dominant, its price may climb to $0.80 and rally past it.

However, if the bears re-emerge and regain control, they may drive the token’s value down to $0.58.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.